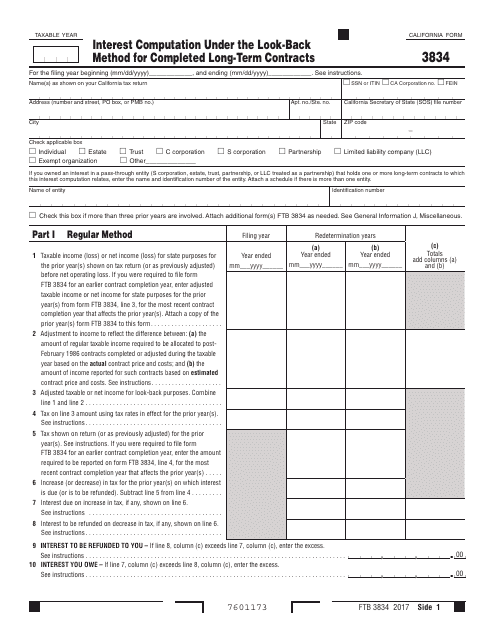

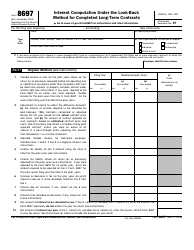

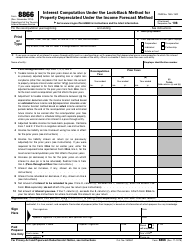

Form FTB3834 Interest Computation Under the Look-Back Method for Completed Long-Term Contracts - California

What Is Form FTB3834?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3834?

A: Form FTB3834 is a form used in California to compute interest under the Look-Back Method for completed long-term contracts.

