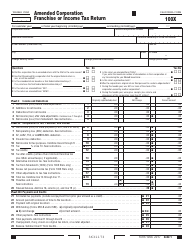

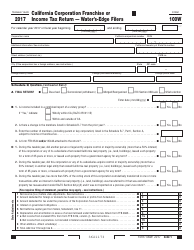

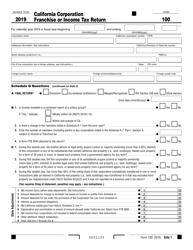

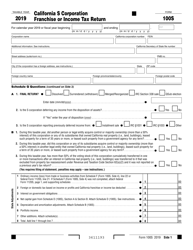

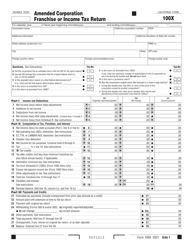

Instructions for Form 100X Amended Corporation Franchise or Income Tax Return - California

This document contains official instructions for Form 100X , Amended Corporation Franchise or Income Tax Return - a form released and collected by the California Franchise Tax Board.

FAQ

Q: What is Form 100X?

A: Form 100X is an amended corporation franchise or income tax return for the state of California.

Q: When should I use Form 100X?

A: You should use Form 100X when you need to amend a previously filed corporation franchise or income tax return for California.

Q: What information do I need to fill out Form 100X?

A: You will need the information from your original tax return as well as any additional information or changes that need to be made.

Q: Are there any fees associated with filing Form 100X?

A: No, there are no fees associated with filing Form 100X.

Q: Can Form 100X be filed electronically?

A: No, Form 100X cannot be filed electronically and must be filed by mail.

Q: How long does it take to process a Form 100X?

A: The processing time for Form 100X can vary, but it generally takes several weeks.

Q: What should I do if I made a mistake on my Form 100X?

A: If you made a mistake on your Form 100X, you will need to file another amended return to correct the error.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.