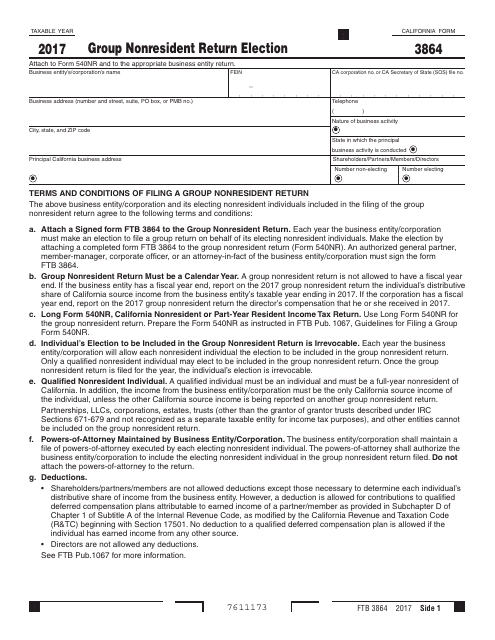

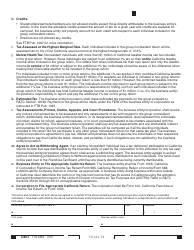

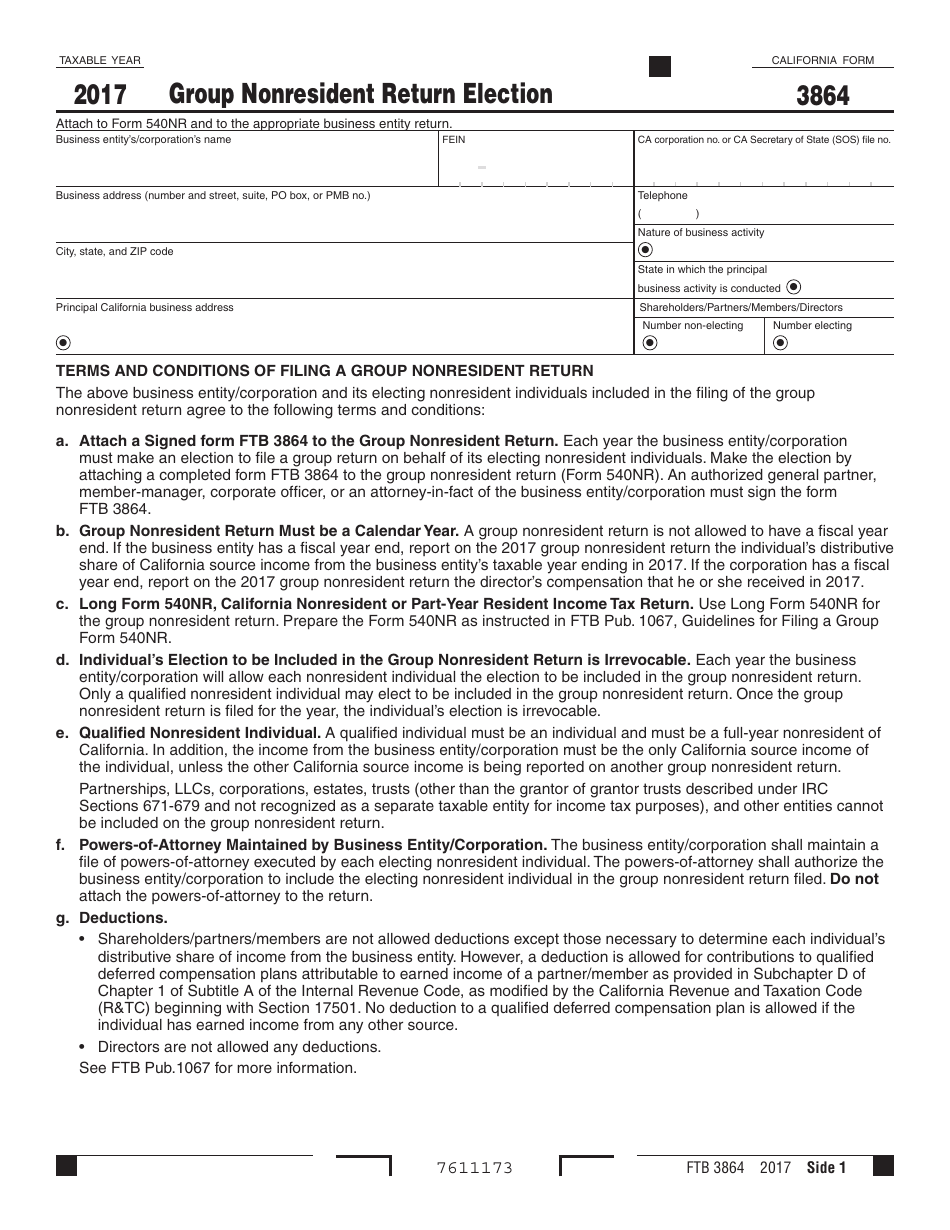

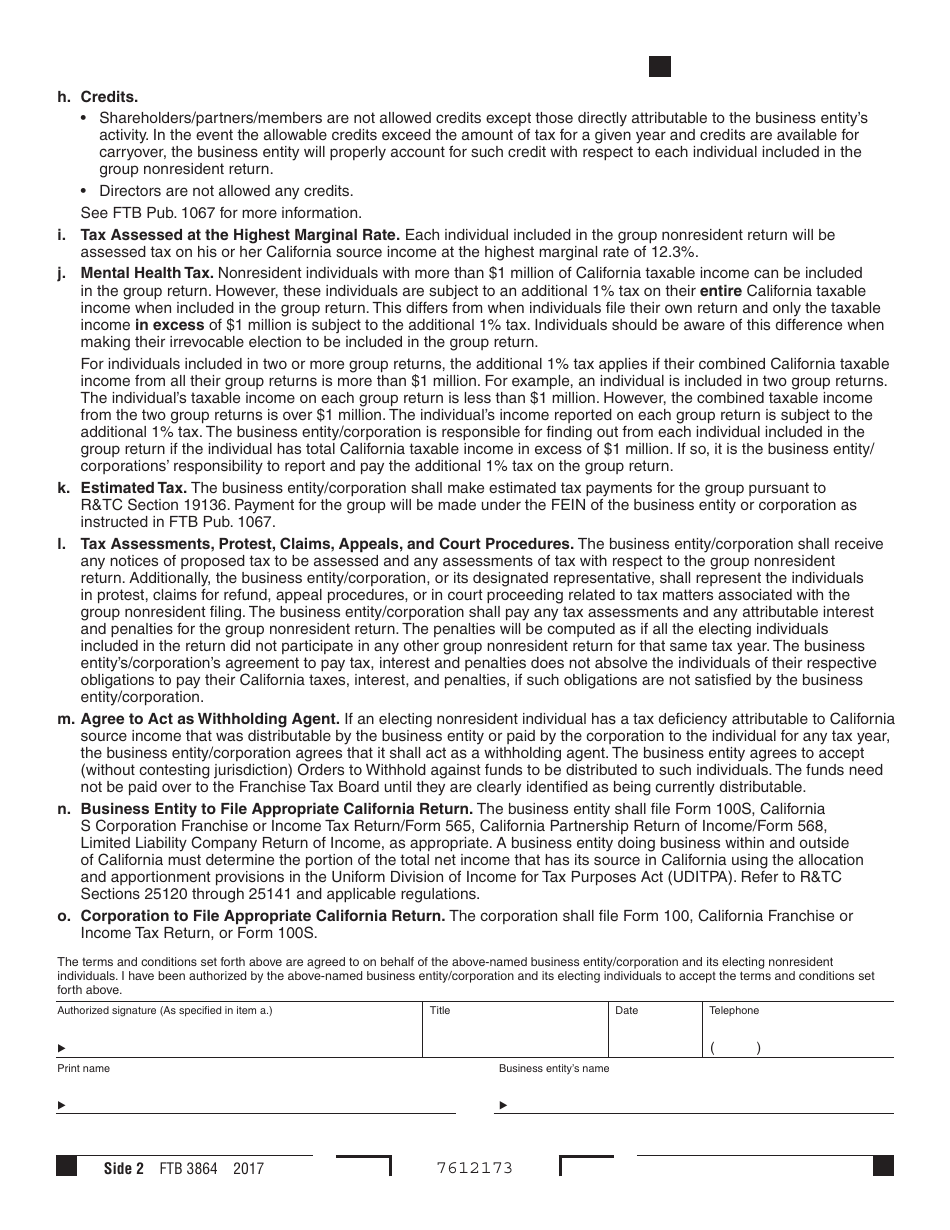

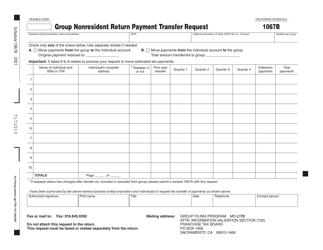

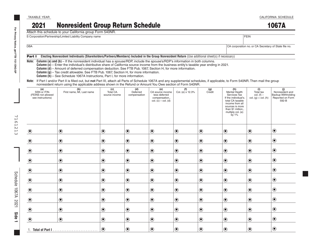

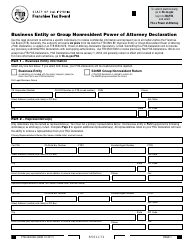

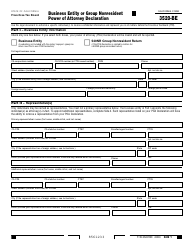

Form FTB3864 Group Nonresident Return Election - California

What Is Form FTB3864?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3864?

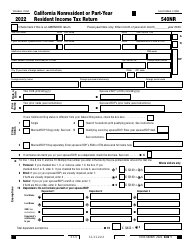

A: Form FTB3864 is a tax form used in California for making a nonresident return election.

Q: Who should file Form FTB3864?

A: Individuals who are nonresidents of California, but have income from California sources, may need to file Form FTB3864.

Q: What is a nonresident return election?

A: A nonresident return election is the choice to file a tax return as a nonresident in California, even if you have income from California sources.

Q: Why would someone need to file Form FTB3864?

A: Someone would need to file Form FTB3864 if they are a nonresident of California, but have income from California sources and want to be taxed as a nonresident.

Q: What information is needed to fill out Form FTB3864?

A: To fill out Form FTB3864, you will need information about your residency status, income from California sources, and other relevant tax details.

Q: When is the deadline to file Form FTB3864?

A: The deadline to file Form FTB3864 is typically the same as the deadline for filing your California tax return, which is April 15th.

Q: Are there any penalties for not filing Form FTB3864?

A: If you are required to file Form FTB3864 and fail to do so, you may be subject to penalties and interest on any unpaid taxes.

Q: Can I e-file Form FTB3864?

A: Yes, you can e-file Form FTB3864 using the California e-file system.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB3864 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.