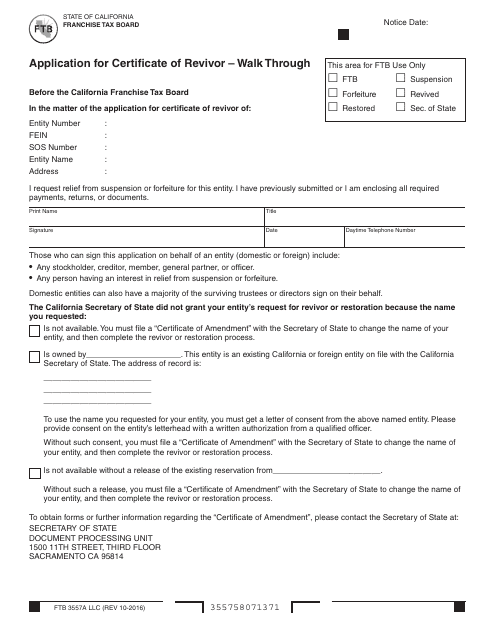

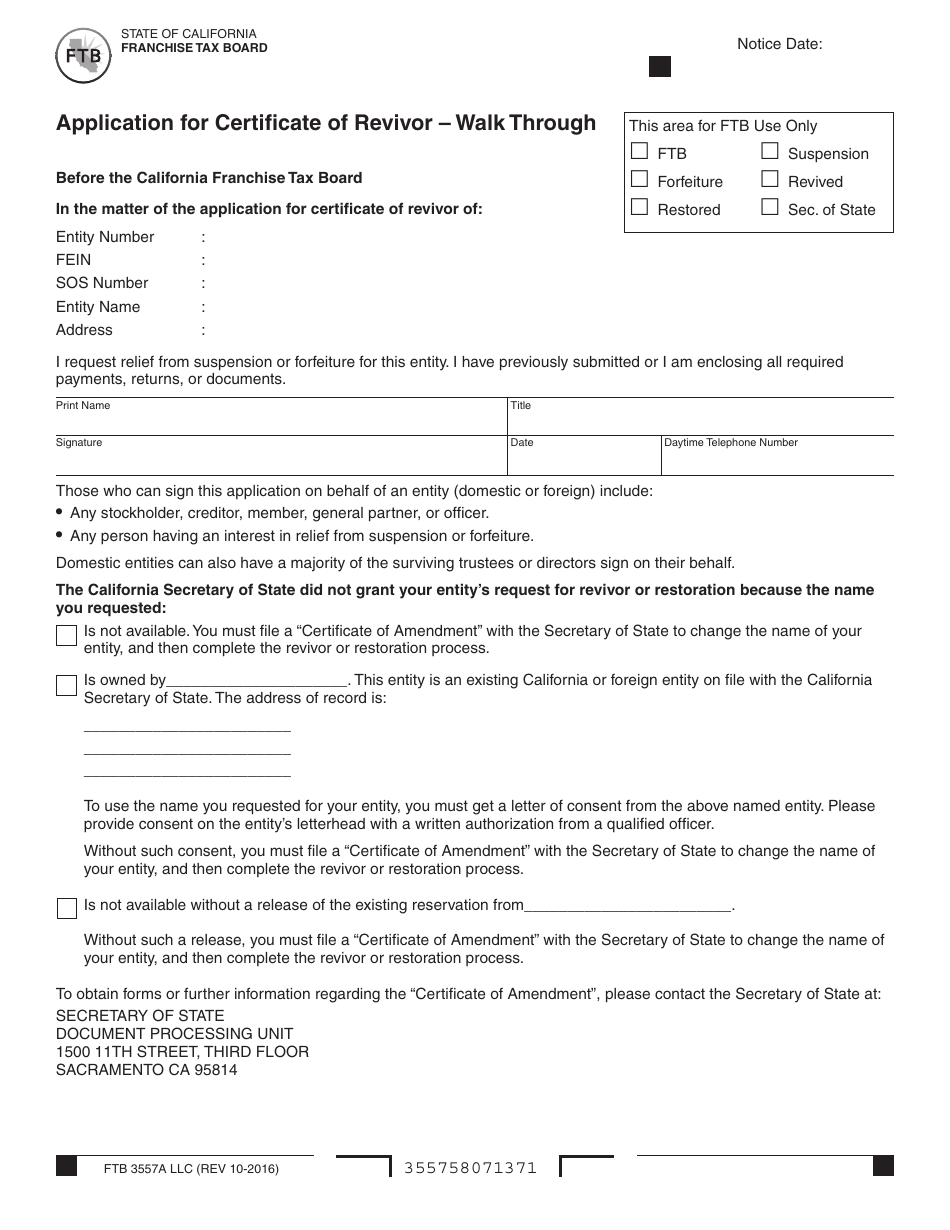

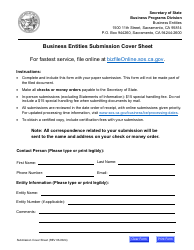

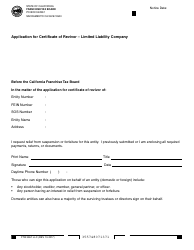

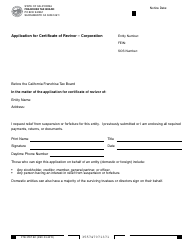

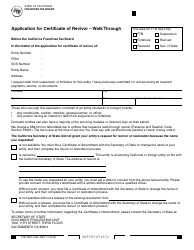

Form FTB3557A LLC Application for Certificate of Revivor - Walk Through - California

What Is Form FTB3557A LLC?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3557A?

A: Form FTB3557A is the LLC Application for Certificate of Revivor in California.

Q: What is it used for?

A: It is used to revive a limited liability company (LLC) in California that has been suspended or forfeited.

Q: What is the purpose of reviving an LLC?

A: To reinstate the LLC's active status and regain its legal rights and privileges.

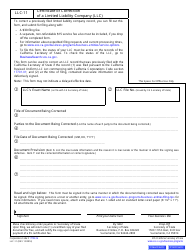

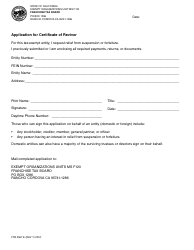

Q: What are the requirements for filing Form FTB3557A?

A: The LLC must have been suspended or forfeited, all delinquent tax returns and fees must be filed and paid, and a valid Registered Agent for Service of Process must be appointed.

Q: Is there a fee to file Form FTB3557A?

A: Yes, there is a filing fee of $50.

Q: How long does it take to process the application?

A: Processing times can vary, but it generally takes 4-6 weeks.

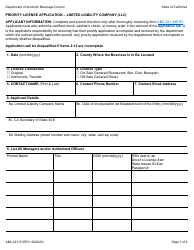

Q: Are there any additional forms or documents required?

A: Yes, you may need to provide a Statement of Information (Form LLC-12) and any necessary supporting documents.

Q: What happens after the LLC is revived?

A: Once the LLC is revived, it will regain its active status and can resume its business activities.

Q: Is it necessary to consult a tax professional or legal advisor?

A: It is recommended to consult with a tax professional or legal advisor for specific guidance based on your situation.

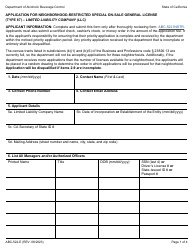

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3557A LLC by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.