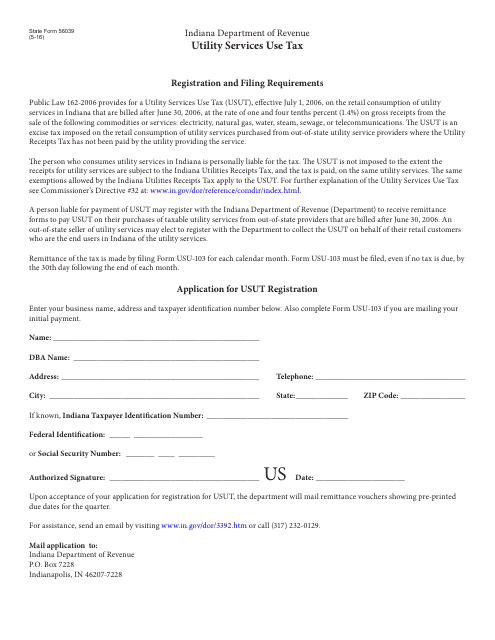

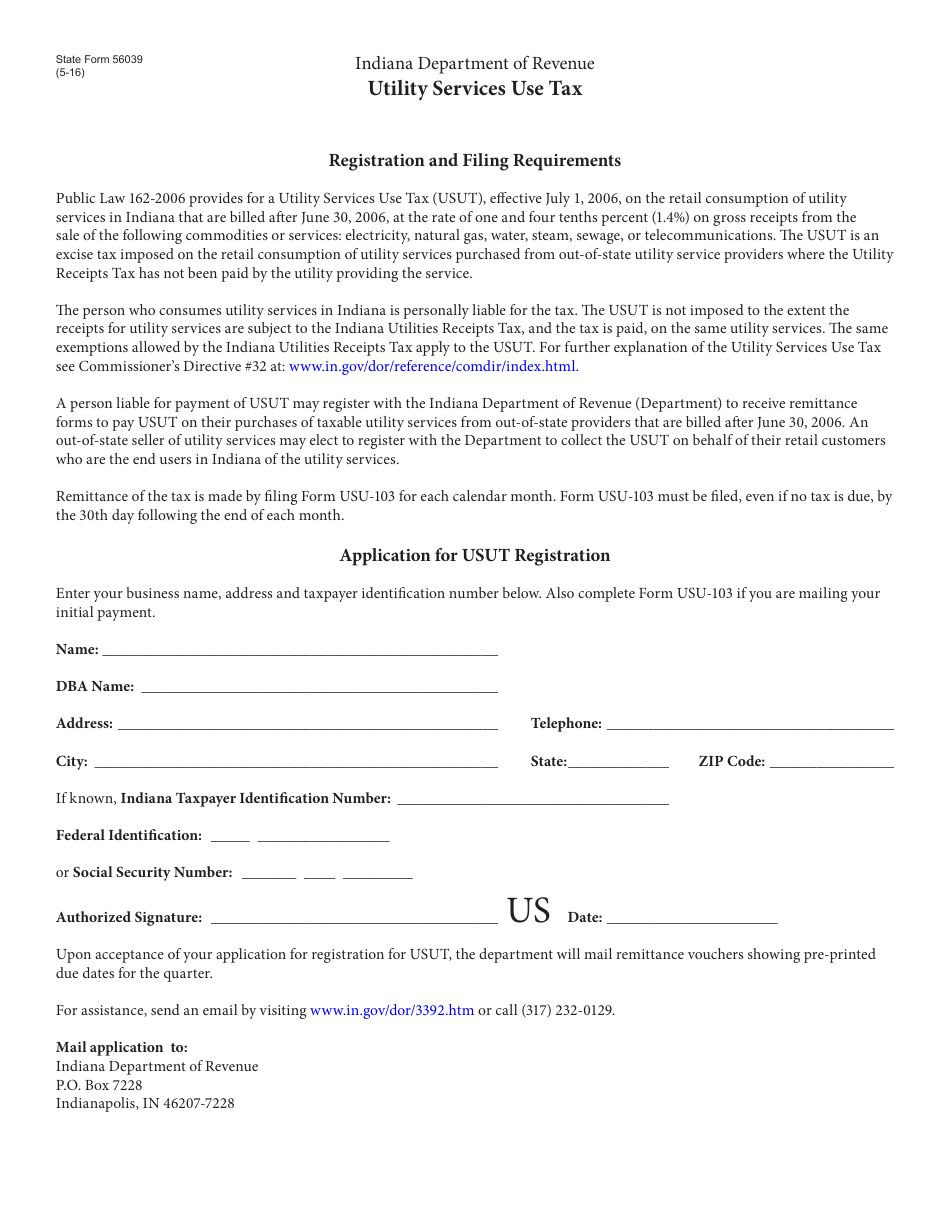

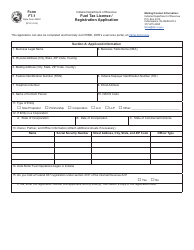

State Form 56039 Utility Services Use Tax (Usut) Registration Application - Indiana

What Is State Form 56039?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the State Form 56039?

A: State Form 56039 is the Utility ServicesUse Tax (USUT) Registration Application for Indiana.

Q: What is the Utility Services Use Tax (USUT) Registration Application?

A: The Utility Services Use Tax (USUT) Registration Application is a form used to register for the Utility Services Use Tax in Indiana.

Q: What is the purpose of the Utility Services Use Tax (USUT)?

A: The Utility Services Use Tax (USUT) is a tax imposed on certain utility services in Indiana.

Q: Who needs to file the Utility Services Use Tax (USUT) Registration Application?

A: Anyone engaged in the business of selling taxable utility services in Indiana needs to file the Utility Services Use Tax (USUT) Registration Application.

Q: Is there a fee to file the Utility Services Use Tax (USUT) Registration Application?

A: No, there is no fee to file the Utility Services Use Tax (USUT) Registration Application.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 56039 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.