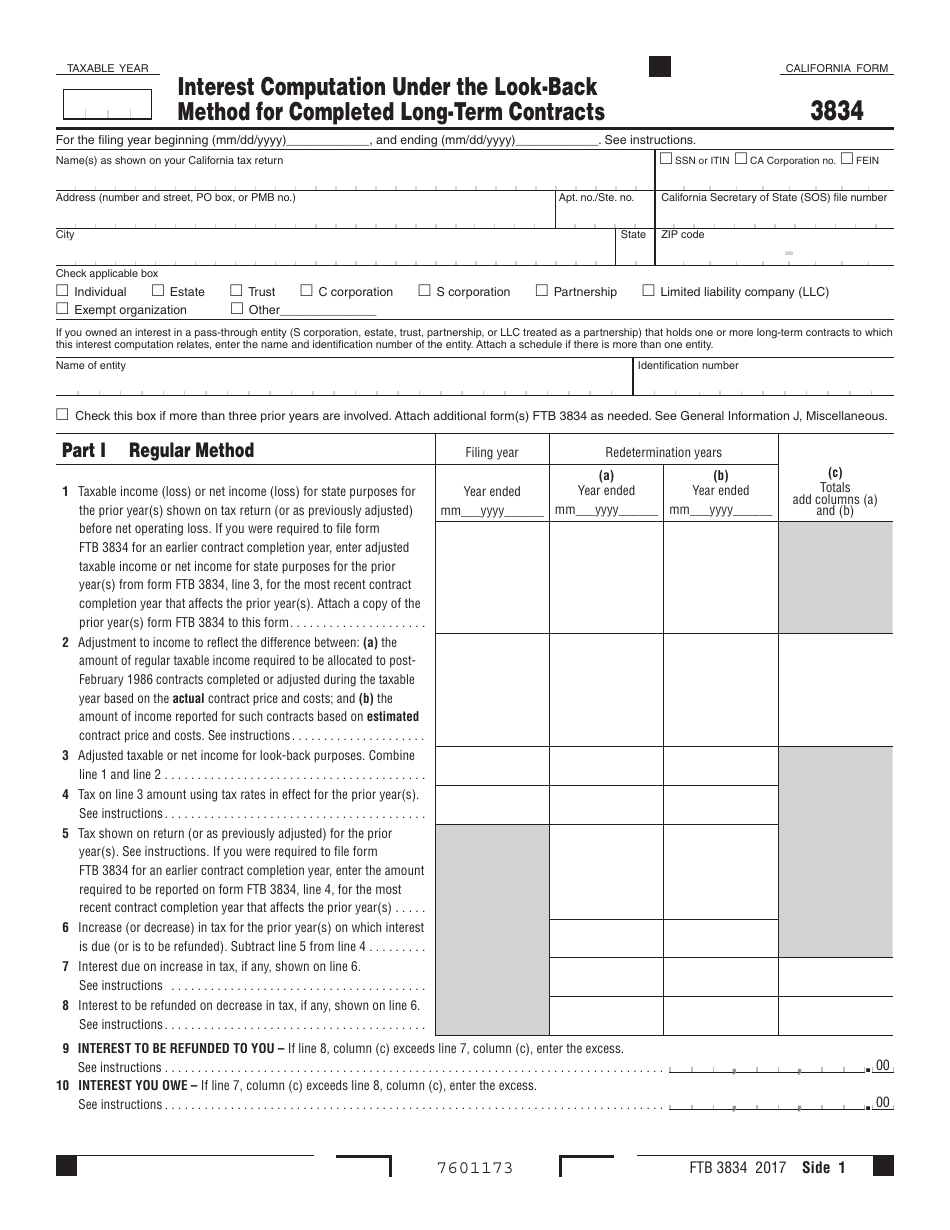

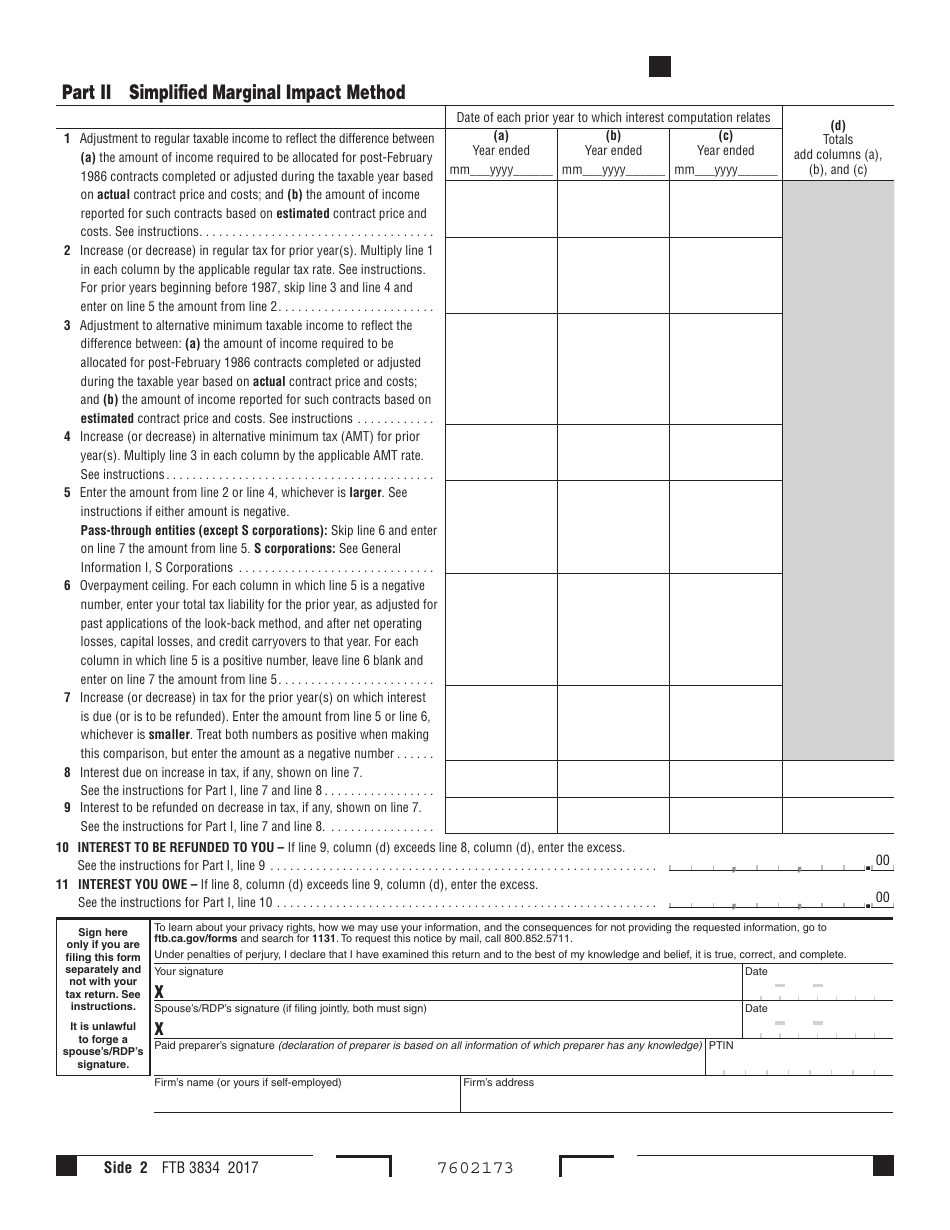

Q: What is the Look-Back Method?

A: The Look-Back Method is used to determine the interest to be assessed or refunded on long-term contracts that take more than one year to complete.

Q: Who needs to file Form FTB3834?

A: Taxpayers who have completed long-term contracts and need to compute the interest under the Look-Back Method in California need to file Form FTB3834.

Q: How is the interest computed?

A: The interest is computed using a look-back method that compares the actual income received with the estimated income reported on previous income tax returns.

Q: When does Form FTB3834 need to be filed?

A: Form FTB3834 needs to be filed within 180 days after the completion of a long-term contract.

Q: Can I file Form FTB3834 electronically?

A: Yes, Form FTB3834 can be filed electronically through the California Franchise Tax Board's e-file system.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB3834 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.