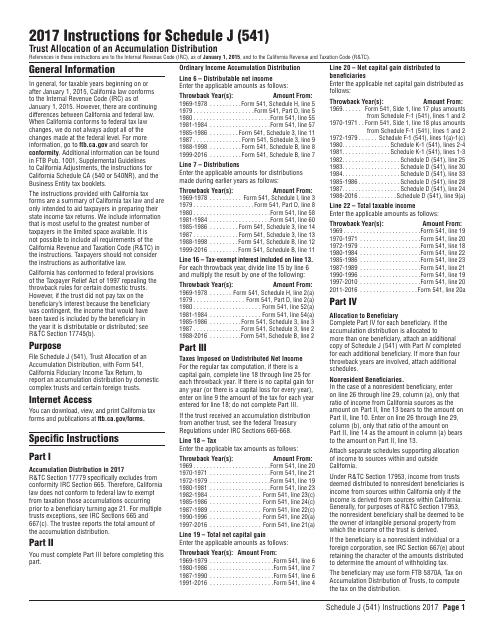

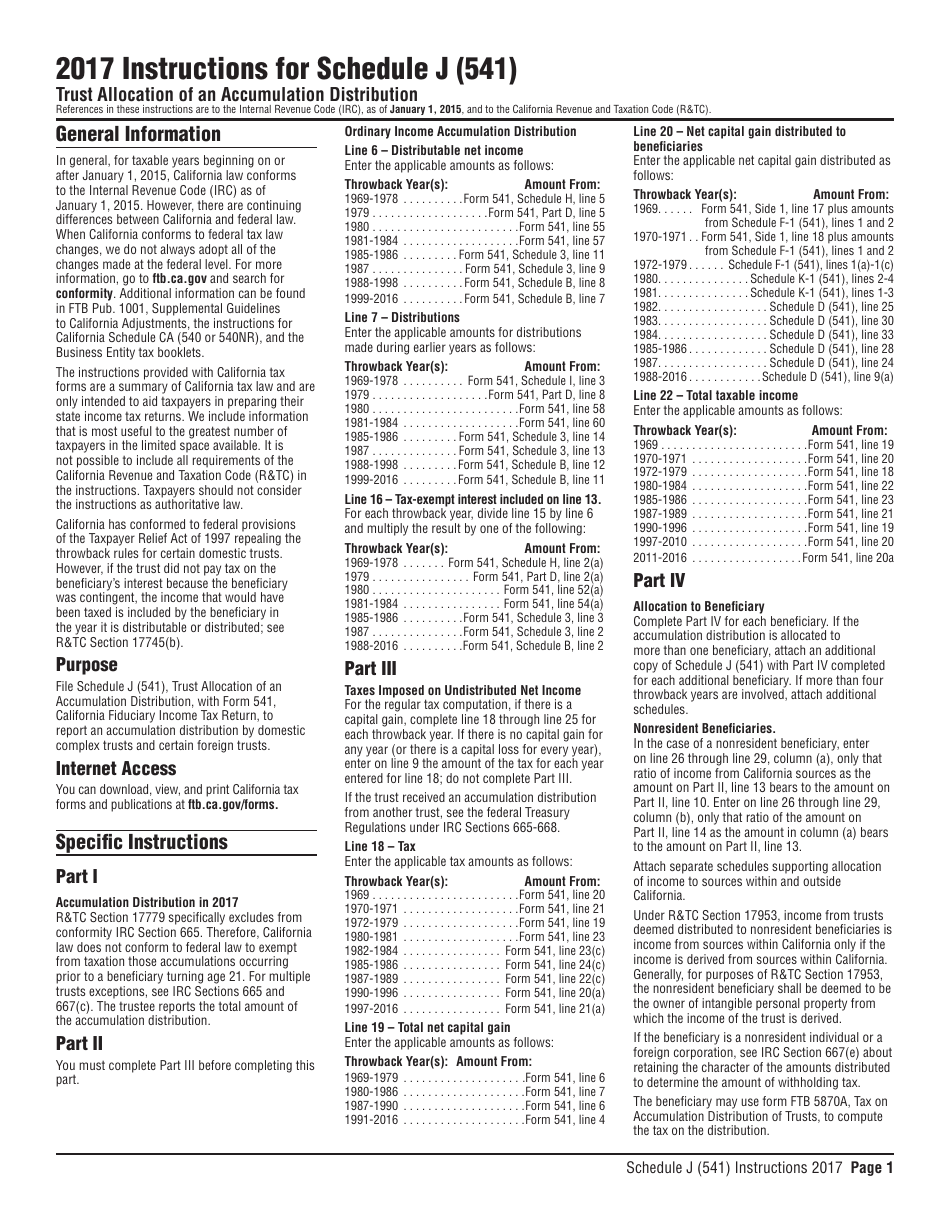

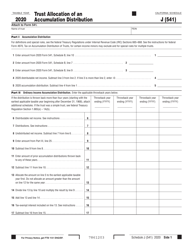

Instructions for Form 541 Schedule J Trust Allocation of an Accumulation Distribution - California

This document contains official instructions for Form 541 Schedule J, Trust Allocation of an Accumulation Distribution - a form released and collected by the California Franchise Tax Board.

FAQ

Q: What is Form 541 Schedule J?

A: Form 541 Schedule J is a form used in California to report the trust allocation of an accumulation distribution.

Q: Who needs to fill out Form 541 Schedule J?

A: This form needs to be filled out by trustees of California trusts that have made an accumulation distribution.

Q: What is an accumulation distribution?

A: An accumulation distribution is the distribution of income that has been accumulated or kept within the trust.

Q: What information is required on Form 541 Schedule J?

A: This form requires the allocation of the accumulation distribution among the trust beneficiaries, including their names, identification numbers, and share of the distribution.

Q: When is Form 541 Schedule J due?

A: Form 541 Schedule J is generally due on the same date as the Form 541, California Fiduciary Income Tax Return.

Q: Are there any penalties for not filing Form 541 Schedule J?

A: Yes, there may be penalties for failing to file Form 541 Schedule J or filing it late. It is important to file the form on time to avoid any penalties or interest charges.

Q: Can I electronically file Form 541 Schedule J?

A: Yes, you can electronically file Form 541 Schedule J using approved tax software or through a tax professional who offers e-filing services.

Q: Can I amend Form 541 Schedule J if I made a mistake?

A: Yes, you can amend Form 541 Schedule J by filing Form 541X, Amended California Fiduciary Income Tax Return.

Q: Is Form 541 Schedule J only for California trusts?

A: Yes, Form 541 Schedule J is specifically for reporting the trust allocation of an accumulation distribution for California trusts.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.