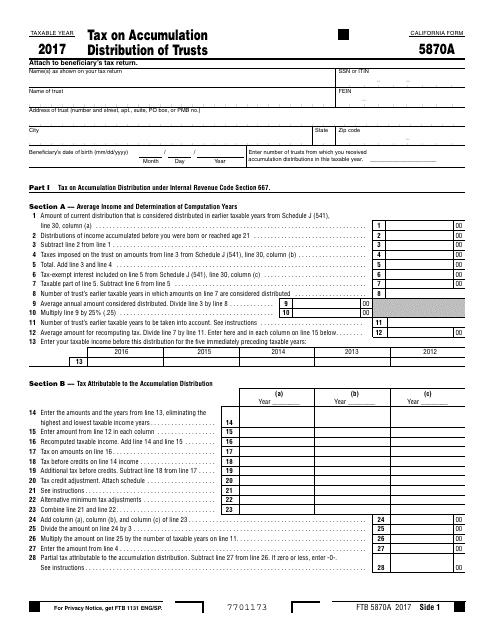

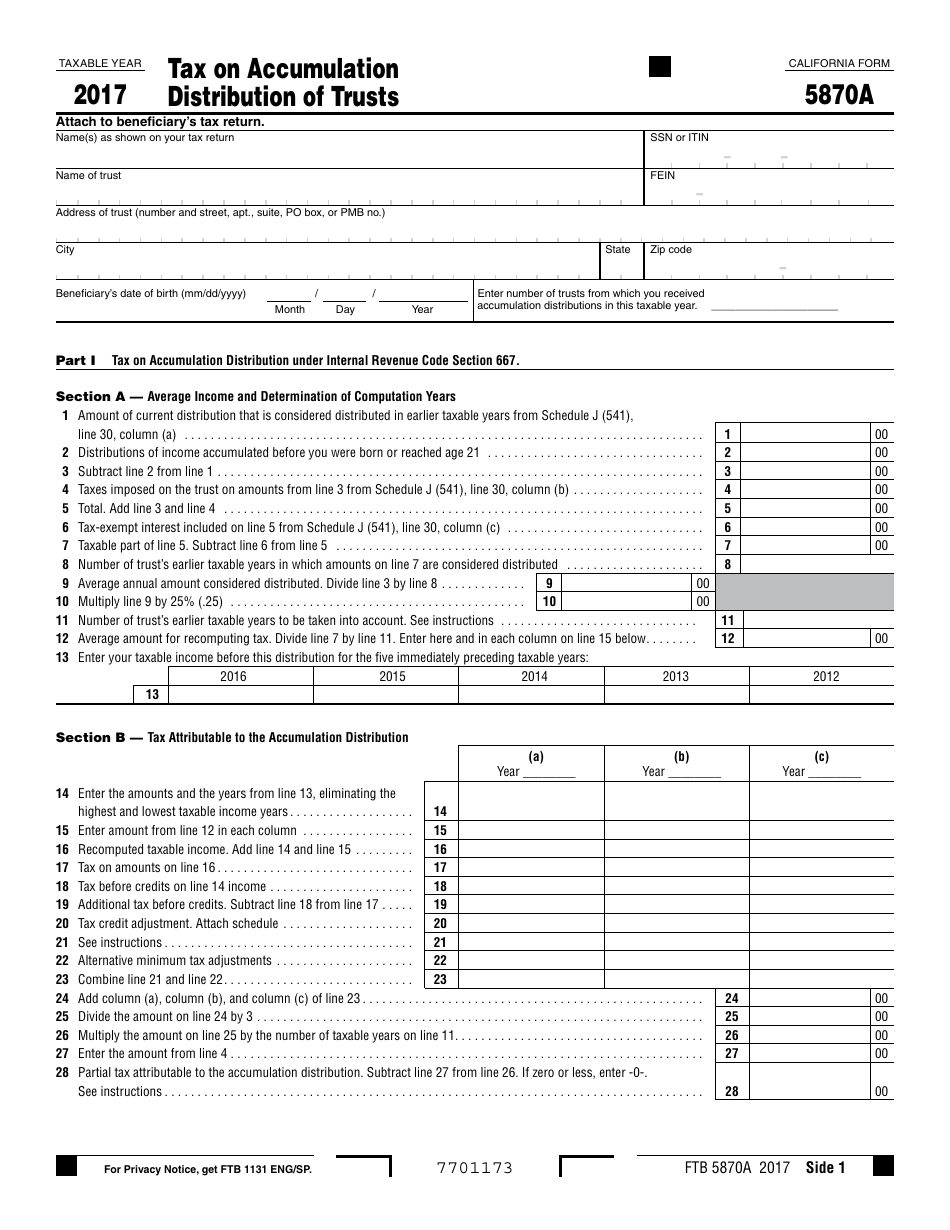

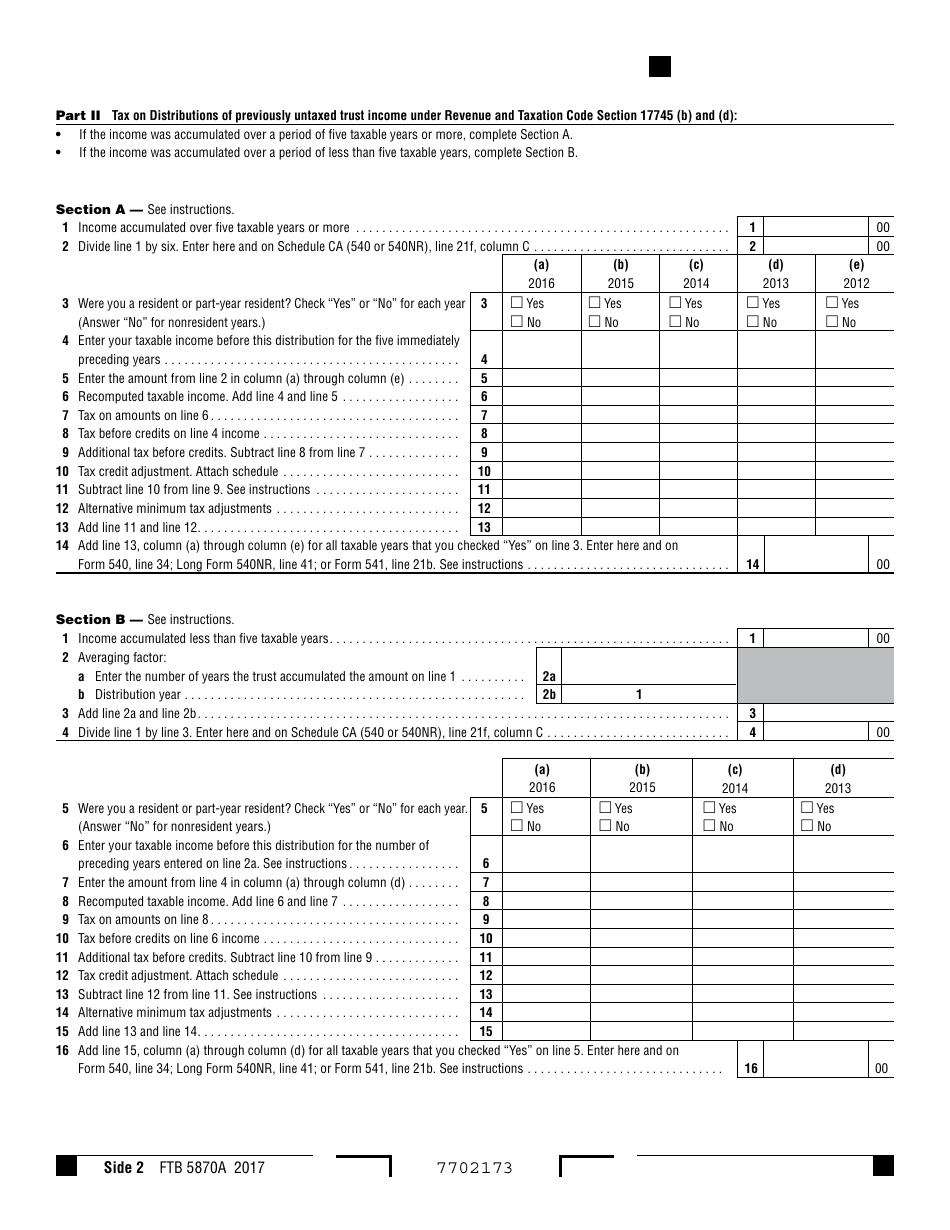

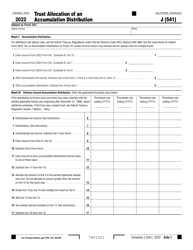

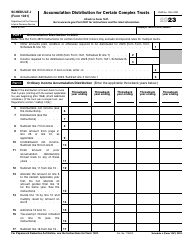

Form FTB5870A Tax on Accumulation Distribution of Trusts - California

What Is Form FTB5870A?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form FTB5870A?

A: Form FTB5870A is the Tax on Accumulation Distribution of Trusts form for California.

Q: Who needs to file Form FTB5870A?

A: Trusts that have accumulated income exceeding $10,000 and have a California source-partnership or S corporation income allocation are required to file Form FTB5870A.

Q: What is the purpose of Form FTB5870A?

A: The purpose of Form FTB5870A is to calculate and report the tax on accumulation distributions made by trusts in California.

Q: When is Form FTB5870A due?

A: Form FTB5870A is due on or before the 15th day of the 4th month following the close of the taxable year.

Q: Is there a penalty for late filing of Form FTB5870A?

A: Yes, there is a penalty for late filing of Form FTB5870A. The penalty is based on the amount of tax due and the number of days late.

Q: Are there any exceptions to filing Form FTB5870A?

A: There are certain exceptions to filing Form FTB5870A, such as if the trust is a grantor trust or if it is a martial trust with only one beneficiary.

Q: Can Form FTB5870A be filed electronically?

A: No, Form FTB5870A cannot be filed electronically. It must be filed by mail or delivered in person to the Franchise Tax Board.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB5870A by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.