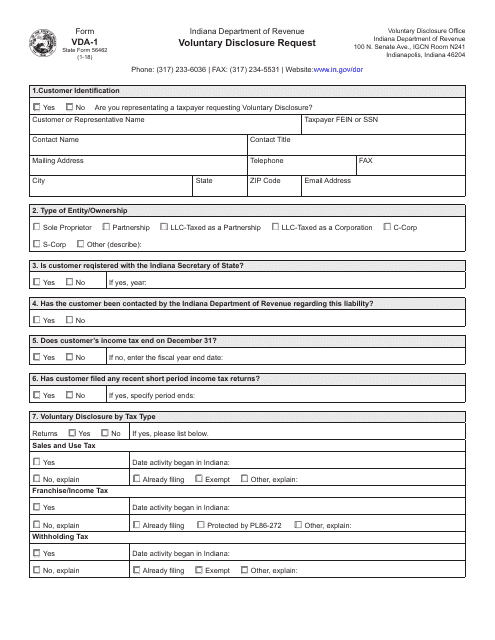

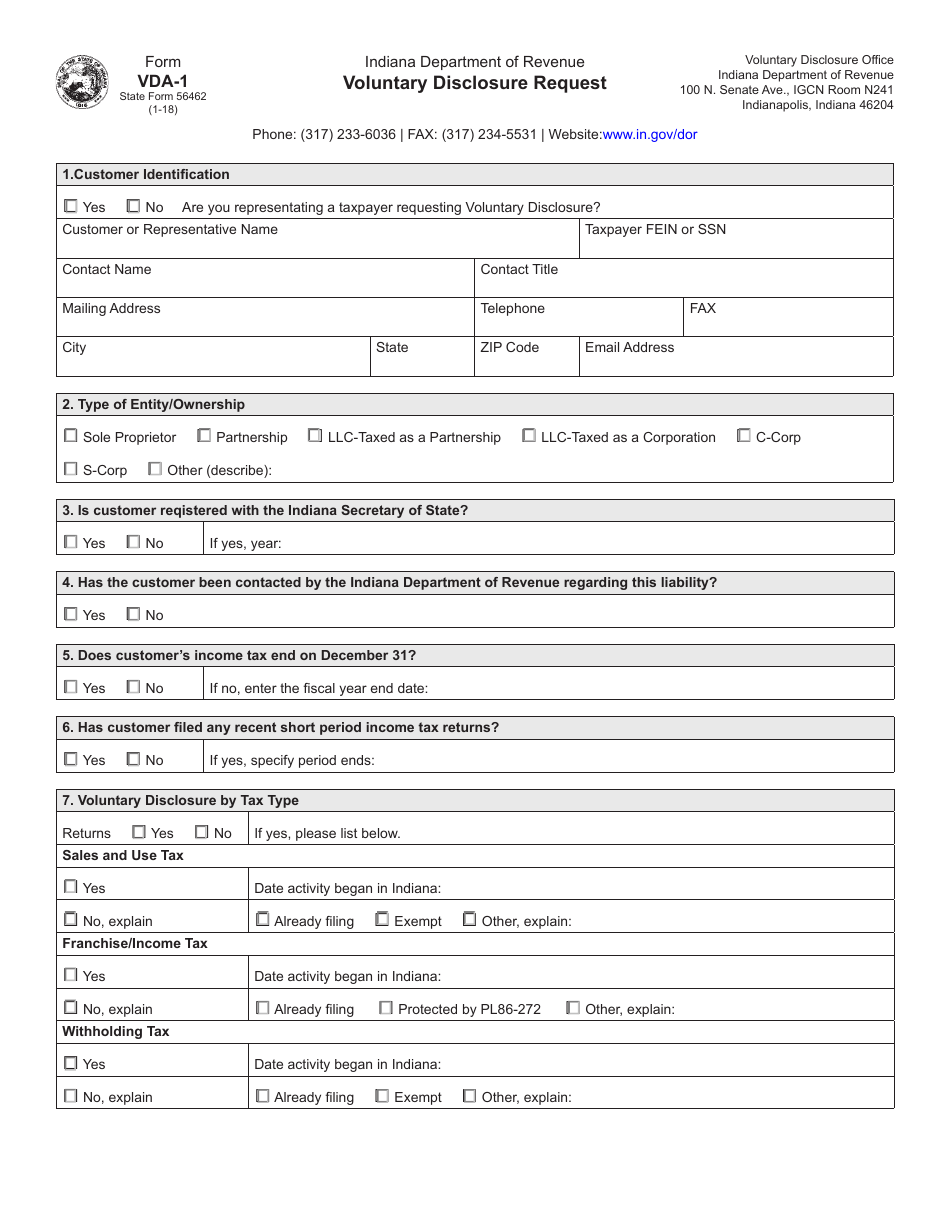

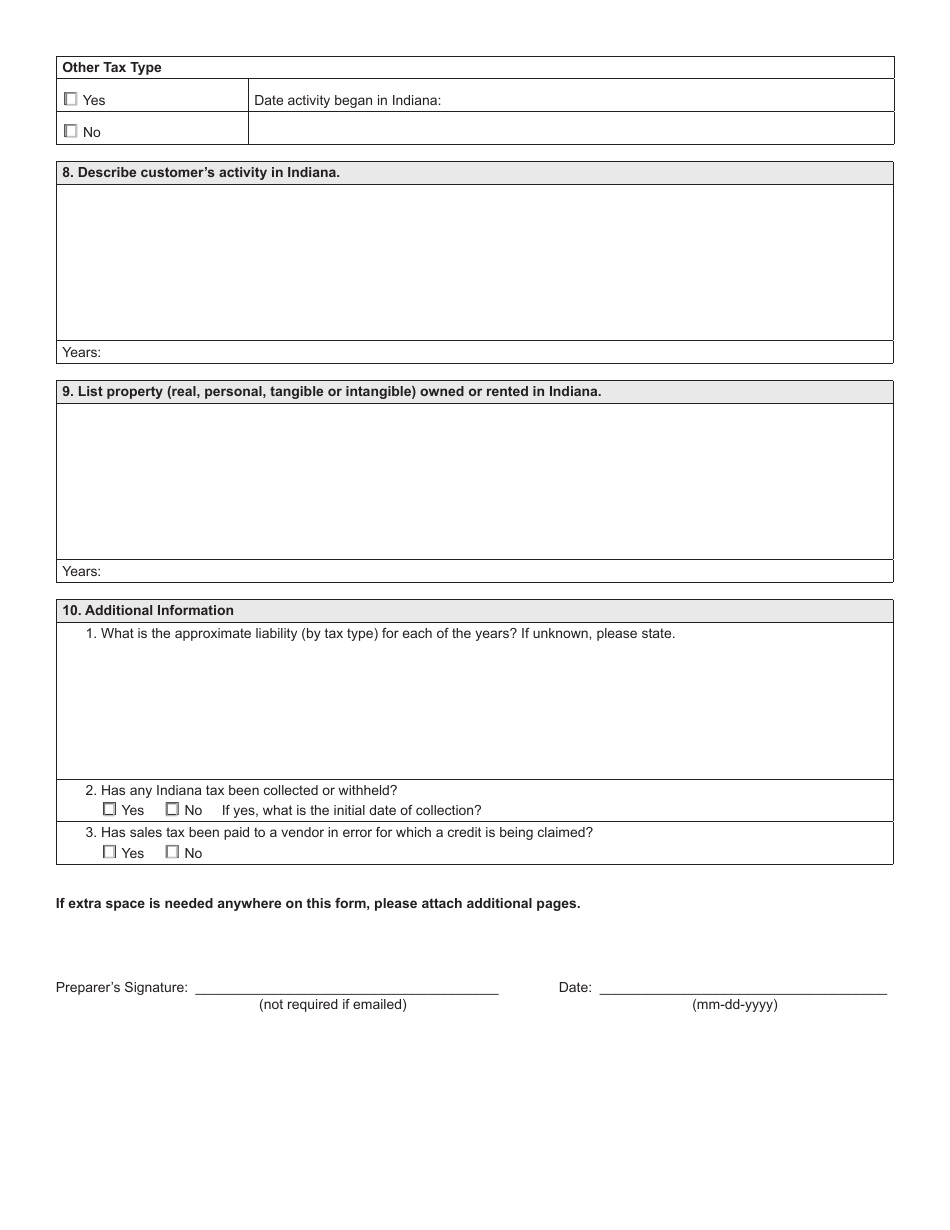

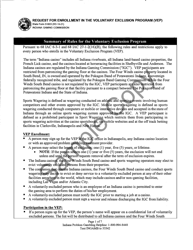

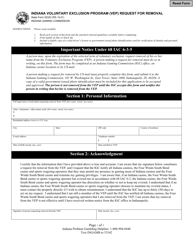

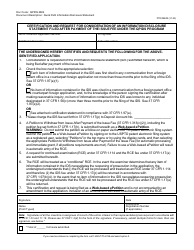

State Form 56462 (VDA-1) Voluntary Disclosure Request - Indiana

What Is State Form 56462 (VDA-1)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 56462?

A: Form 56462 is the Voluntary Disclosure Request form for Indiana.

Q: What is the purpose of form 56462?

A: The purpose of form 56462 is to request voluntary disclosure from Indiana.

Q: Who can use form 56462?

A: Any individual or business entity can use form 56462 to request voluntary disclosure in Indiana.

Q: What should I include in form 56462?

A: You should include all relevant information, such as your name, contact information, and details of the voluntary disclosure you are requesting.

Q: Are there any fees associated with form 56462?

A: There may be fees associated with form 56462. You should refer to the instructions or contact the Indiana Department of Revenue for more information.

Q: Is form 56462 mandatory?

A: Form 56462 is not mandatory. It is a voluntary request form for disclosing information to the Indiana Department of Revenue.

Q: What happens after submitting form 56462?

A: After submitting form 56462, the Indiana Department of Revenue will review your request and determine if they will grant the voluntary disclosure.

Q: Can I request confidentiality when using form 56462?

A: Yes, you can request confidentiality when using form 56462. However, the Indiana Department of Revenue will review the request and determine if confidentiality can be granted.

Q: Is there a deadline for submitting form 56462?

A: There may be a deadline for submitting form 56462. You should refer to the instructions or contact the Indiana Department of Revenue for the specific deadline.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 56462 (VDA-1) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.