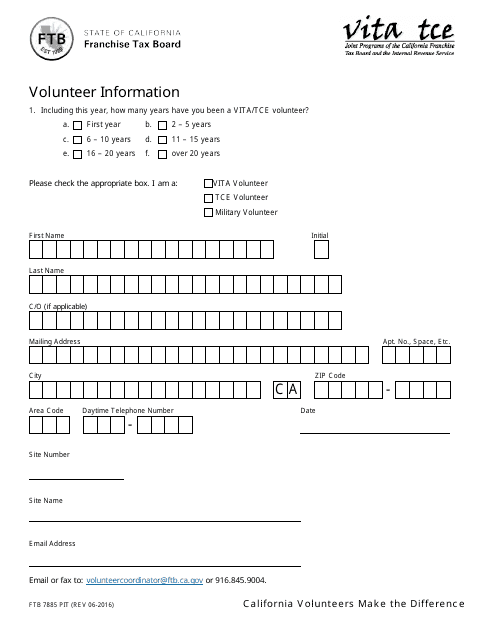

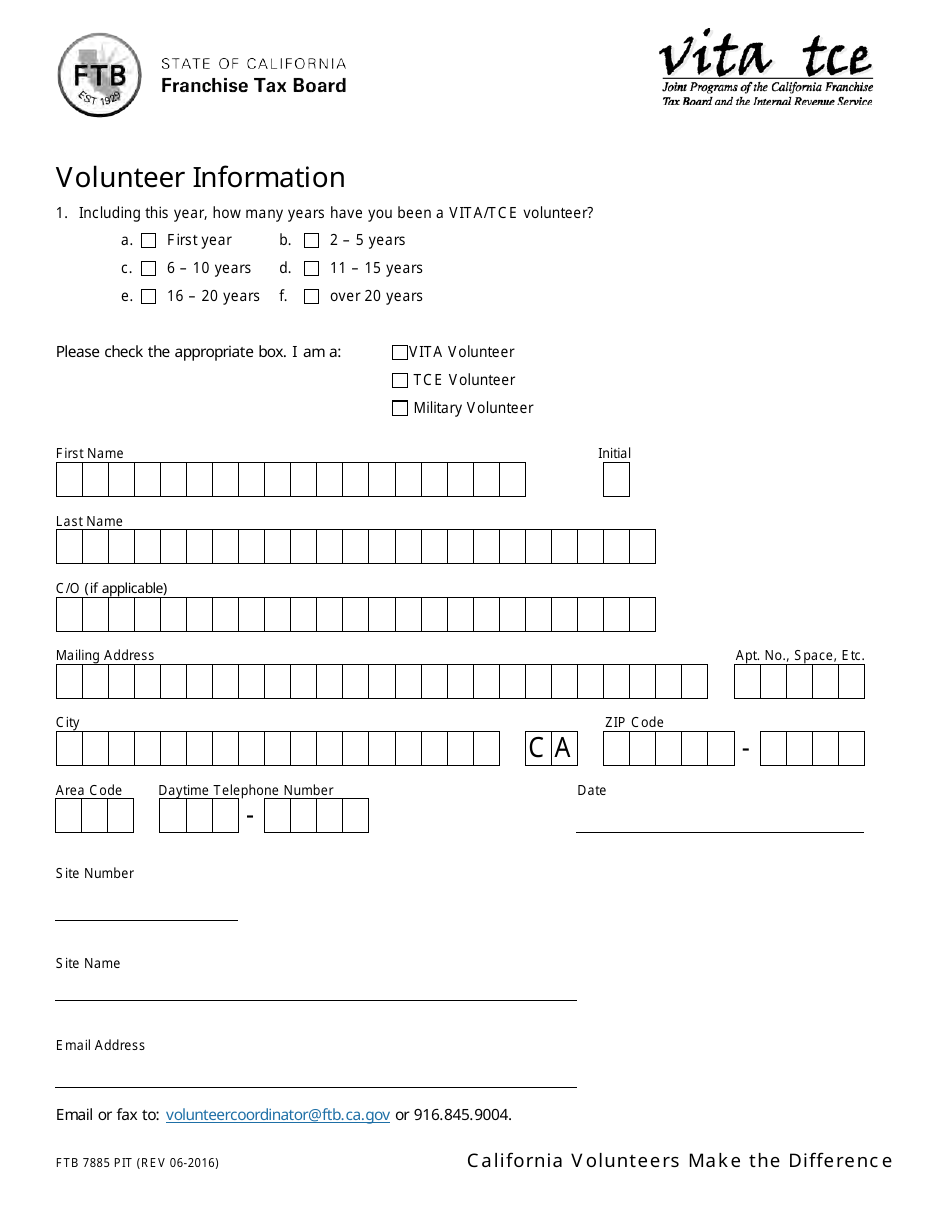

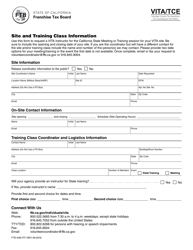

Form FTB7885 PIT Volunteer Information - California

What Is Form FTB7885 PIT?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB7885 PIT?

A: Form FTB7885 PIT is the Volunteer Information form used in California.

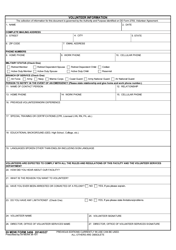

Q: Who needs to fill out Form FTB7885 PIT?

A: Individuals who volunteered for Tax Counseling for the Elderly (TCE) or Volunteer Income Tax Assistance (VITA) programs in California need to fill out this form.

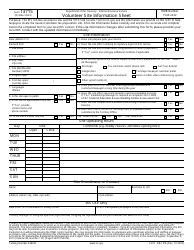

Q: What information is required on Form FTB7885 PIT?

A: Form FTB7885 PIT requires information such as the volunteer's name, address, phone number, social security number, and details about the volunteer's work with the TCE or VITA programs.

Q: When is the deadline to file Form FTB7885 PIT?

A: Form FTB7885 PIT should be filed by April 15th of the year following the tax year in which the volunteer provided services.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB7885 PIT by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.