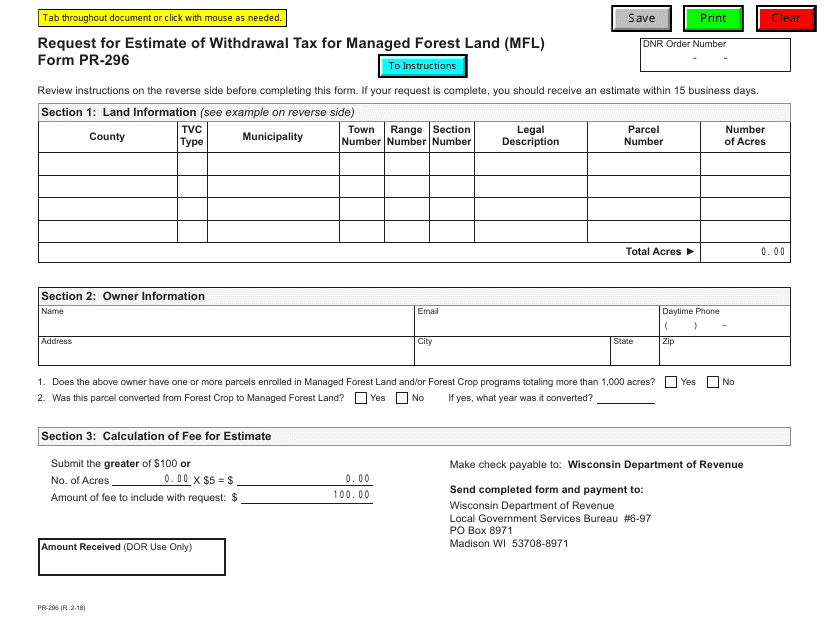

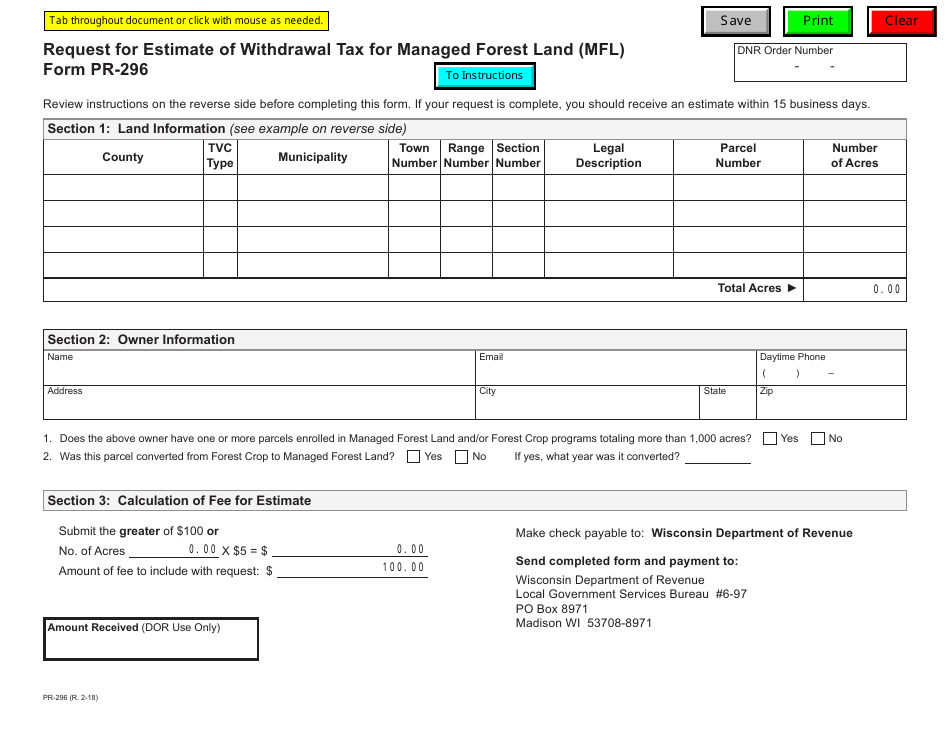

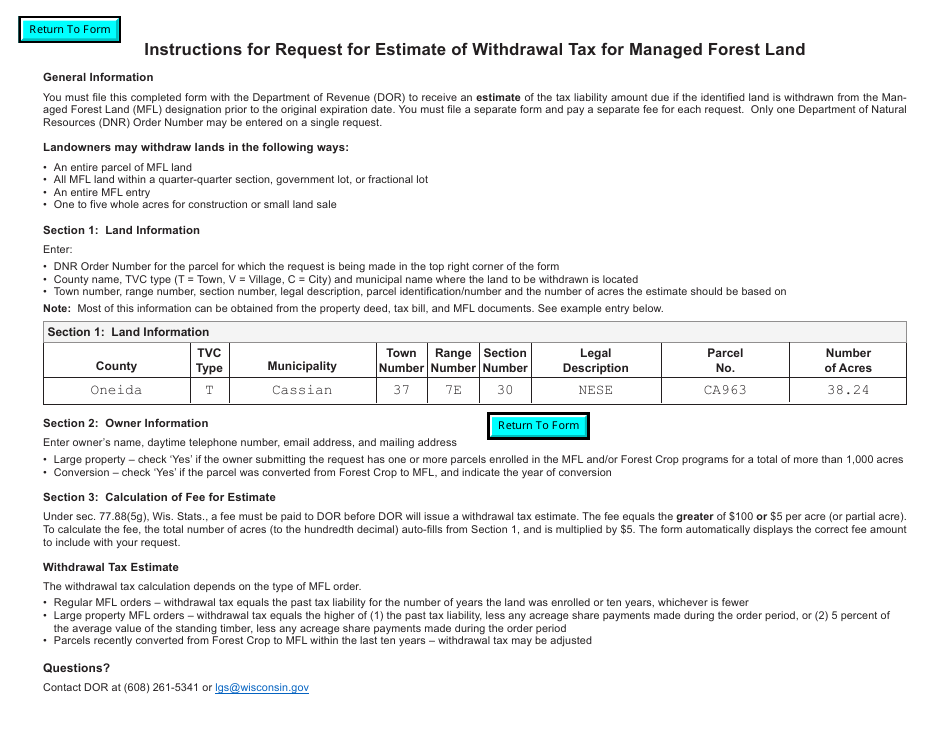

Form PR-296 Request for Estimate of Withdrawal Tax for Managed Forest Land (Mfl) - Wisconsin

What Is Form PR-296?

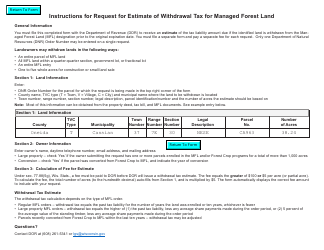

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PR-296?

A: Form PR-296 is a request for an estimate of withdrawal tax for Managed Forest Land (MFL) in Wisconsin.

Q: What is Managed Forest Land (MFL) in Wisconsin?

A: Managed Forest Land (MFL) is a tax benefit program in Wisconsin that encourages landowners to manage their forest land for sustainable timber production.

Q: Who should use Form PR-296?

A: Landowners who have enrolled their land in the Managed Forest Land (MFL) program in Wisconsin should use Form PR-296 to request an estimate of withdrawal tax.

Q: What is the purpose of Form PR-296?

A: The purpose of Form PR-296 is to request an estimate of withdrawal tax to help landowners plan for the potential tax liability when exiting the Managed Forest Land (MFL) program.

Q: Is there a filing fee for Form PR-296?

A: No, there is no filing fee for Form PR-296.

Q: Are there any deadlines for submitting Form PR-296?

A: Yes, Form PR-296 should be submitted at least 90 days before the anticipated withdrawal of land from the Managed Forest Land (MFL) program.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PR-296 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.