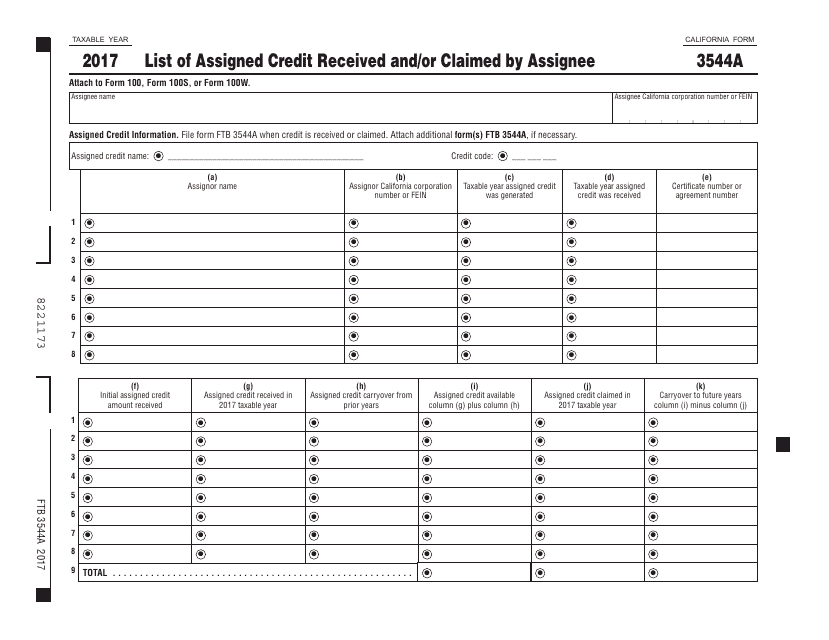

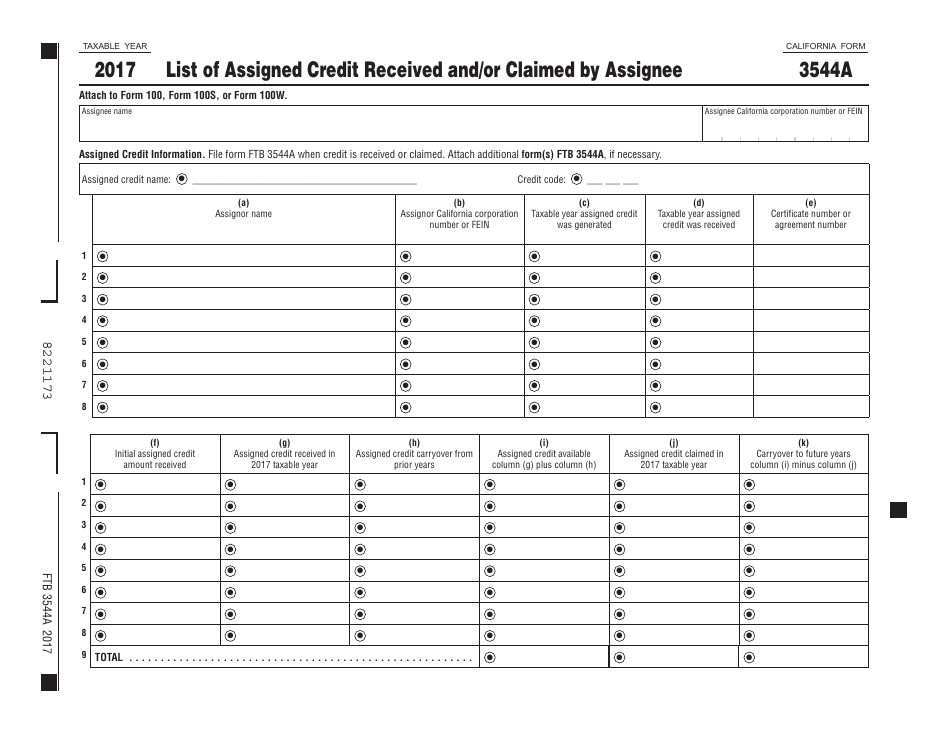

Form FTB3544A List of Assigned Credit Received and / or Claimed by Assignee - California

What Is Form FTB3544A?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form FTB3544A?

A: Form FTB3544A is a form used in California to list the assigned credits received and/or claimed by an assignee.

Q: Who uses Form FTB3544A?

A: Form FTB3544A is used by assignees in California.

Q: What is an assignee?

A: An assignee is a person or entity that has been assigned a tax credit by another taxpayer.

Q: What kind of credits can be listed on Form FTB3544A?

A: Form FTB3544A can be used to list various types of assigned credits, such as carryover credits or other assigned credits.

Q: What is the purpose of listing assigned credits on Form FTB3544A?

A: The purpose of listing assigned credits on Form FTB3544A is to report the credits and determine the amount of credit that can be claimed.

Q: Do I need to attach any supporting documentation with Form FTB3544A?

A: Yes, you may need to attach supporting documentation, such as a copy of the assignment agreement or evidence of the credit being assigned.

Q: What should I do if I have any questions or need assistance with Form FTB3544A?

A: If you have any questions or need assistance with Form FTB3544A, you can contact the California Franchise Tax Board for guidance.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB3544A by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.