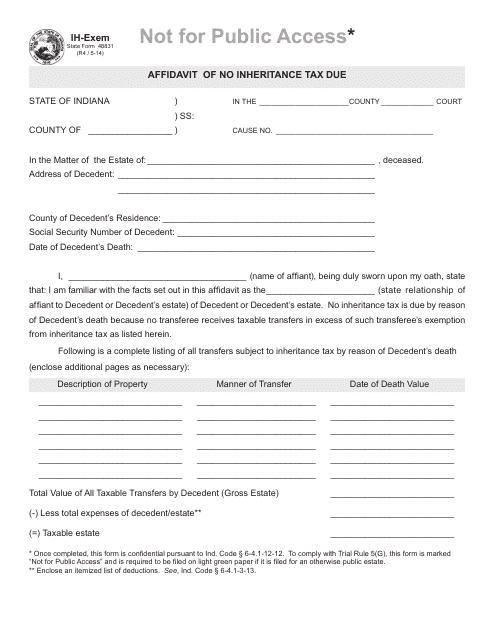

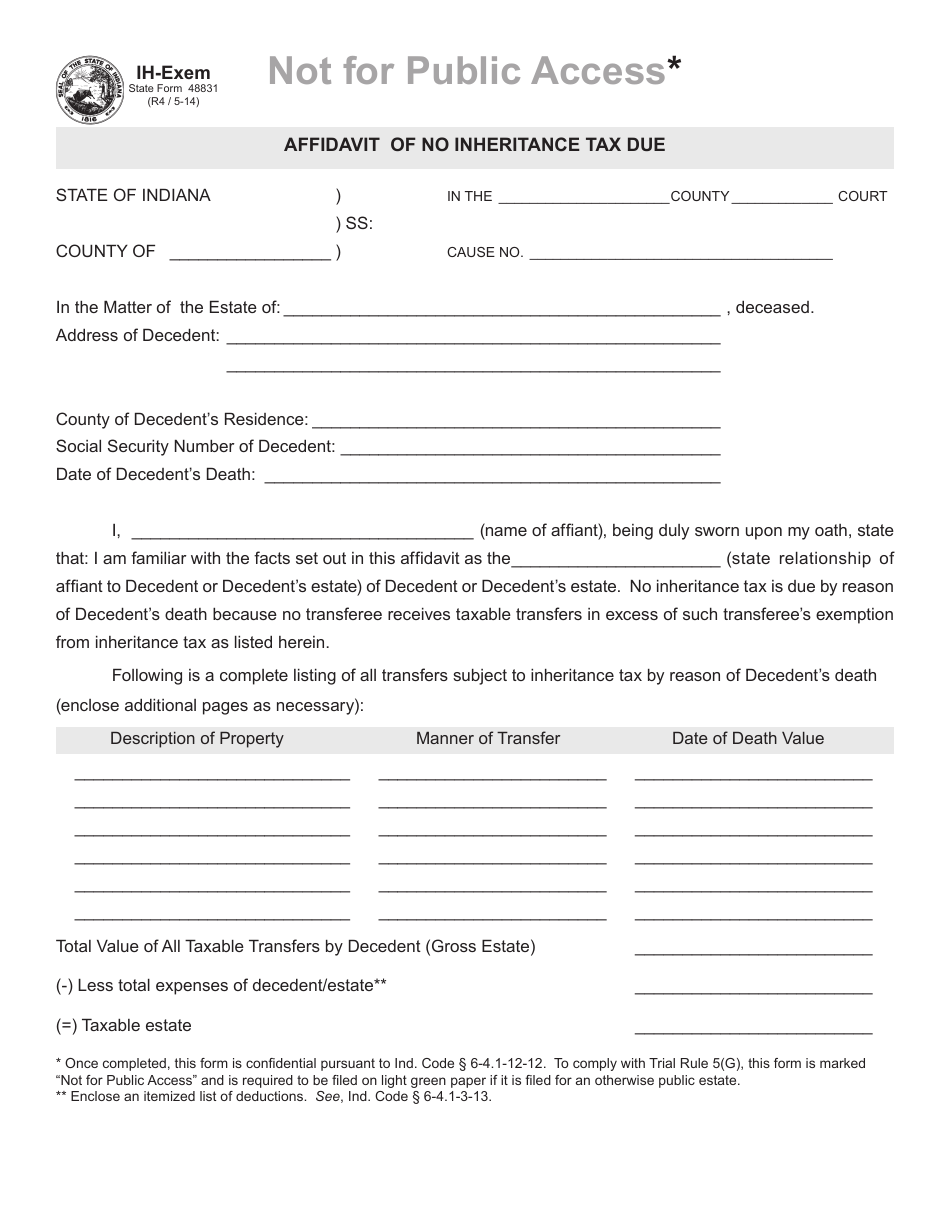

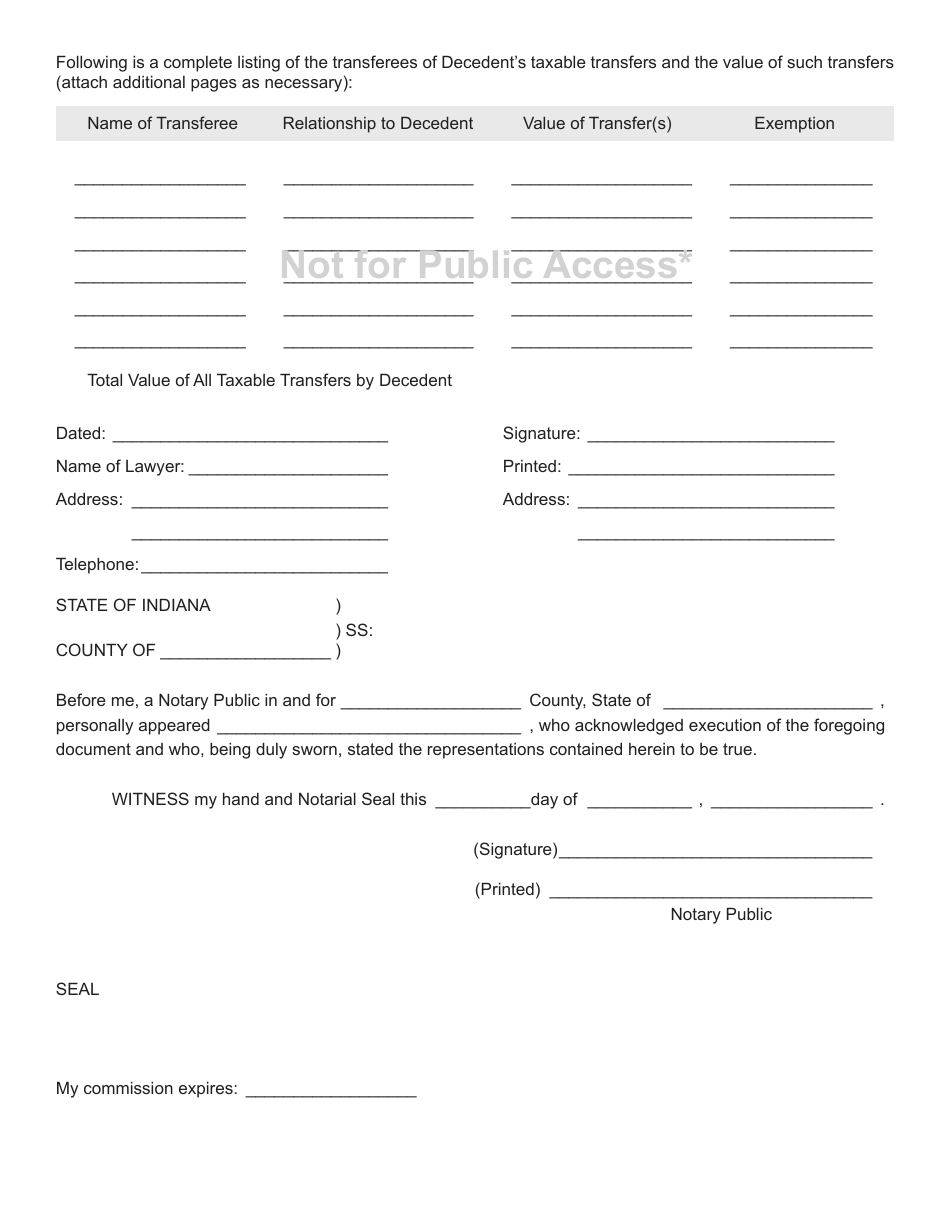

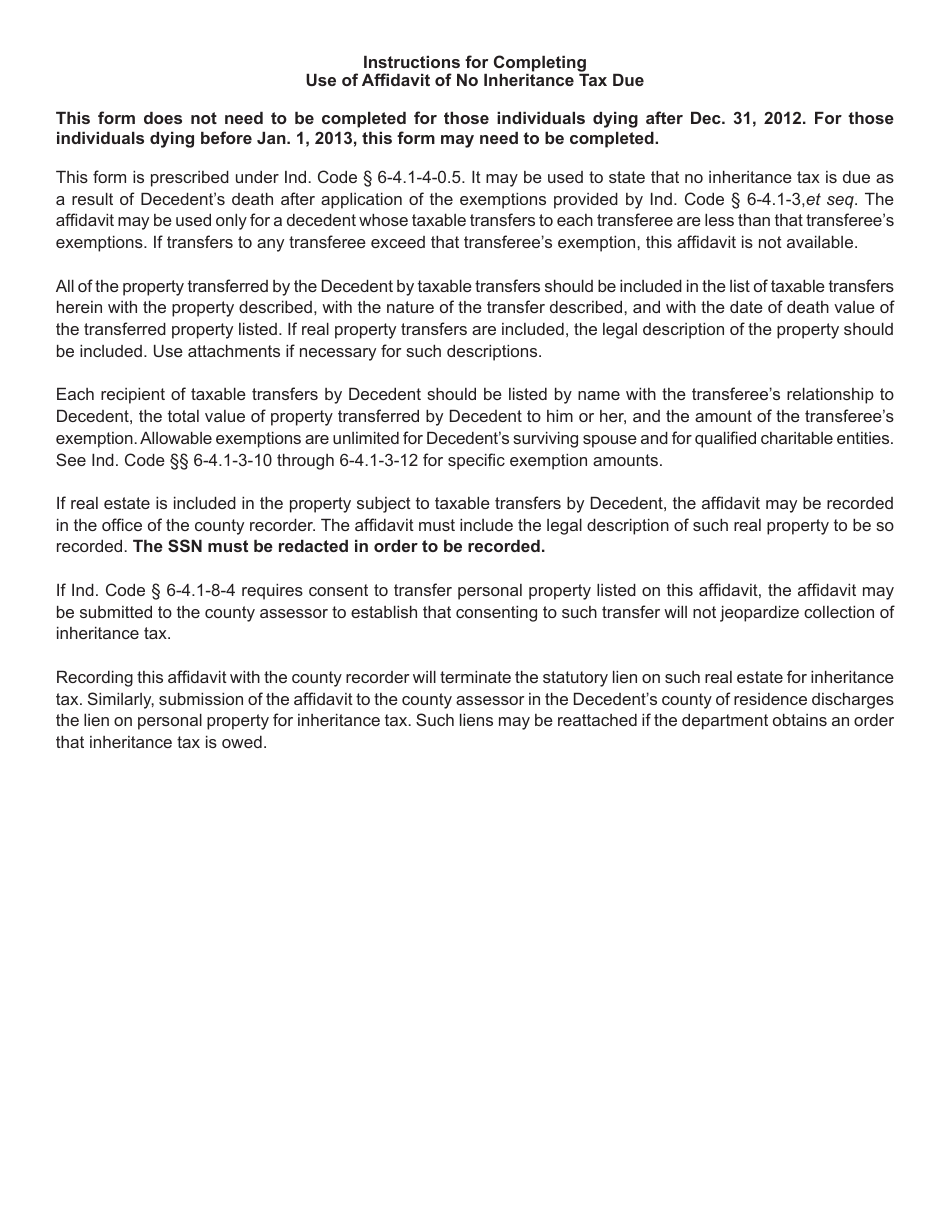

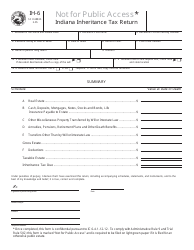

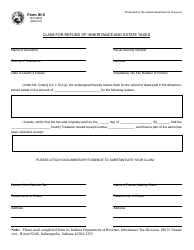

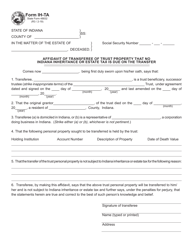

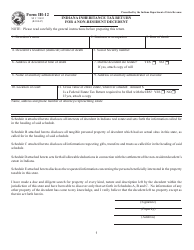

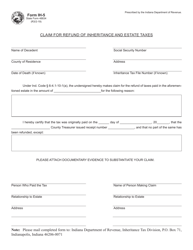

State Form 48831 (IH-EXEM) Affidavit of No Inheritance Tax Due - Indiana

What Is State Form 48831 (IH-EXEM)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 48831?

A: State Form 48831 is an Affidavit of No Inheritance Tax Due specifically for Indiana.

Q: What is an Affidavit of No Inheritance Tax Due?

A: It is a form used to declare that no inheritance tax is due on an estate.

Q: Who needs to file State Form 48831?

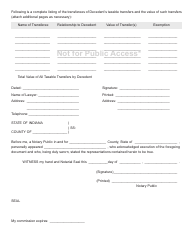

A: Anyone who is handling an estate in Indiana and believes that no inheritance tax is due.

Q: Why would no inheritance tax be due?

A: There are several exemptions and thresholds in place that may eliminate the need for an estate to pay inheritance tax.

Q: Are there any filing fees for State Form 48831?

A: No, there are no filing fees associated with filing this form in Indiana.

Form Details:

- Released on May 1, 2014;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 48831 (IH-EXEM) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.