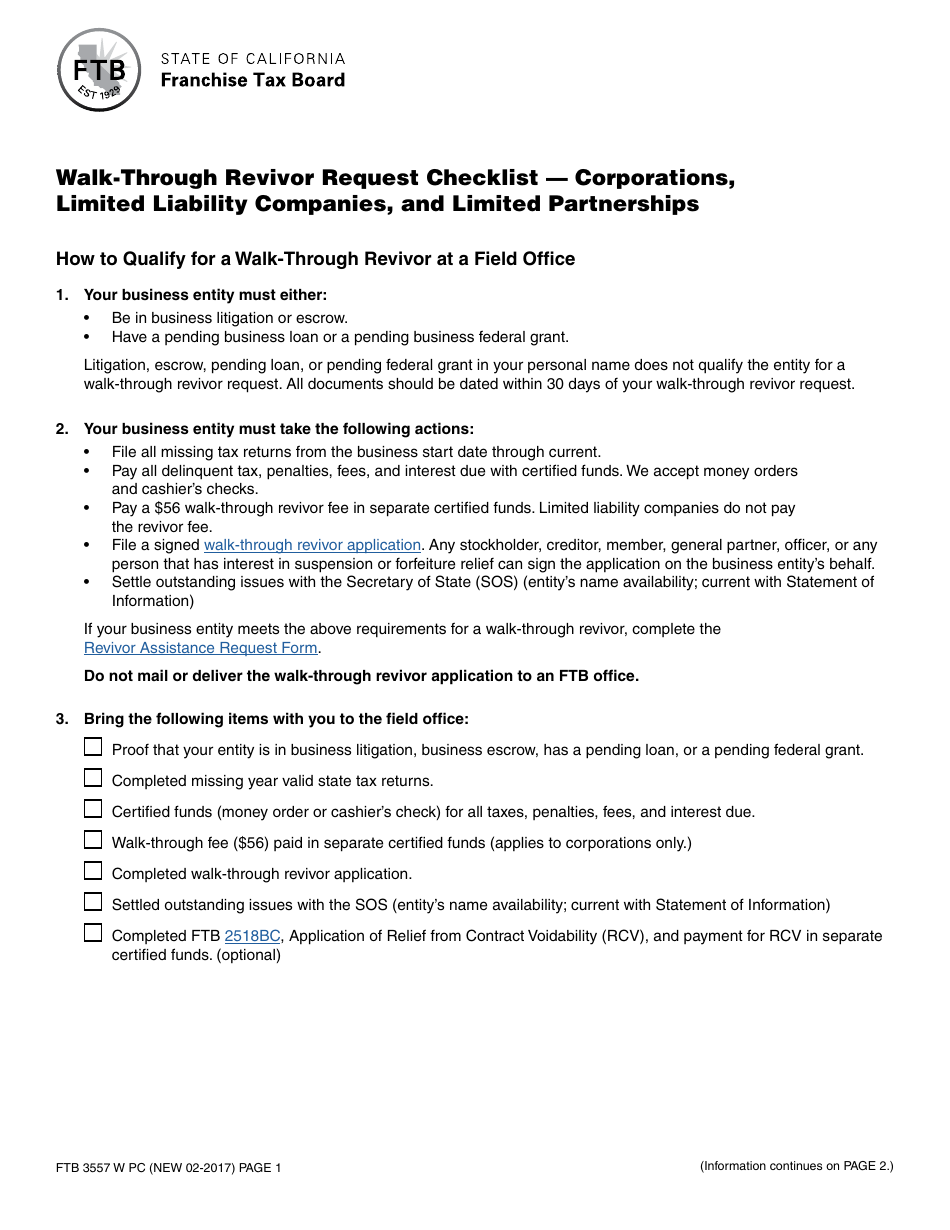

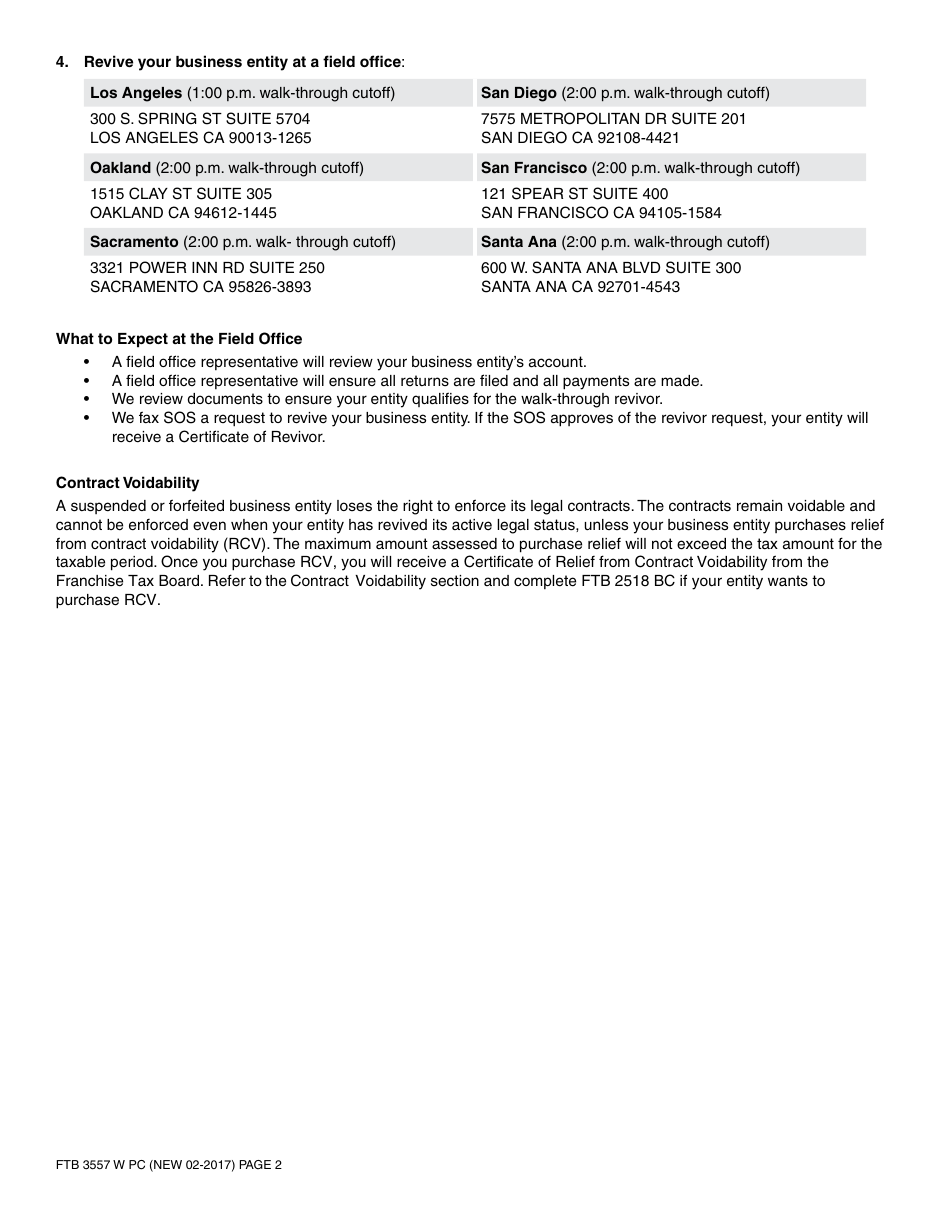

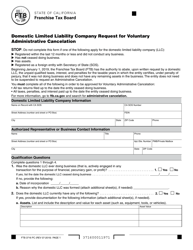

Form FTB3557 W PC Walk-Through Revivor Request Checklist " Corporations, Limited Liability Companies, and Limited Partnerships - California

What Is Form FTB3557 W PC?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3557 W PC?

A: Form FTB3557 W PC is a Walk-Through Revivor Request Checklist for Corporations, Limited Liability Companies, and Limited Partnerships in California.

Q: Who is required to use Form FTB3557 W PC?

A: Corporations, Limited Liability Companies, and Limited Partnerships in California are required to use Form FTB3557 W PC.

Q: What is the purpose of Form FTB3557 W PC?

A: The purpose of Form FTB3557 W PC is to request revivor of a suspended or forfeited business entity in California.

Q: Is Form FTB3557 W PC only for California businesses?

A: Yes, Form FTB3557 W PC is specifically for businesses in California.

Q: What information is required on Form FTB3557 W PC?

A: Form FTB3557 W PC requires information such as the entity type, entity name, tax identification number, and reason for suspension/forfeiture.

Q: What is the deadline for submitting Form FTB3557 W PC?

A: The deadline for submitting Form FTB3557 W PC is generally within 12 months from the date of suspension or forfeiture.

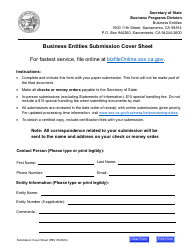

Q: Are there any fees associated with filing Form FTB3557 W PC?

A: Yes, there is a $50 filing fee for Form FTB3557 W PC.

Q: How long does it take to process a Form FTB3557 W PC?

A: Processing time for Form FTB3557 W PC can vary, but it typically takes 8-12 weeks.

Q: Can Form FTB3557 W PC be filed electronically?

A: No, Form FTB3557 W PC cannot be filed electronically and must be submitted by mail.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3557 W PC by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.