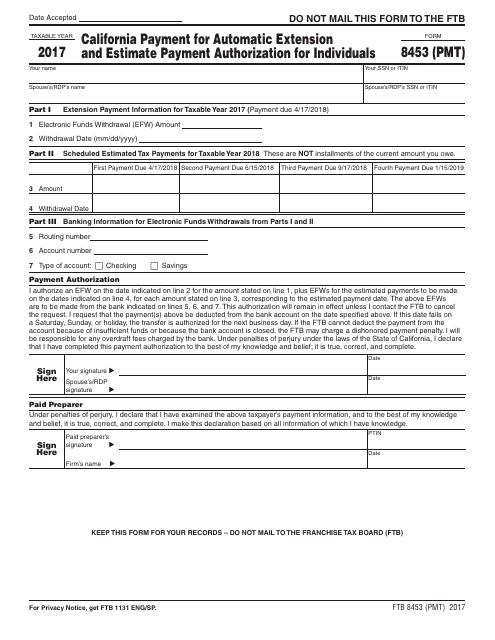

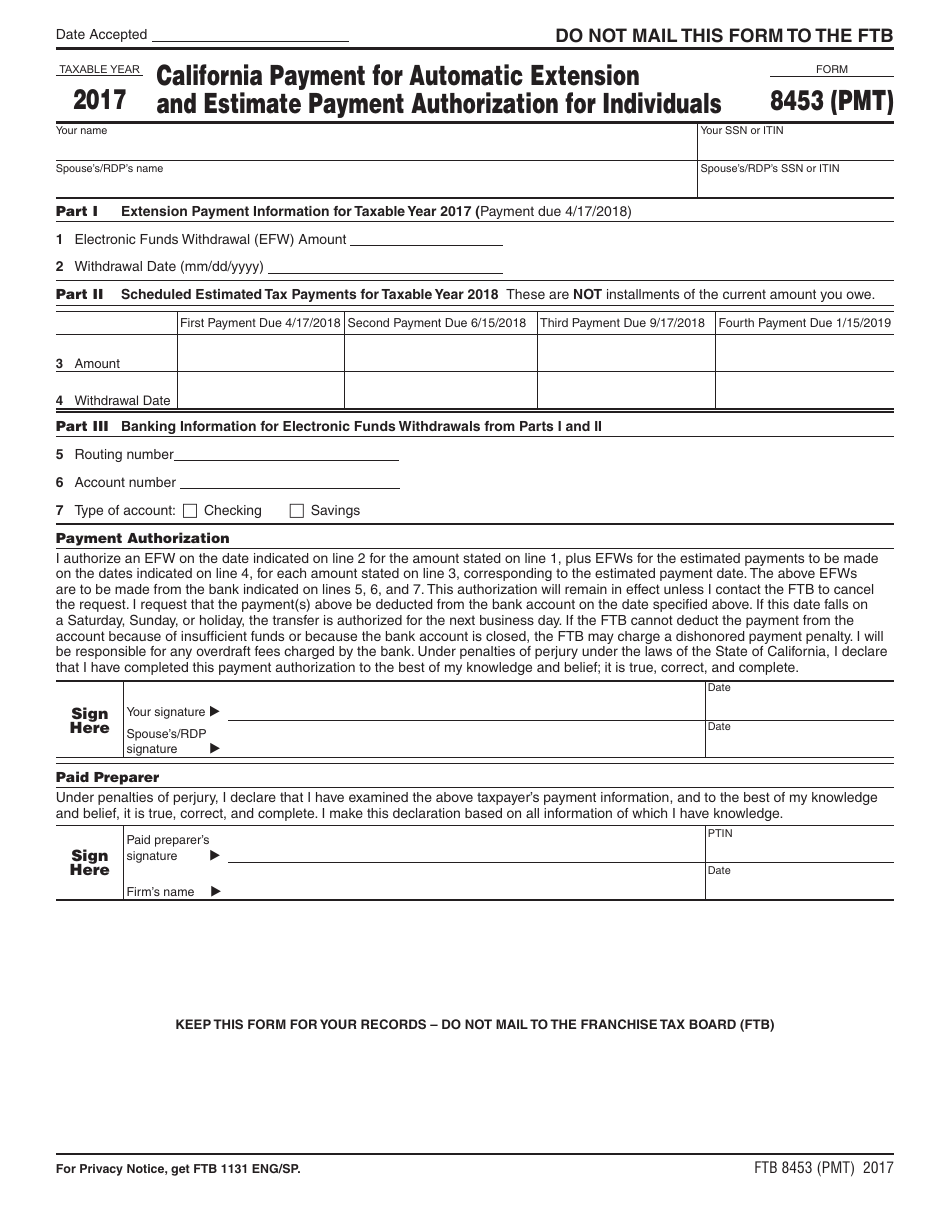

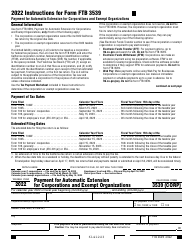

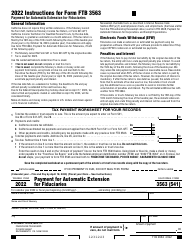

This version of the form is not currently in use and is provided for reference only. Download this version of

Form FTB8453 (PMT)

for the current year.

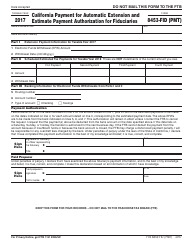

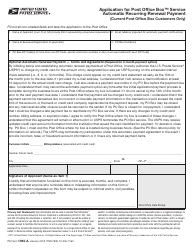

Form FTB8453 (PMT) California Payment for Automatic Extension and Estimate Payment Authorization for Individuals - California

What Is Form FTB8453 (PMT)?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form FTB8453 (PMT)?

A: Form FTB8453 (PMT) is a document used for making payments for automatic extension and estimated taxes in California.

Q: Who needs to fill out Form FTB8453 (PMT)?

A: Individuals who need to make a payment for automatic extension or estimated taxes in California should fill out this form.

Q: What is the purpose of Form FTB8453 (PMT)?

A: The purpose of this form is to authorize payment for automatic extension and estimated taxes in California.

Q: What information is required on Form FTB8453 (PMT)?

A: The form requires information such as the taxpayer's name, SSN or ITIN, payment amount, and payment method.

Q: Are there any deadlines associated with Form FTB8453 (PMT)?

A: Yes, the form should be submitted by the due date for the payment of automatic extension or estimated taxes.

Q: Can the payment be made electronically?

A: Yes, the form allows for payment by electronic funds withdrawal, credit card, or debit card.

Q: What should I do after filling out Form FTB8453 (PMT)?

A: After filling out the form, you should retain a copy for your records and submit it along with the payment to the address provided on the form.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB8453 (PMT) by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.