This version of the form is not currently in use and is provided for reference only. Download this version of

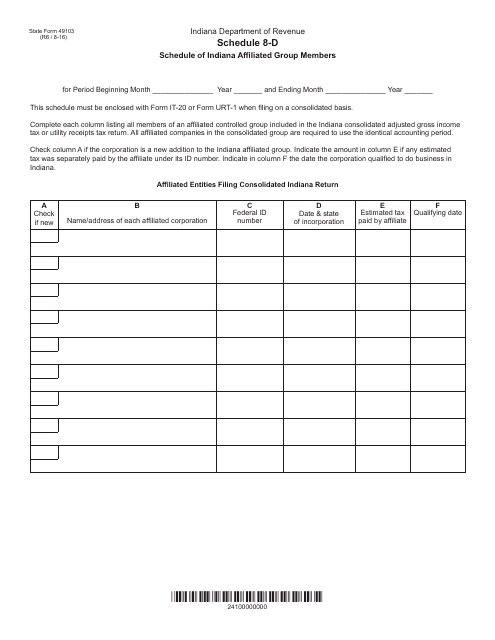

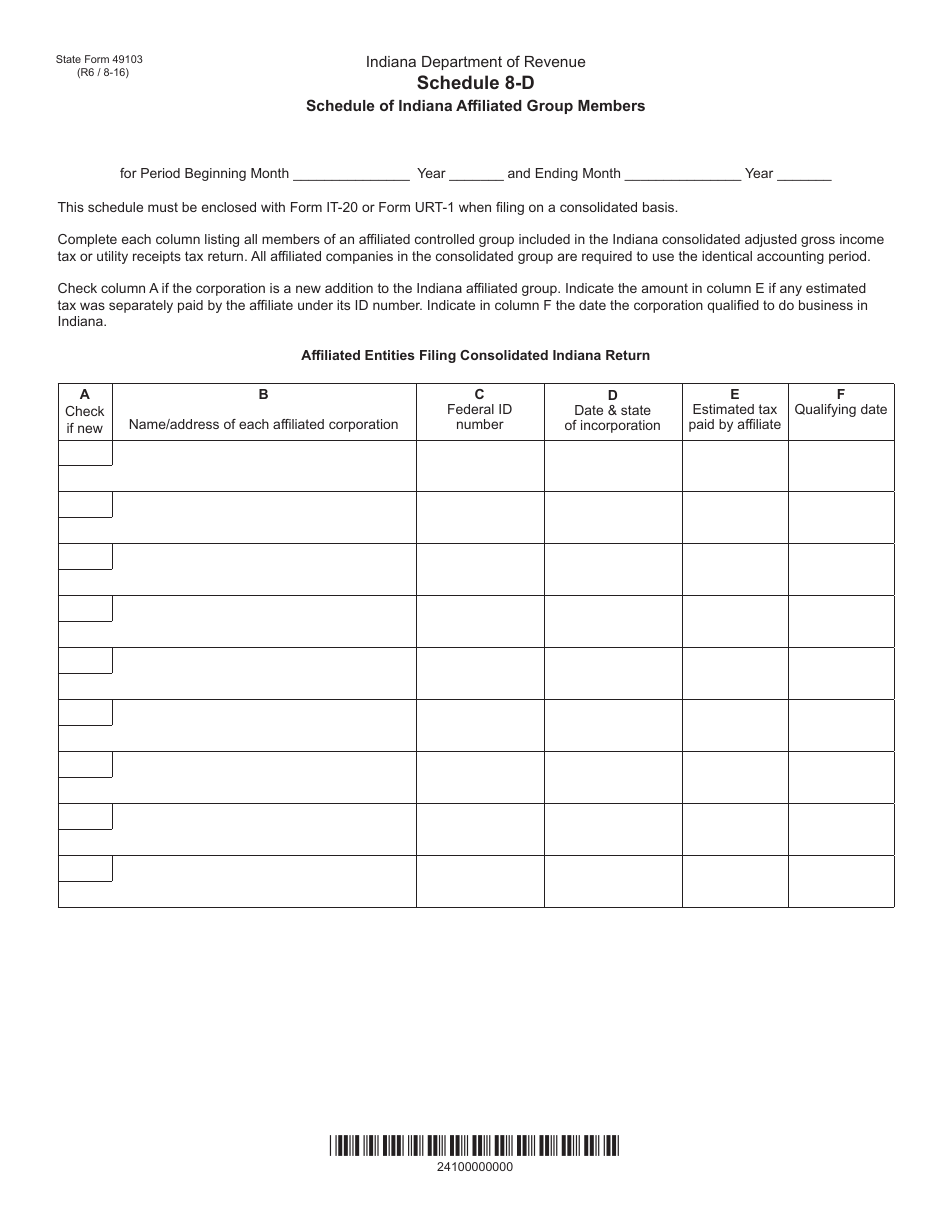

State Form 49103 Schedule 8-D

for the current year.

State Form 49103 Schedule 8-D Schedule of Indiana Affiliated Group Members - Indiana

What Is State Form 49103 Schedule 8-D?

