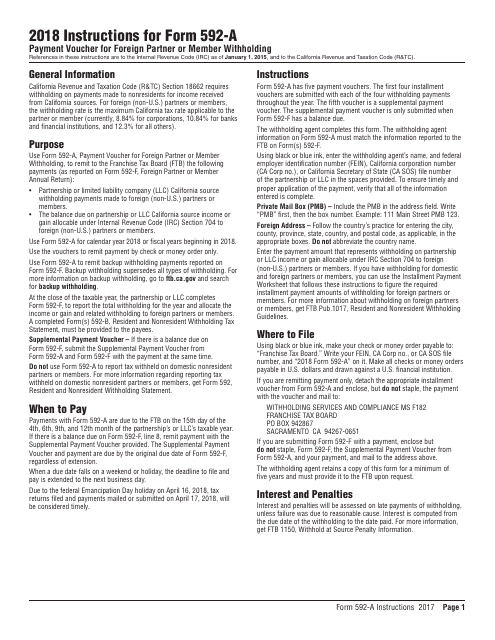

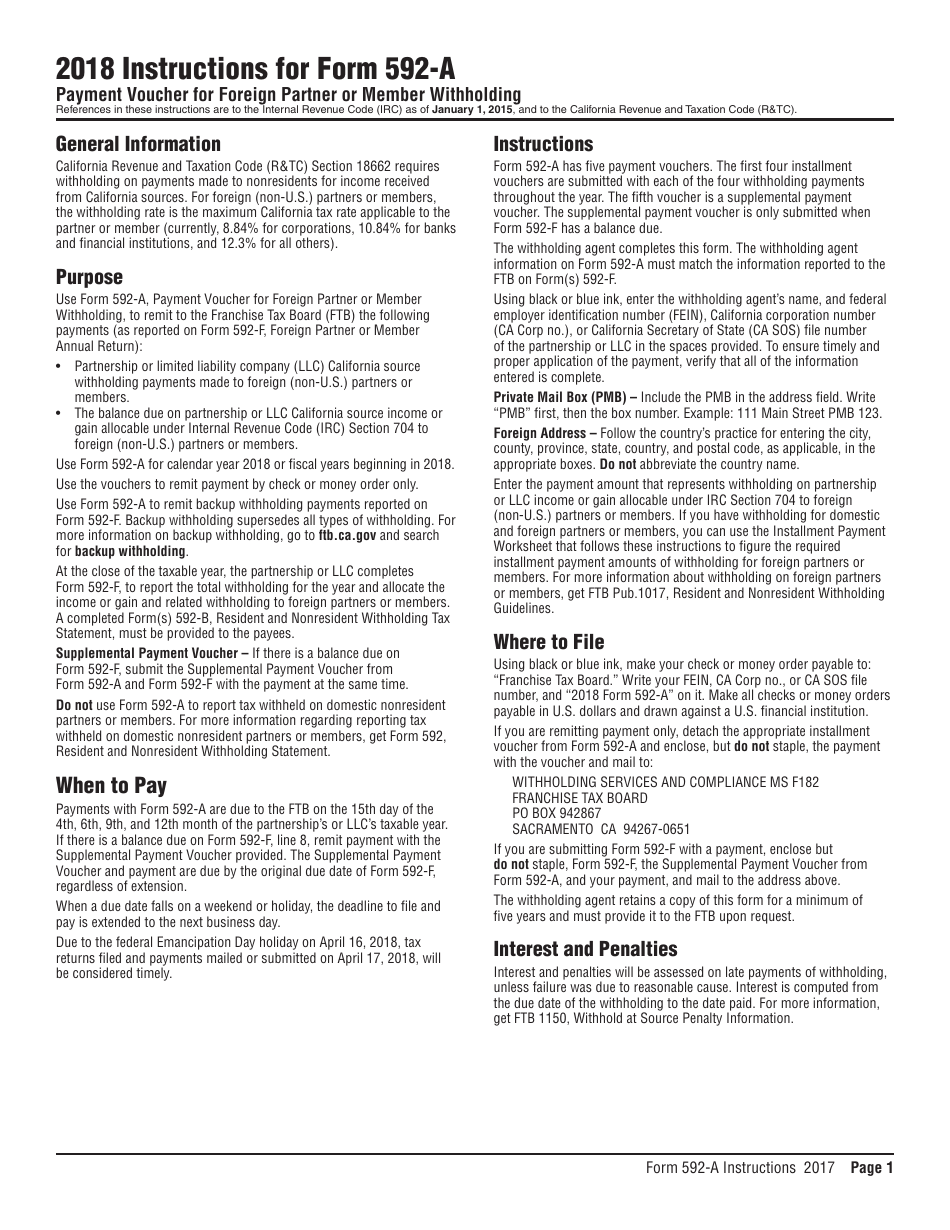

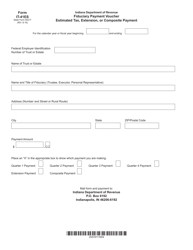

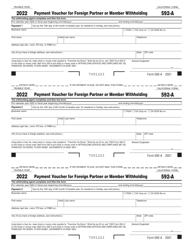

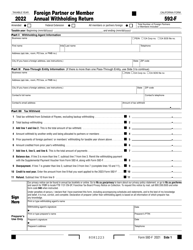

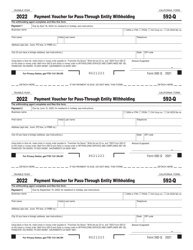

Instructions for Form 592-A Payment Voucher for Foreign Partner or Member Withholding - California

This document contains official instructions for Form 592-A , Payment Voucher for Foreign Partner or Member Withholding - a form released and collected by the California Franchise Tax Board.

