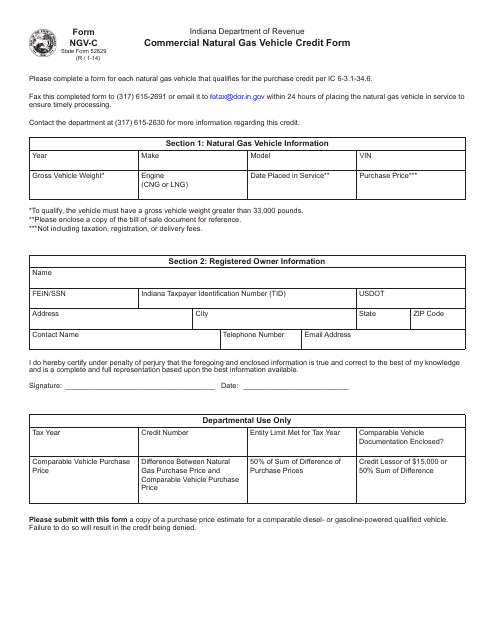

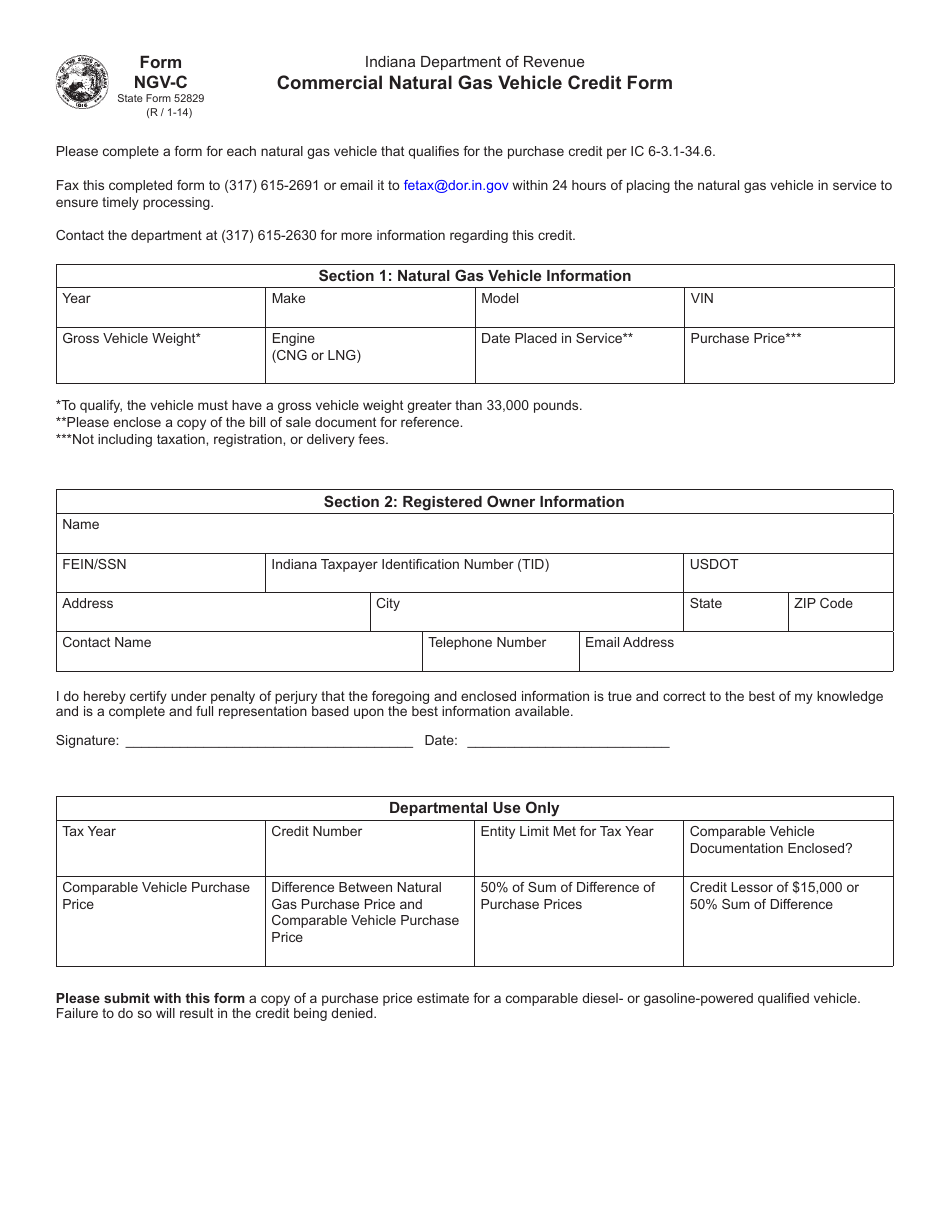

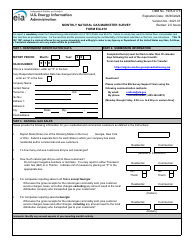

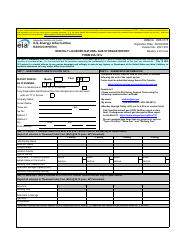

State Form 52829 (NGV-C) Commercial Natural Gas Vehicle Credit Form - Indiana

What Is State Form 52829 (NGV-C)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 52829 (NGV-C)?

A: Form 52829 (NGV-C) is the Commercial Natural Gas Vehicle Credit Form in Indiana.

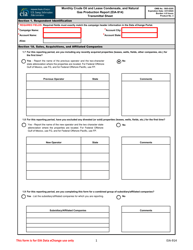

Q: What is the purpose of Form 52829 (NGV-C)?

A: The purpose of Form 52829 (NGV-C) is to claim the commercial natural gas vehicle credit in Indiana.

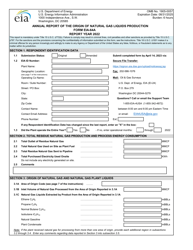

Q: Who can use Form 52829 (NGV-C)?

A: This form is for individuals, corporations, partnerships, and limited liability companies that own or lease commercial natural gas vehicles in Indiana.

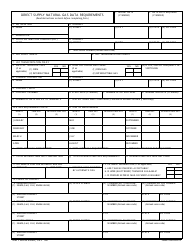

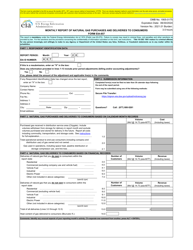

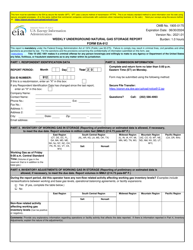

Q: What information is required on Form 52829 (NGV-C)?

A: Form 52829 (NGV-C) requires information about the applicant, vehicle details, and the amount of credit being claimed.

Q: When is the deadline for filing Form 52829 (NGV-C)?

A: Form 52829 (NGV-C) must be filed by April 15th of the year following the calendar year in which the vehicle was placed in service.

Q: Are there any other requirements for claiming the commercial natural gas vehicle credit in Indiana?

A: Yes, in addition to filing Form 52829 (NGV-C), you must also have a verified Indiana Department of Revenue Commercial Natural Gas Vehicle Credit Certificate.

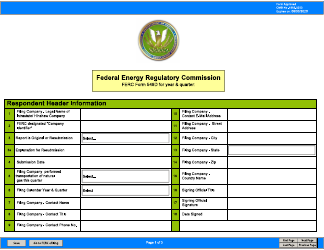

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 52829 (NGV-C) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.