This version of the form is not currently in use and is provided for reference only. Download this version of

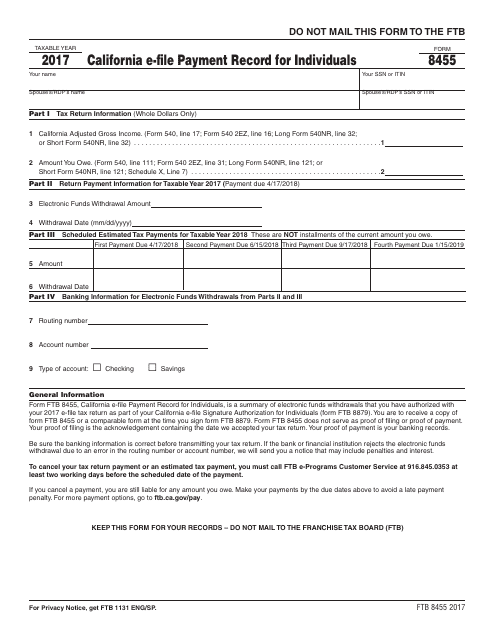

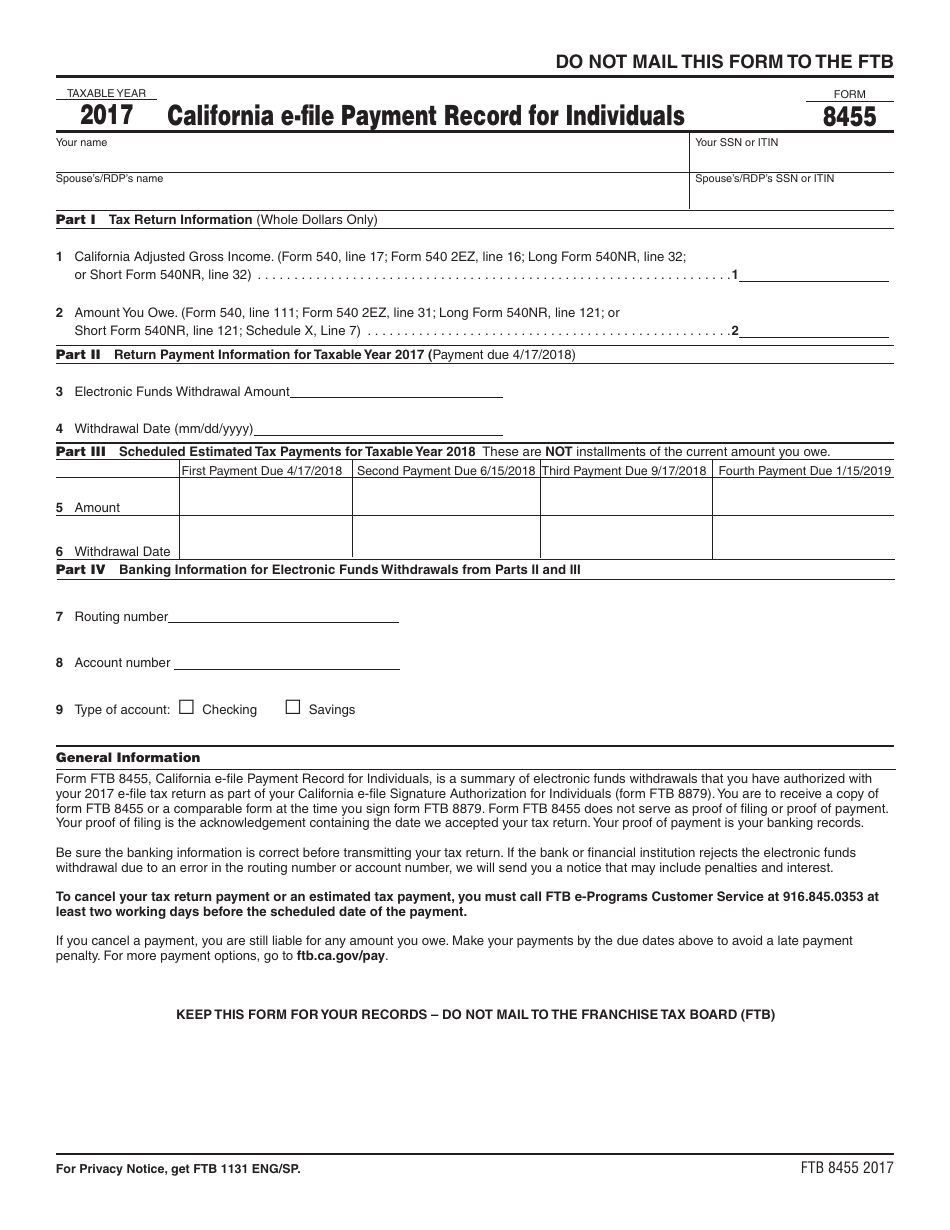

Form FTB8455

for the current year.

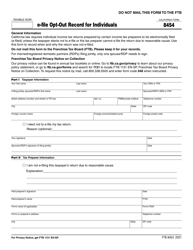

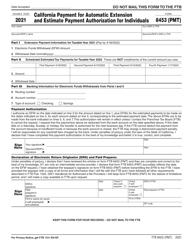

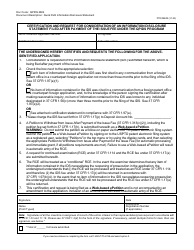

Form FTB8455 California E-File Payment Record for Individuals - California

What Is Form FTB8455?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB8455?

A: Form FTB8455 is the California E-File Payment Record for Individuals.

Q: Who needs to file Form FTB8455?

A: Form FTB8455 must be filed by individuals who are making electronic payments to the California Franchise Tax Board.

Q: What is the purpose of Form FTB8455?

A: The purpose of Form FTB8455 is to record and confirm electronic payments made to the California Franchise Tax Board.

Q: Do I need to file Form FTB8455 if I am filing my taxes electronically?

A: Yes, if you are making electronic payments to the California Franchise Tax Board, you must file Form FTB8455 to record and confirm your payments.

Q: Can I file Form FTB8455 separately from my tax return?

A: Yes, Form FTB8455 can be filed separately from your tax return, but it is recommended to file it at the same time to ensure accurate payment recording.

Q: What information is required on Form FTB8455?

A: Form FTB8455 requires your name, social security number or individual taxpayer identification number, payment type, payment amount, and payment date.

Q: Can I file Form FTB8455 electronically?

A: Yes, you can file Form FTB8455 electronically along with your electronic payment.

Q: How long should I keep a copy of Form FTB8455?

A: It is recommended to keep a copy of Form FTB8455 for at least 4 years in case of future inquiries or audits.

Q: Is there a deadline for filing Form FTB8455?

A: Form FTB8455 should be filed as soon as possible after making your electronic payment, but there is no specific deadline for filing.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB8455 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.