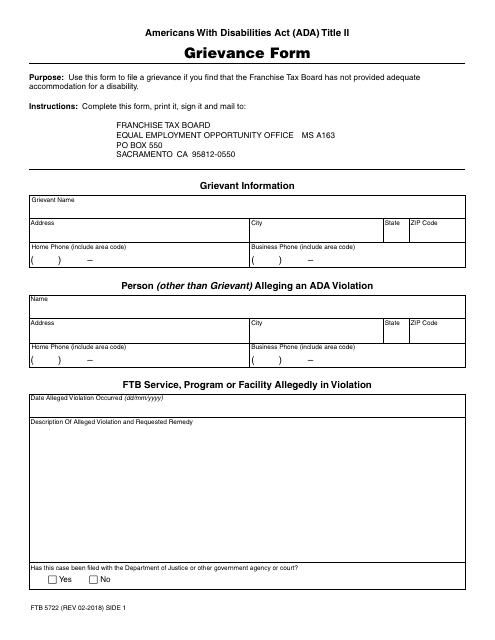

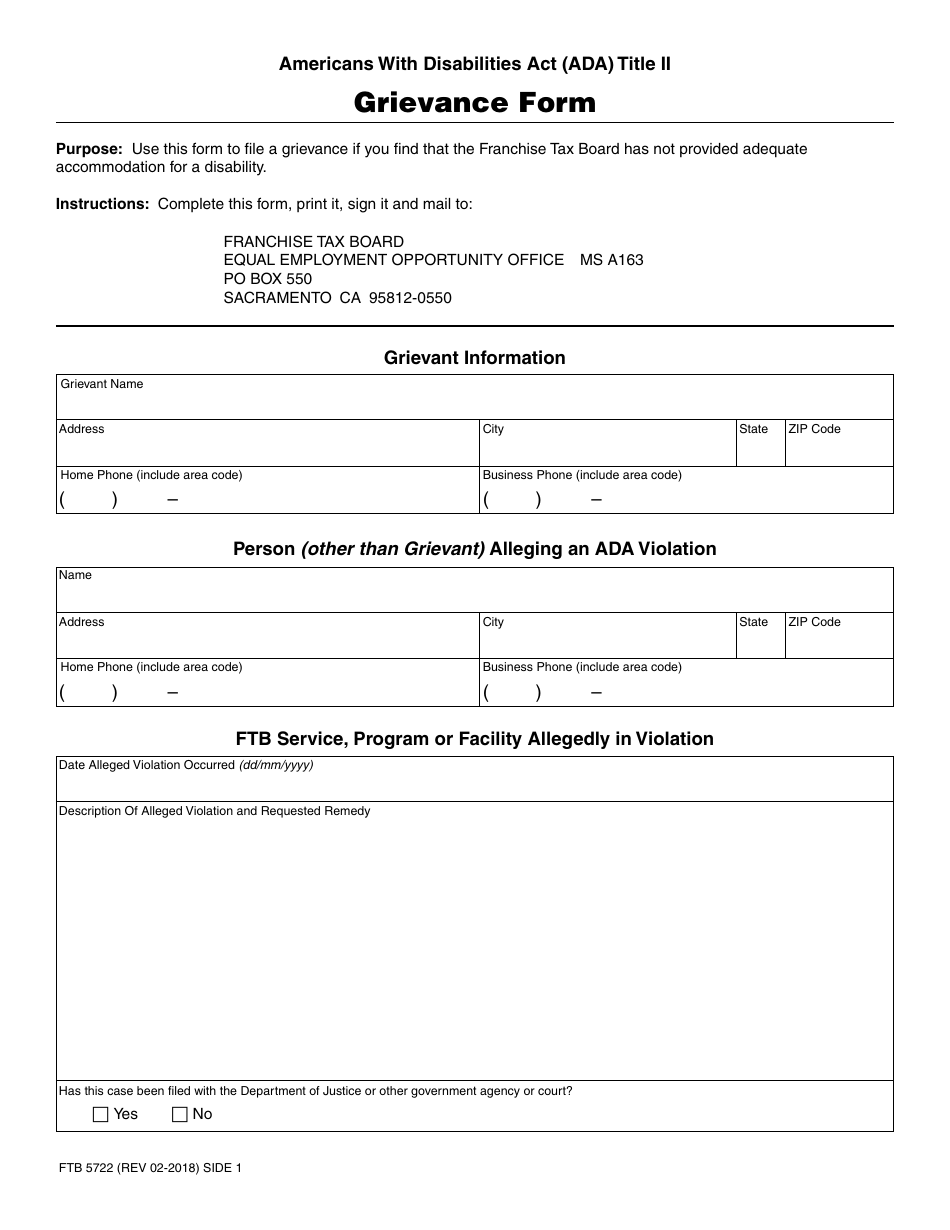

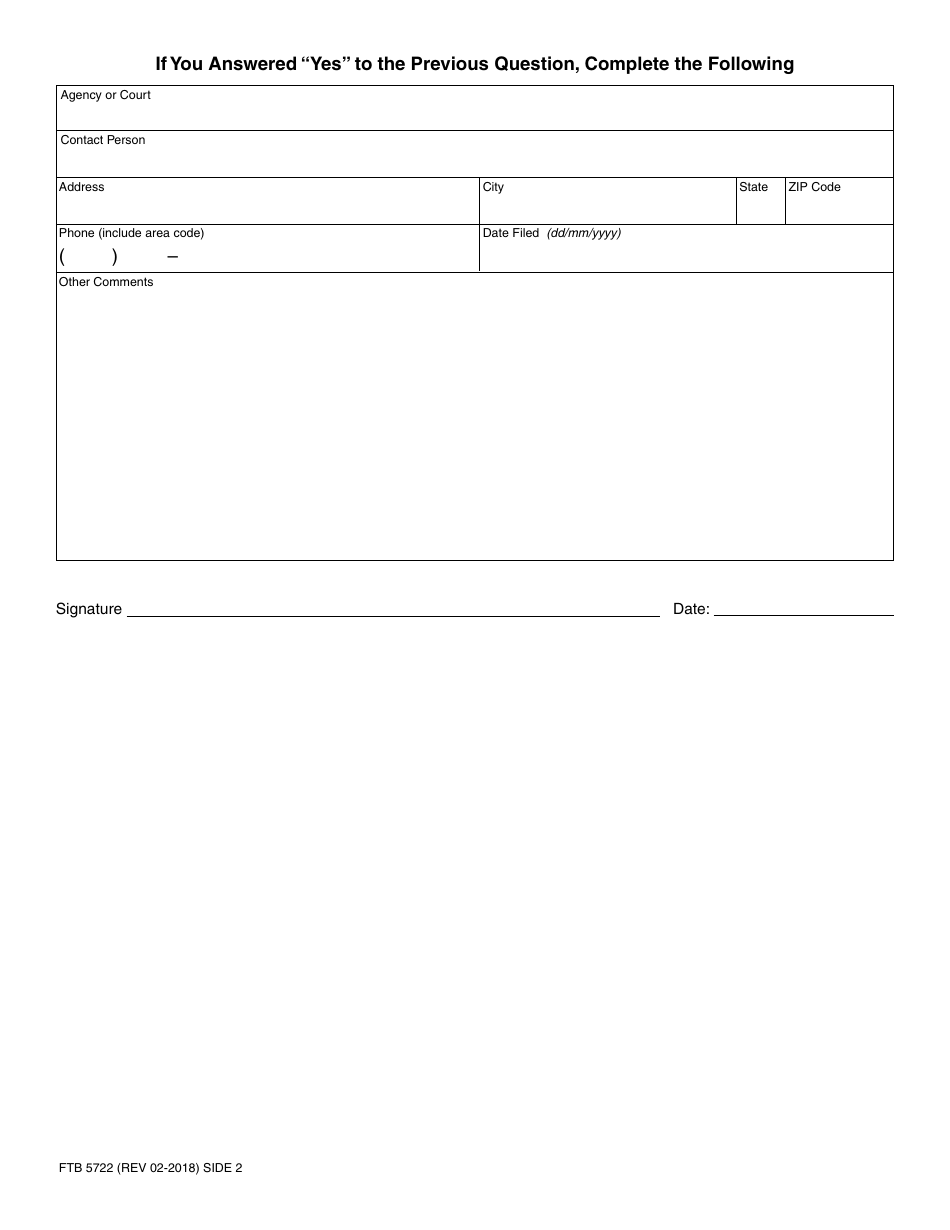

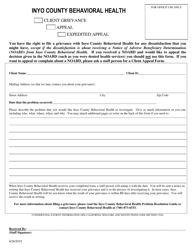

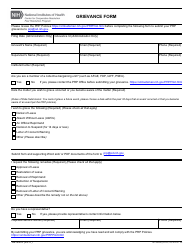

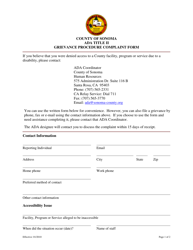

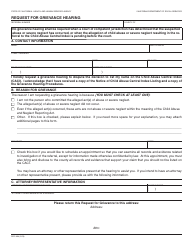

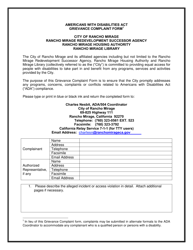

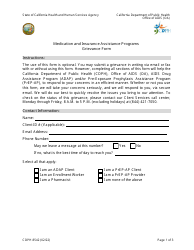

Form FTB5722 Grievance Form - California

What Is Form FTB5722?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB 5722?

A: Form FTB 5722 is a Grievance Form used in California.

Q: What is the purpose of Form FTB 5722?

A: The purpose of Form FTB 5722 is to file a grievance with the California Franchise Tax Board.

Q: Who can use Form FTB 5722?

A: Anyone who wants to file a grievance with the California Franchise Tax Board can use Form FTB 5722.

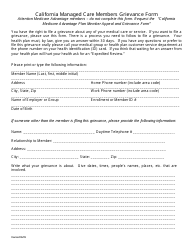

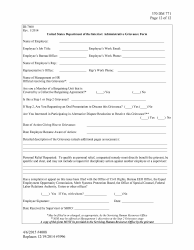

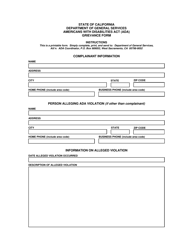

Q: What information is required in Form FTB 5722?

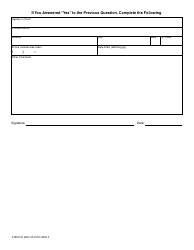

A: Form FTB 5722 requires you to provide your personal details, the tax period in question, and the details of your grievance.

Q: Is there a deadline for submitting Form FTB 5722?

A: Yes, there is a deadline for submitting Form FTB 5722. The deadline is typically within three years from the date the tax was paid or within two years from the date the tax was assessed, whichever is later.

Q: What happens after I submit Form FTB 5722?

A: After you submit Form FTB 5722, the California Franchise Tax Board will review your grievance and respond to you in writing.

Q: Can I appeal if my grievance is denied?

A: Yes, if your grievance is denied, you have the right to appeal the decision.

Q: Are there any fees associated with filing Form FTB 5722?

A: There are no fees associated with filing Form FTB 5722.

Q: Is Form FTB 5722 confidential?

A: Yes, the information provided in Form FTB 5722 is confidential and protected by law.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB5722 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.