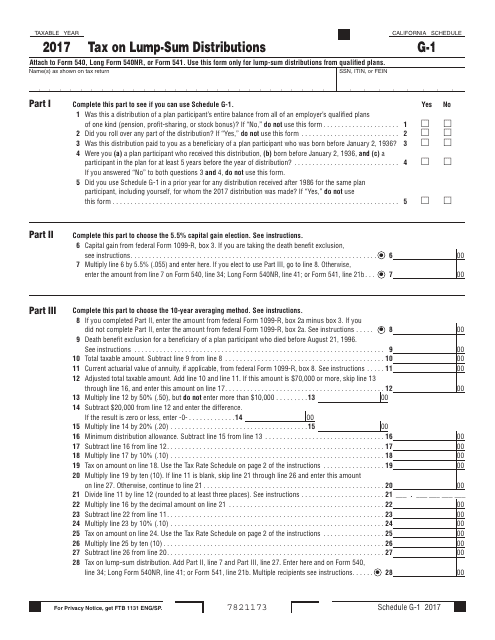

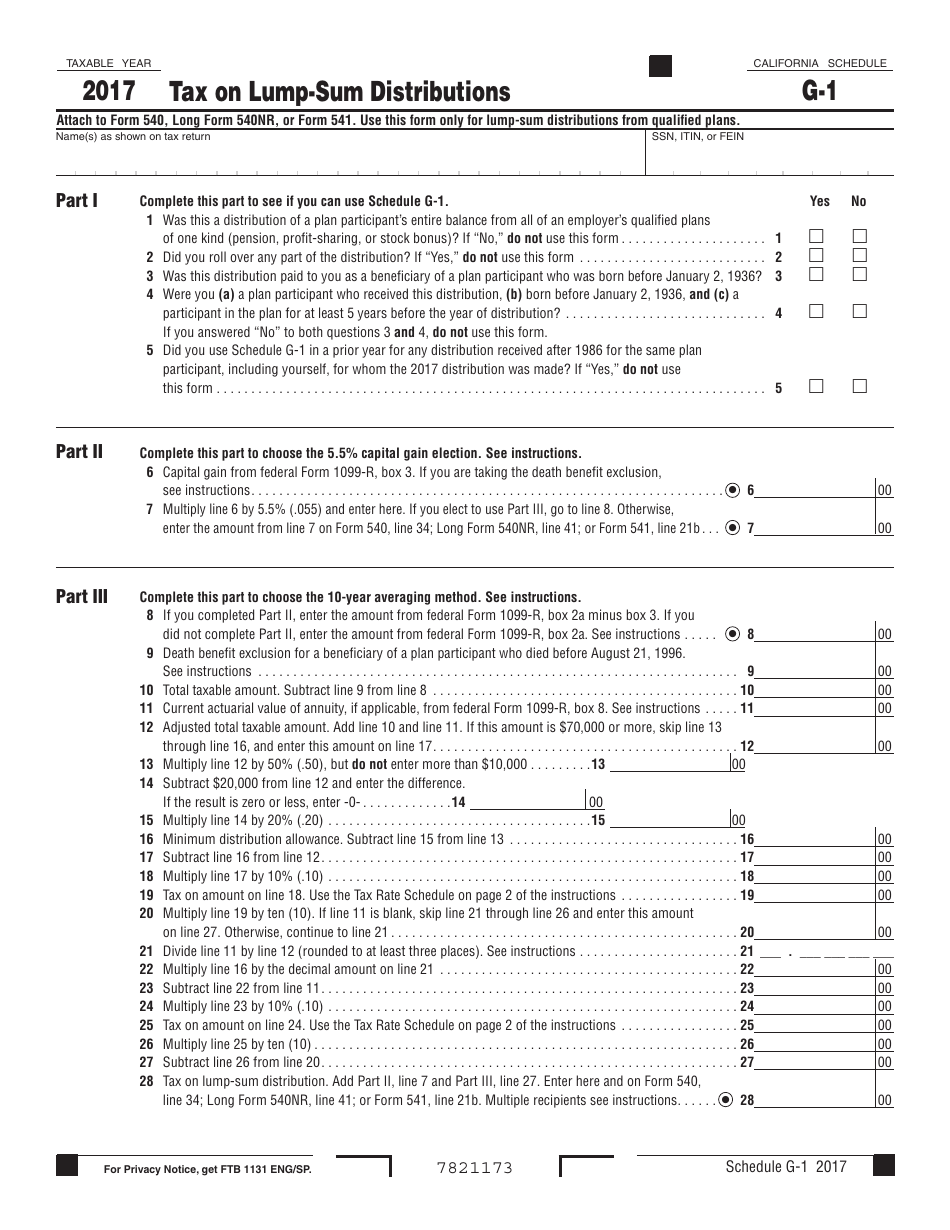

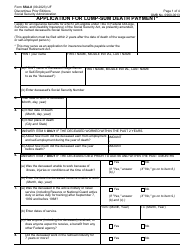

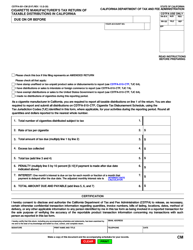

Schedule G-1 Tax on Lump-Sum Distributions - California

What Is Schedule G-1?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule G-1?

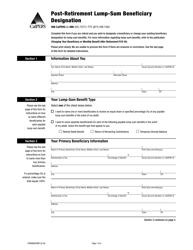

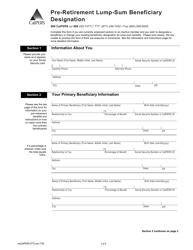

A: Schedule G-1 is a tax form used in California to report lump-sum distributions.

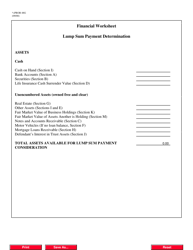

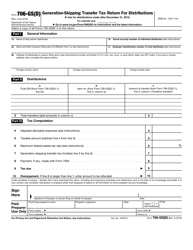

Q: What are lump-sum distributions?

A: Lump-sum distributions are one-time payments from a retirement plan or pension that are usually received in a single tax year.

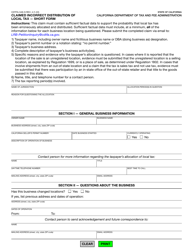

Q: Who needs to file Schedule G-1?

A: Individuals who have received a lump-sum distribution and need to report it for tax purposes in California.

Q: When is the deadline to file Schedule G-1?

A: The deadline to file Schedule G-1 in California is the same as the tax filing deadline, which is usually April 15th.

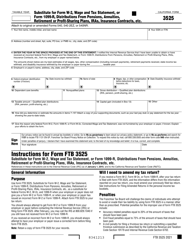

Q: Do I need to attach other forms or documents with Schedule G-1?

A: Yes, you may need to attach other forms or documents, such as Form 540, to report your income and deductions.

Q: What happens if I don't file Schedule G-1?

A: If you are required to file Schedule G-1 and fail to do so, you may face penalties and interest charges from the California Franchise Tax Board.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule G-1 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.