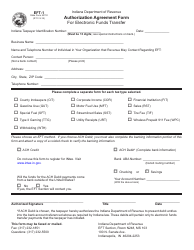

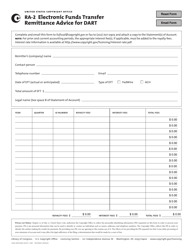

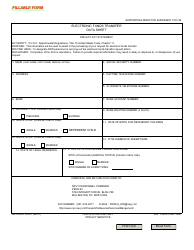

State Form 50110 (EFT-1) Authorization Agreement Form for Electronic Funds Transfer - Indiana

What Is State Form 50110 (EFT-1)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50110 (EFT-1)?

A: Form 50110 (EFT-1) is an Authorization Agreement Form for Electronic Funds Transfer.

Q: What is the purpose of Form 50110 (EFT-1)?

A: The purpose of Form 50110 (EFT-1) is to authorize the electronic transfer of funds.

Q: Who should use Form 50110 (EFT-1)?

A: Anyone who wants to authorize electronic funds transfer in Indiana should use Form 50110 (EFT-1).

Q: Is Form 50110 (EFT-1) specific to Indiana?

A: Yes, Form 50110 (EFT-1) is specific to Indiana.

Q: What information is required on Form 50110 (EFT-1)?

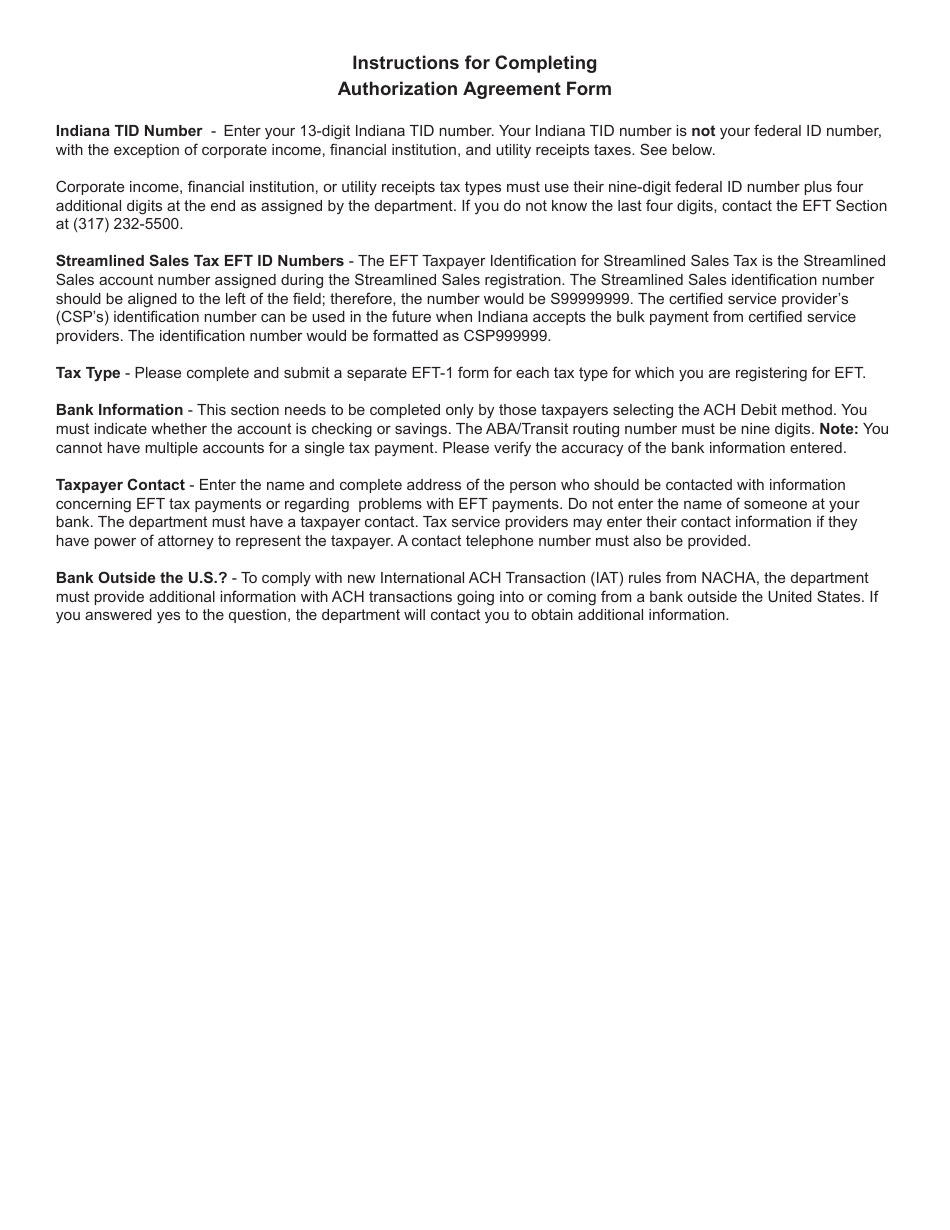

A: Form 50110 (EFT-1) requires information such as your name, address, bank account information, and authorization details.

Q: Are there any fees associated with using Form 50110 (EFT-1)?

A: There may be fees associated with using Form 50110 (EFT-1), depending on the specific circumstances and the financial institution.

Q: How long does it take for Form 50110 (EFT-1) to be processed?

A: The processing time for Form 50110 (EFT-1) can vary, but it typically takes a few business days.

Q: Can I cancel or modify my authorization after submitting Form 50110 (EFT-1)?

A: Yes, you can usually cancel or modify your authorization by contacting the appropriate institution or department.

Form Details:

- Released on September 1, 2014;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 50110 (EFT-1) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.