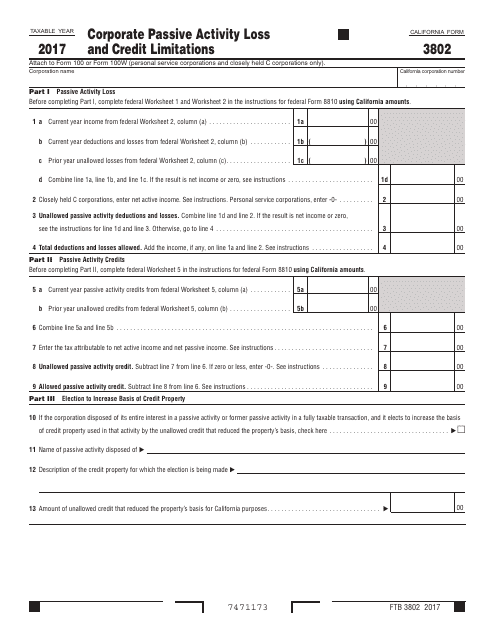

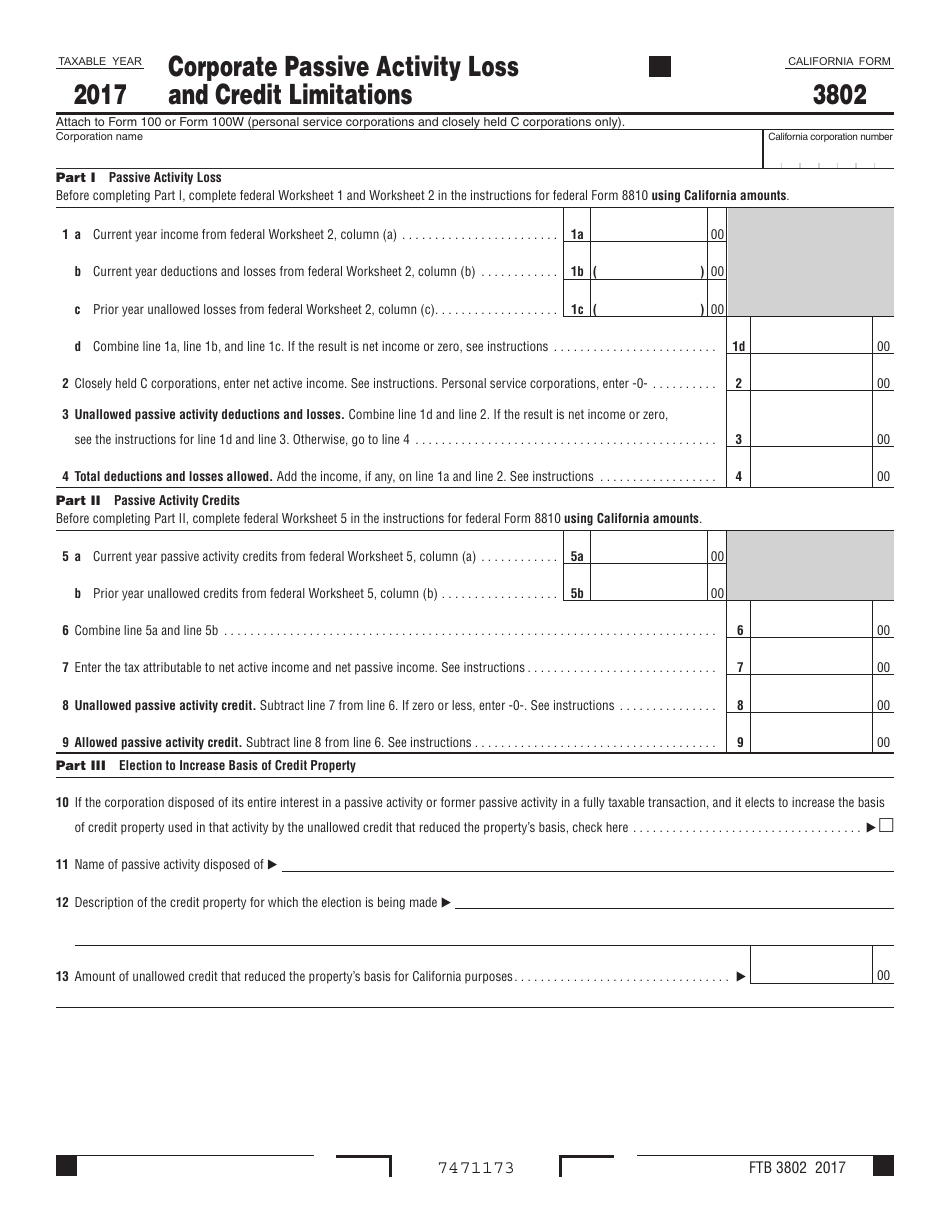

Form FTB3802 Corporate Passive Activity Loss and Credit Limitations - California

What Is Form FTB3802?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FTB3802?

A: FTB3802 is a form used to calculate the passive activity loss and credit limitations for corporations in California.

Q: Who needs to file Form FTB3802?

A: Corporations that have passive activity losses or credits in California need to file Form FTB3802.

Q: What are passive activity losses?

A: Passive activity losses are losses generated from rental real estate, limited partnerships, or other activities in which the taxpayer is not materially involved.

Q: What are credit limitations?

A: Credit limitations refer to the amount of credits that can be claimed by a taxpayer in a given year, often based on the taxpayer's income.

Q: How do I calculate passive activity loss and credit limitations on Form FTB3802?

A: The instructions for Form FTB3802 provide a step-by-step guide on how to calculate passive activity loss and credit limitations.

Q: When is the deadline to file Form FTB3802?

A: The deadline to file Form FTB3802 is the same as the deadline to file the corporation's tax return - generally April 15th or the 15th day of the 4th month after the close of the corporation's taxable year.

Q: What happens if I don't file Form FTB3802?

A: If you are required to file Form FTB3802 and fail to do so, you may be subject to penalties and interest on any underreported income or disallowed credits.

Q: Can I e-file Form FTB3802?

A: No, Form FTB3802 cannot be e-filed and must be filed by mail or submitted in person.

Q: Is Form FTB3802 only for corporations in California?

A: Yes, Form FTB3802 is specifically for reporting passive activity loss and credit limitations for corporations in California.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB3802 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.