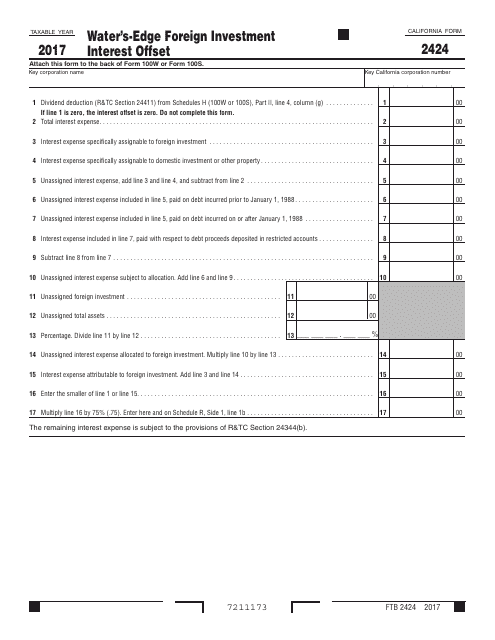

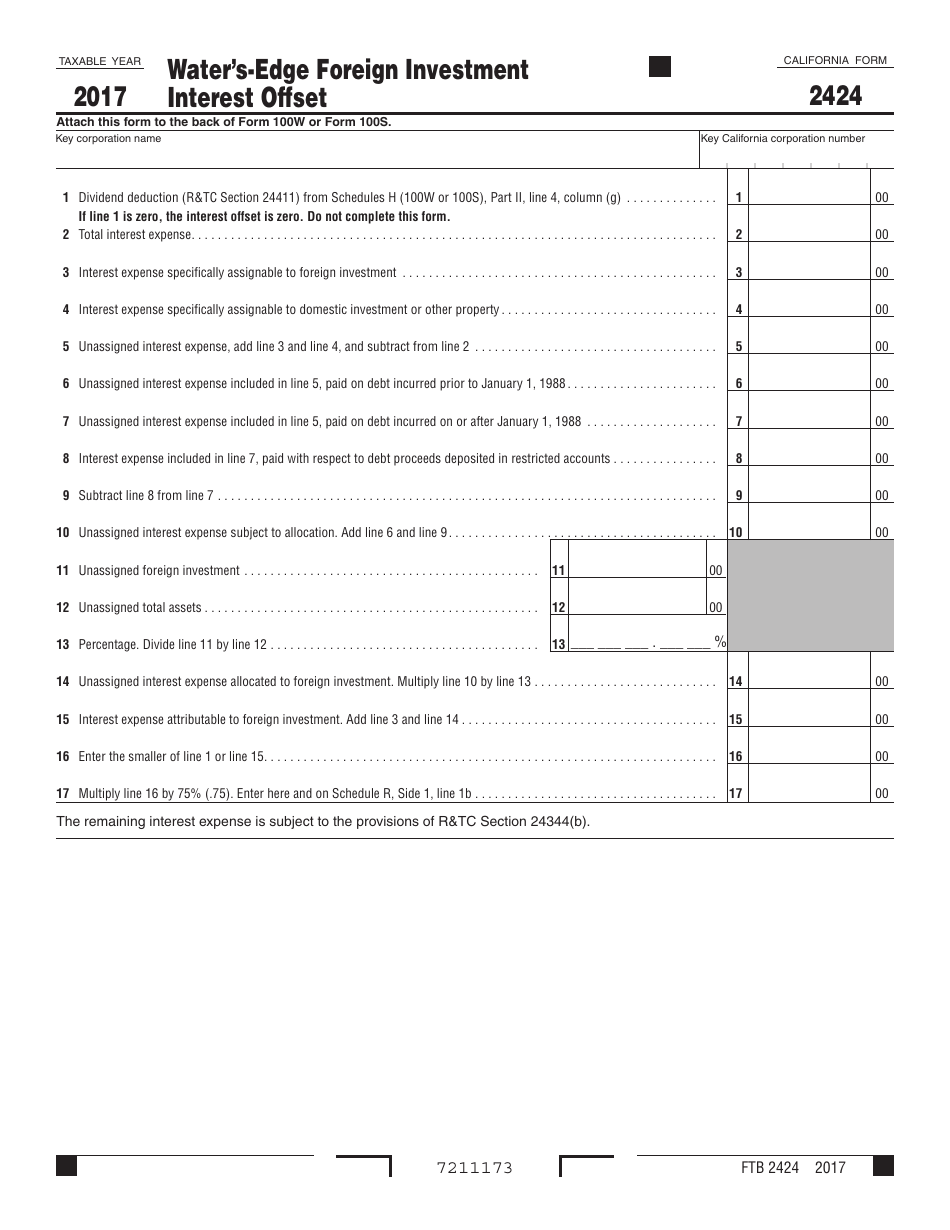

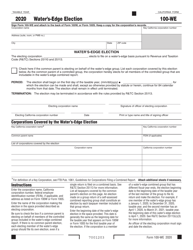

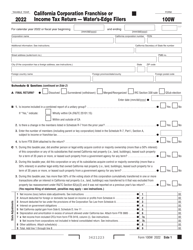

This version of the form is not currently in use and is provided for reference only. Download this version of

Form FTB2424

for the current year.

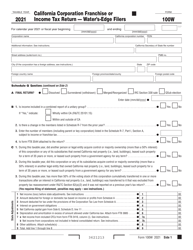

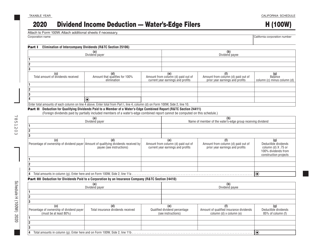

Form FTB2424 Water's-Edge Foreign Investment Interest Offset - California

What Is Form FTB2424?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form FTB 2424?

A: Form FTB 2424 is a form used in California to claim the Water's-Edge Foreign Investment Interest Offset.

Q: What is the Water's-Edge Foreign Investment Interest Offset?

A: The Water's-Edge Foreign Investment Interest Offset is a tax benefit available to corporations in California that have foreign investments.

Q: Who can use Form FTB 2424?

A: Corporations in California that have foreign investments can use Form FTB 2424 to claim the Water's-Edge Foreign Investment Interest Offset.

Q: What information is required on Form FTB 2424?

A: Form FTB 2424 requires information such as the taxpayer's name, federal employer identification number (FEIN), and details about the foreign investments.

Q: Is there a deadline for filing Form FTB 2424?

A: Yes, Form FTB 2424 must be filed with the California Franchise Tax Board by the due date of the taxpayer's annual tax return.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB2424 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.