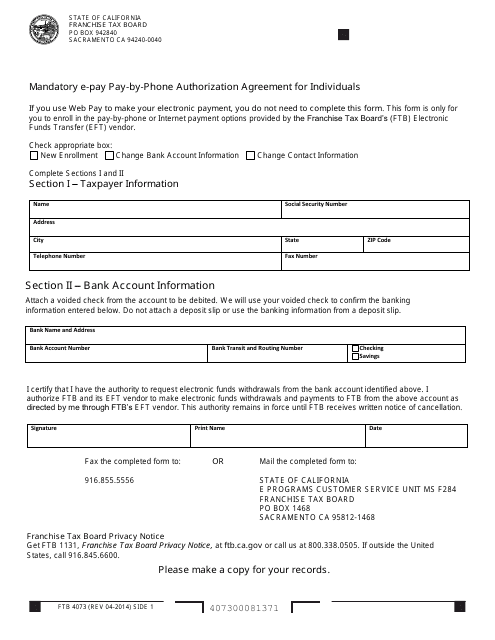

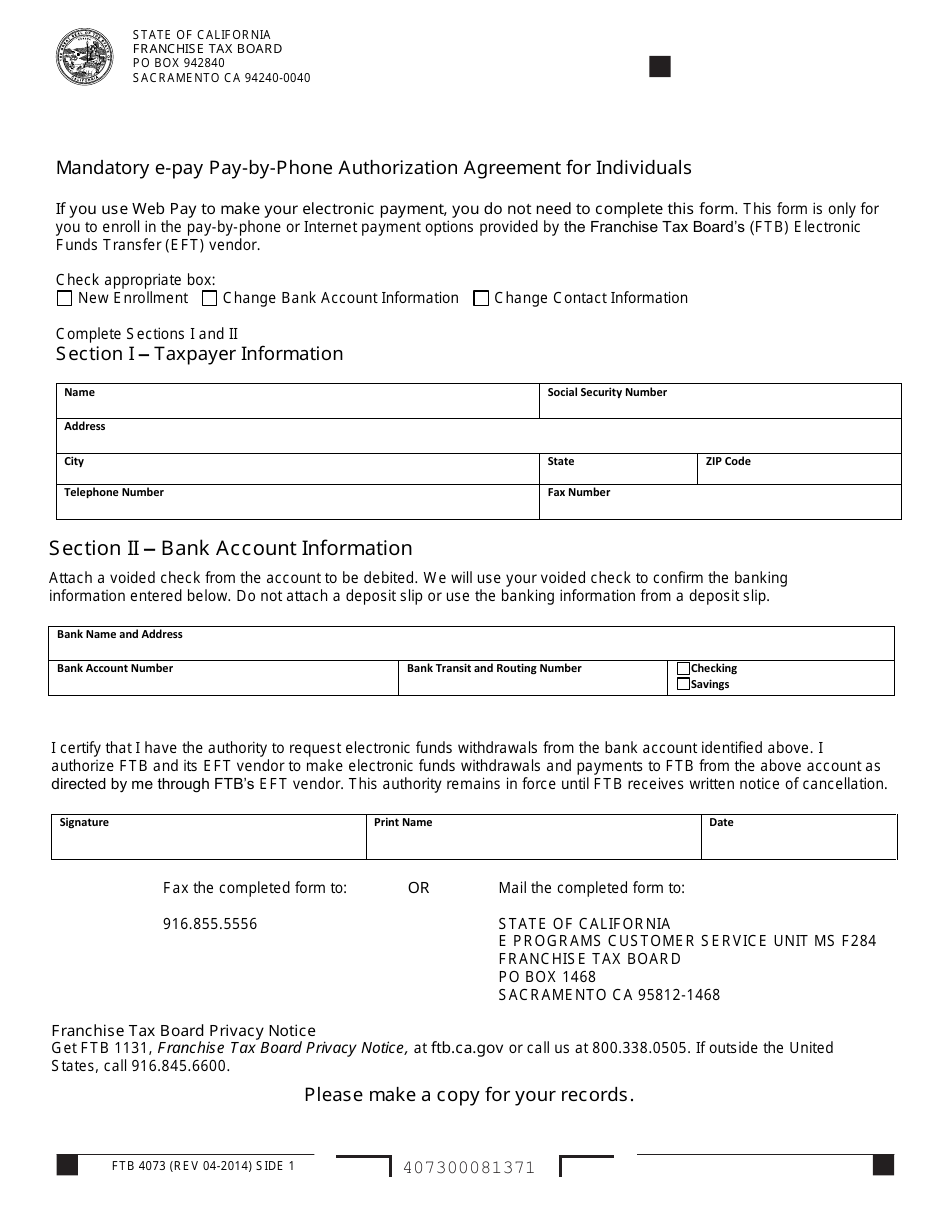

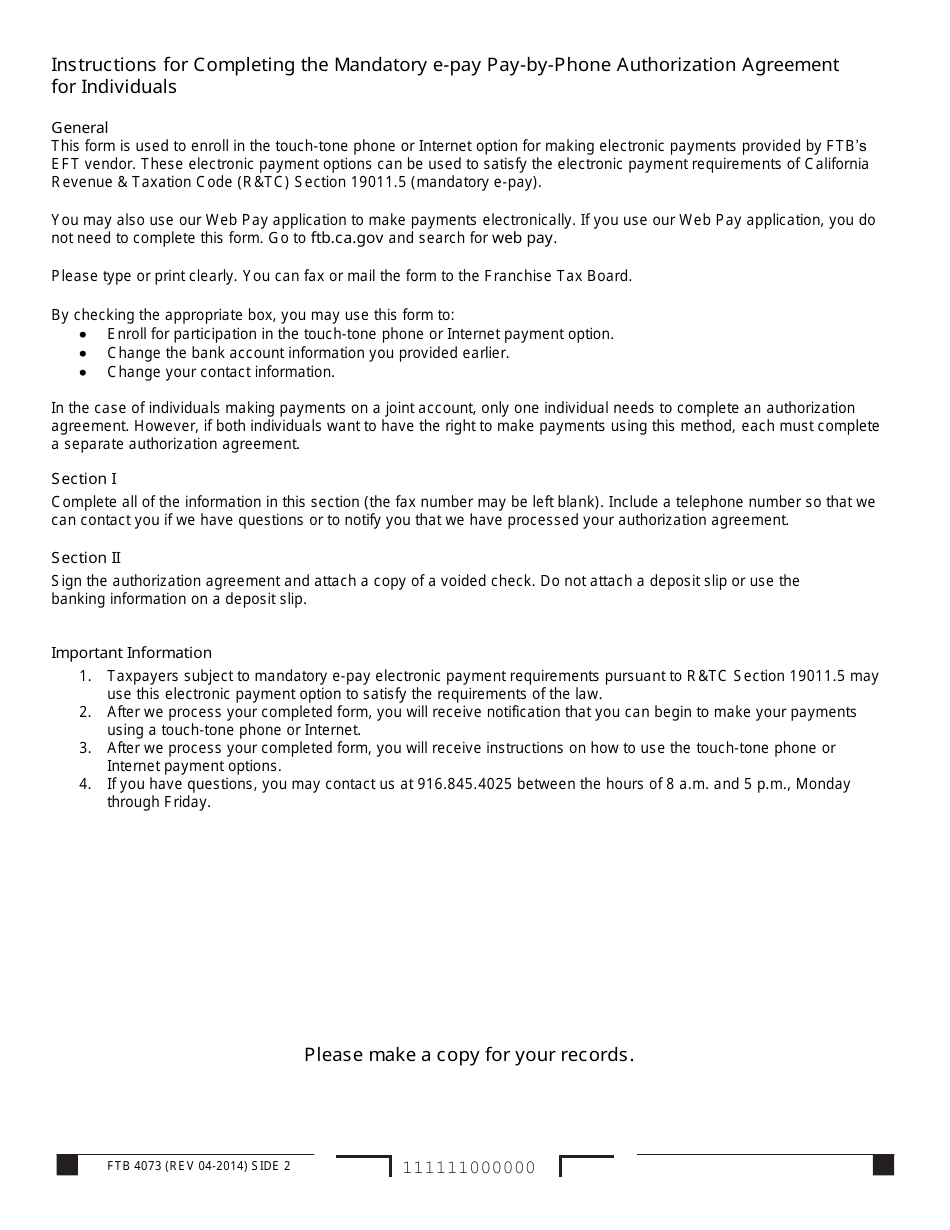

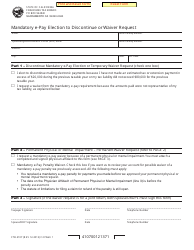

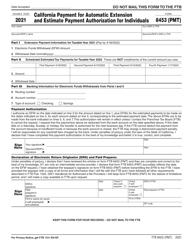

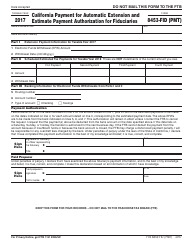

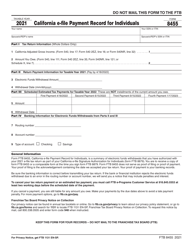

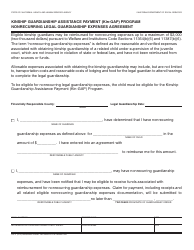

Form FTB4073 Mandatory E-Pay Pay-By-Phone Authorization Agreement for Individuals - California

What Is Form FTB4073?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

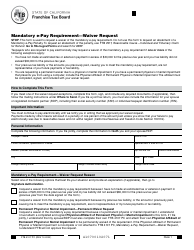

Q: What is Form FTB4073?

A: Form FTB4073 is the Mandatory E-Pay Pay-By-Phone Authorization Agreement for Individuals in California.

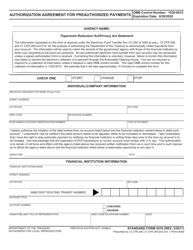

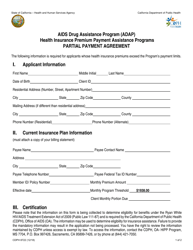

Q: Who needs to complete Form FTB4073?

A: Any individual in California who wants to authorize electronic payments by phone needs to complete Form FTB4073.

Q: What is the purpose of Form FTB4073?

A: The purpose of Form FTB4073 is to authorize electronic payments by phone for individuals in California.

Q: Is Form FTB4073 mandatory?

A: Yes, Form FTB4073 is mandatory for individuals in California who want to authorize electronic payments by phone.

Q: How do I complete Form FTB4073?

A: You need to provide your personal information, such as your name, address, and Social Security Number, and sign the form to complete Form FTB4073.

Q: Can I use Form FTB4073 for business tax payments?

A: No, Form FTB4073 is specifically for individuals and cannot be used for business tax payments.

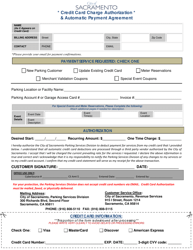

Q: Are there any fees for using the Pay-By-Phone option?

A: No, there are no fees for using the Pay-By-Phone option to make electronic payments authorized through Form FTB4073.

Form Details:

- Released on April 1, 2014;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB4073 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.