FAQ

Q: What is Form 592-A?

A: Form 592-A is a payment voucher for foreign partners or members withholding in California.

Q: Who needs to use Form 592-A?

A: Foreign partners or members who have income subject to California withholding.

Q: What is the purpose of Form 592-A?

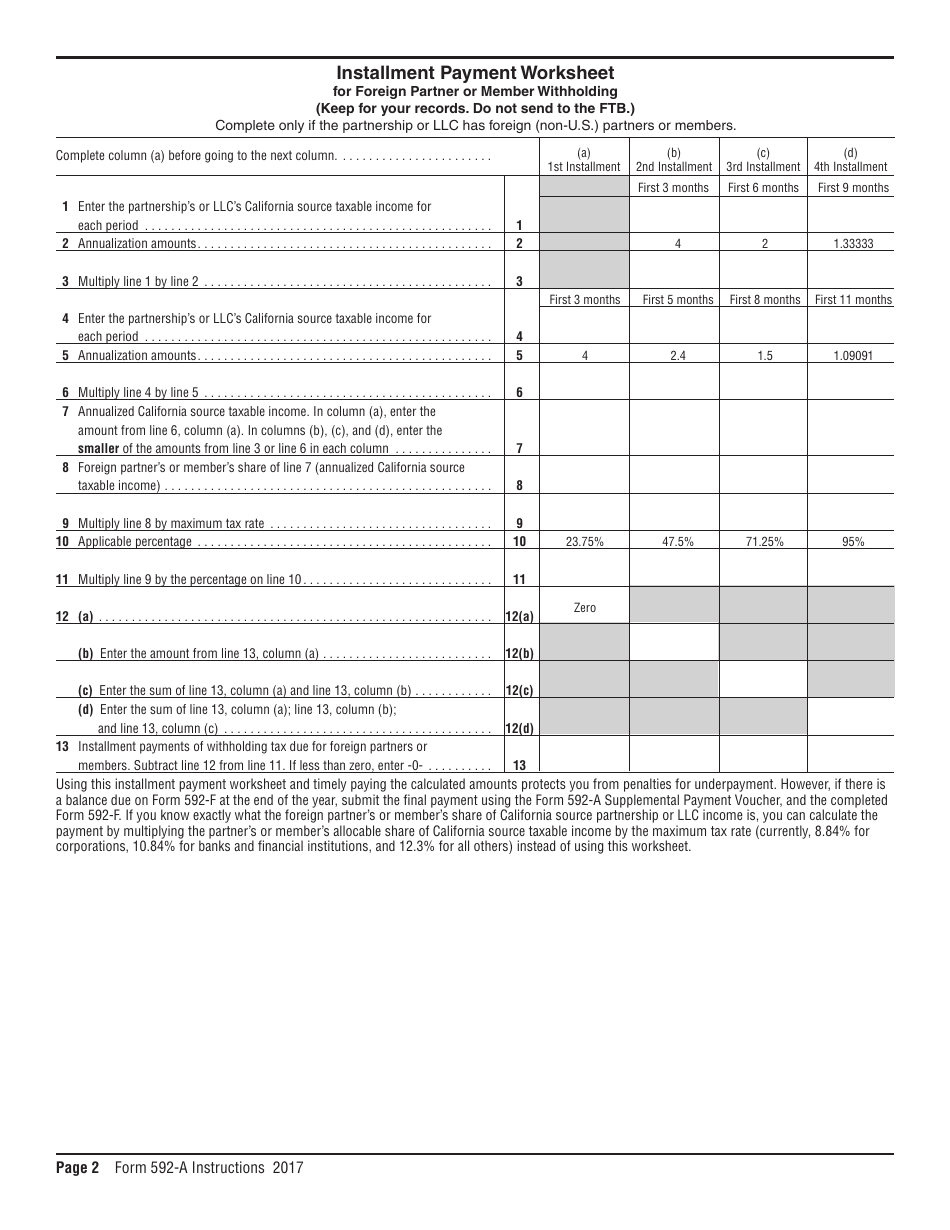

A: Form 592-A is used to calculate and remit withholding payments for foreign partners or members in California.

Q: How do I fill out Form 592-A?

A: You must provide information about the partnership or LLC making the payment, and calculate the withholding amount based on the income.

Q: When is the deadline to file Form 592-A?

A: Form 592-A must be filed and the payment must be made by the due date provided by the Franchise Tax Board.

Q: Are there any penalties for late filing or payment?

A: Yes, there may be penalties for late filing or payment, so it is important to submit the form and payment on time.

Q: Can I file Form 592-A electronically?

A: No, Form 592-A cannot be filed electronically and must be submitted by mail.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.