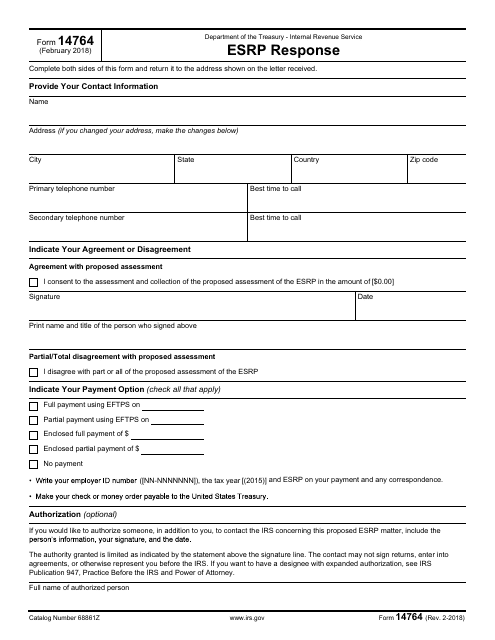

IRS Form 14764 Esrp Response

What Is IRS Form 14764?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14764?

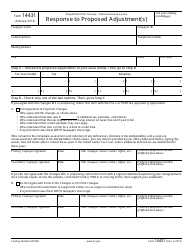

A: IRS Form 14764 is used to submit a response to an Employer Shared Responsibility Payment (ESRP) notice.

Q: What is an Employer Shared Responsibility Payment (ESRP) notice?

A: An ESRP notice is sent by the IRS to inform employers of the amount they owe for failing to comply with the Affordable Care Act's employer mandate.

Q: Who needs to fill out IRS Form 14764?

A: Employers who receive an ESRP notice from the IRS need to fill out IRS Form 14764.

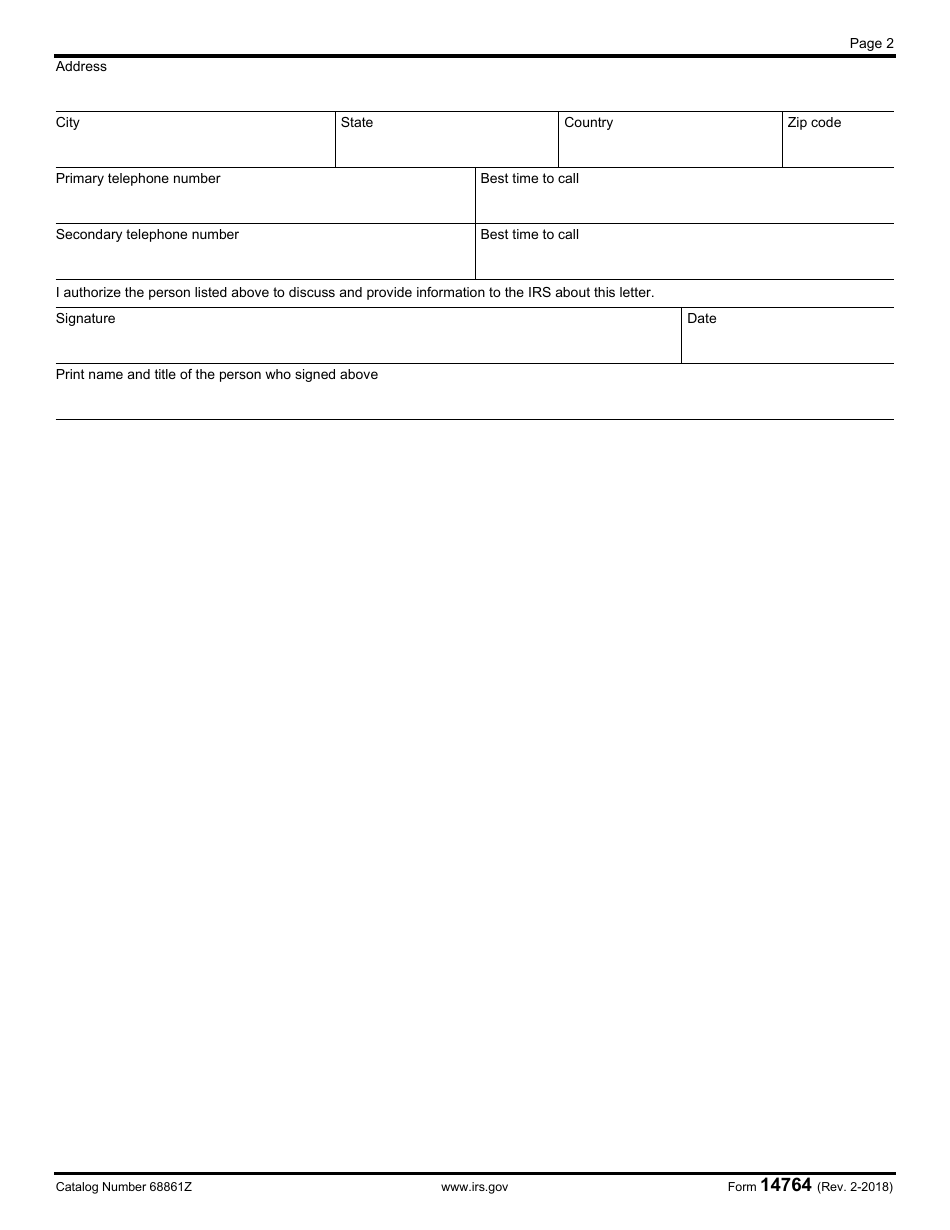

Q: What information is required on IRS Form 14764?