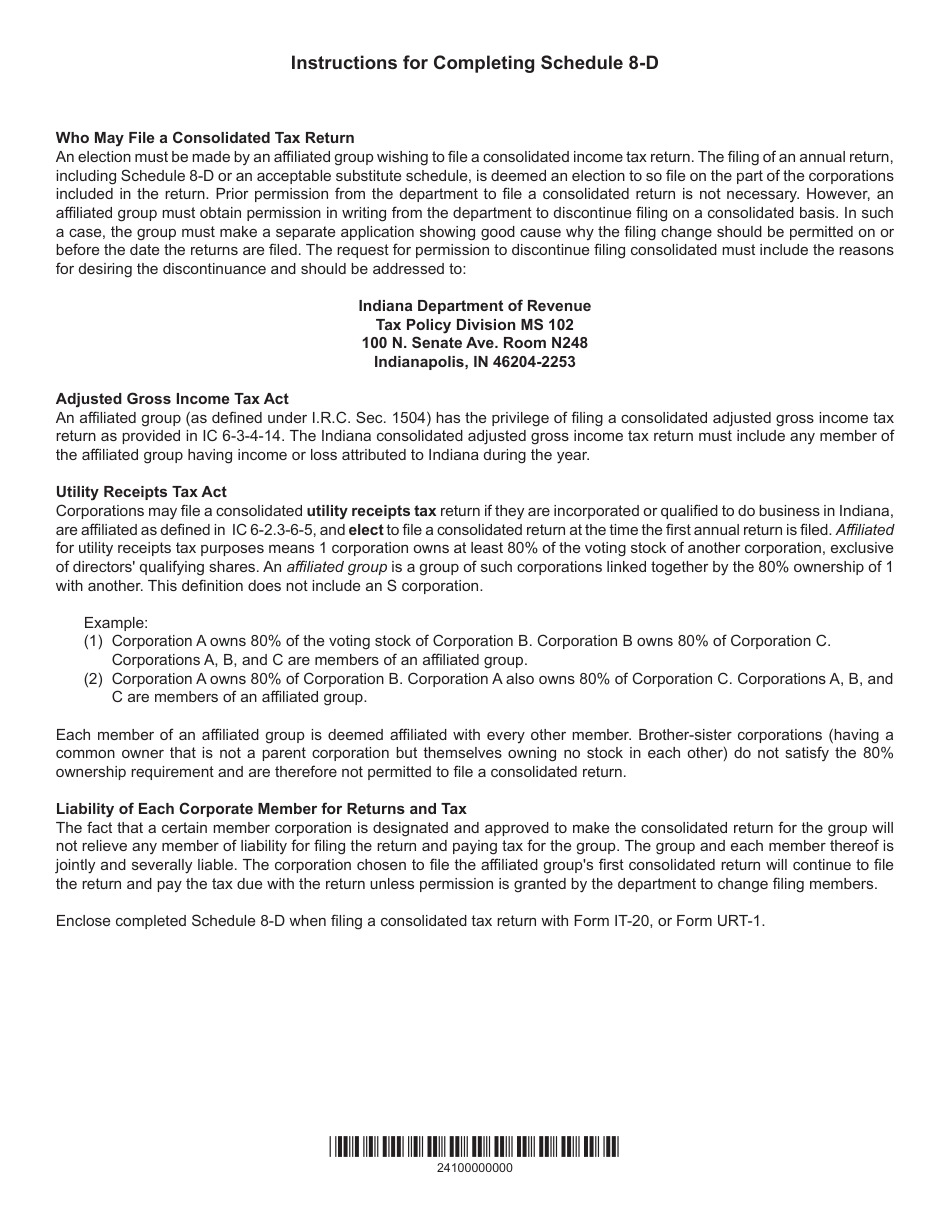

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 49103?

A: State Form 49103 is a form used in Indiana for reporting tax information.

Q: What is Schedule 8-D?

A: Schedule 8-D is a specific section within State Form 49103 that pertains to the Schedule of Indiana Affiliated Group Members.

Q: What is the Schedule of Indiana Affiliated Group Members?

A: The Schedule of Indiana Affiliated Group Members is a section where you provide details about the affiliated group members related to your Indiana taxes.

Q: Who needs to fill out Schedule 8-D?

A: Anyone who is part of an affiliated group and has tax obligations in Indiana needs to fill out Schedule 8-D.

Q: What information is required in Schedule 8-D?

A: Schedule 8-D requires information about the affiliated group members, including their names, addresses, and tax identification numbers.

Q: Is it mandatory to fill out Schedule 8-D?

A: If you are part of an affiliated group with tax obligations in Indiana, it is mandatory to fill out Schedule 8-D.

Q: Are there any penalties for not filing Schedule 8-D?

A: Failure to file Schedule 8-D may result in penalties and interest assessed by the Indiana Department of Revenue.

Q: Can I get assistance in filling out Schedule 8-D?

A: Yes, you can seek assistance from tax professionals or reach out to the Indiana Department of Revenue for guidance on filling out Schedule 8-D.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 49103 Schedule 8-D by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.