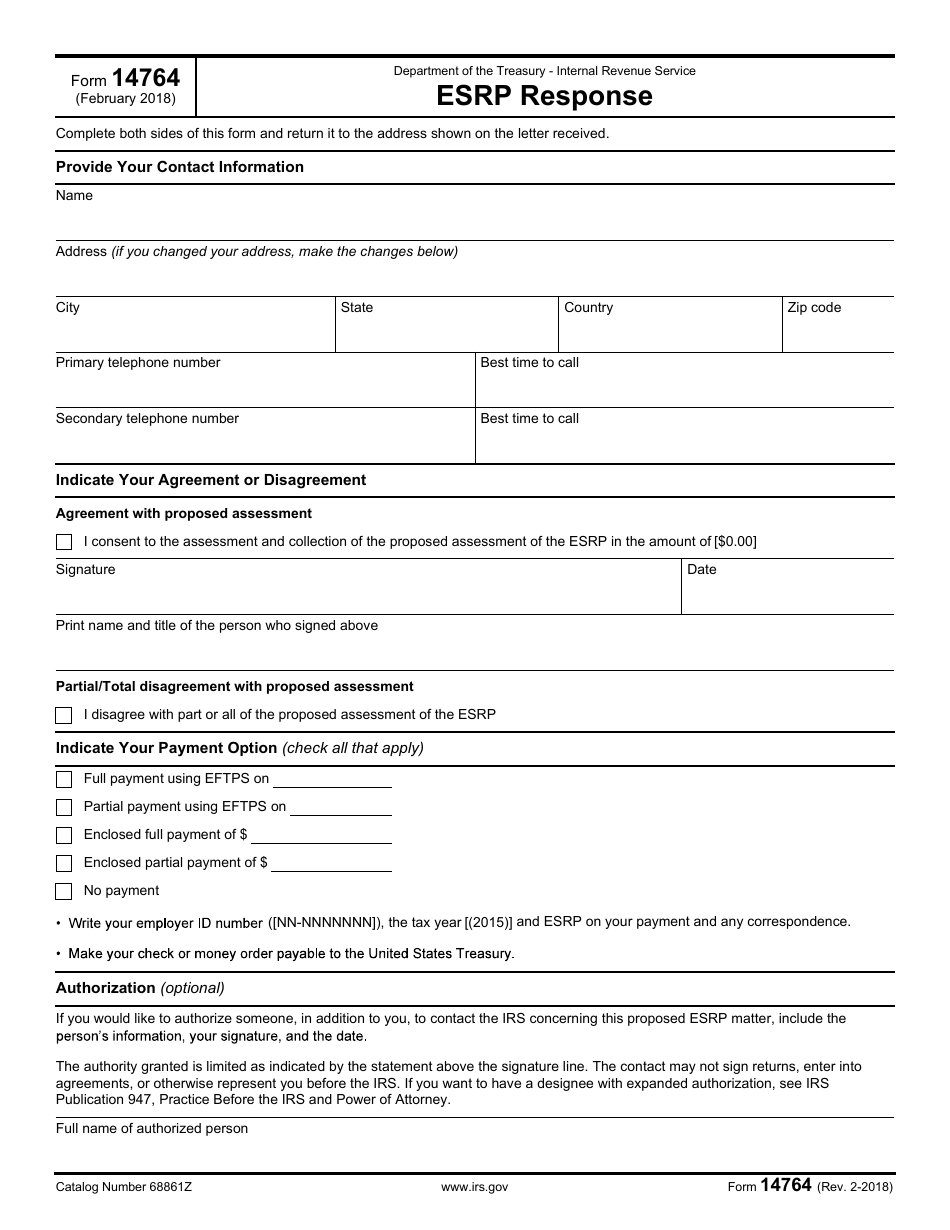

A: IRS Form 14764 requires employers to provide their contact information, as well as a detailed explanation and supporting documentation for their response to the ESRP notice.

Q: What happens after I submit IRS Form 14764?

A: After you submit IRS Form 14764, the IRS will review your response and make a determination regarding your ESRP payment obligation.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14764 through the link below or browse more documents in our library of IRS Forms.