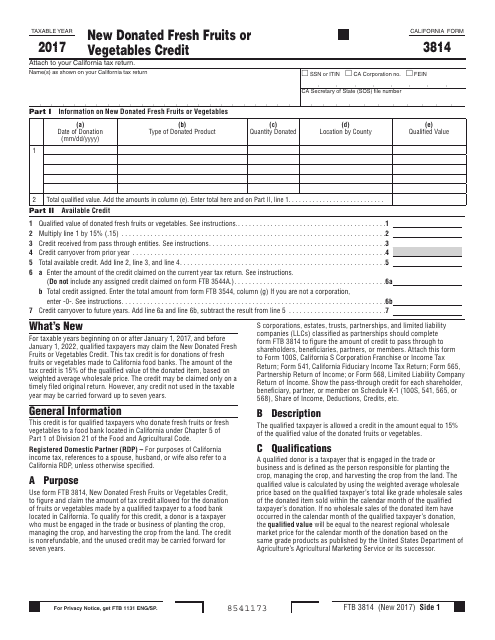

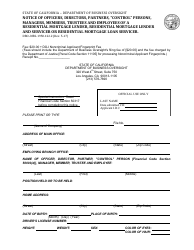

Form FTB3814 New Donated Fresh Fruits or Vegetables Credit - California

What Is Form FTB3814?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3814?

A: Form FTB3814 is a tax form specifically for claiming the New Donated Fresh Fruits or Vegetables Credit in the state of California.

Q: What is the New Donated Fresh Fruits or Vegetables Credit?

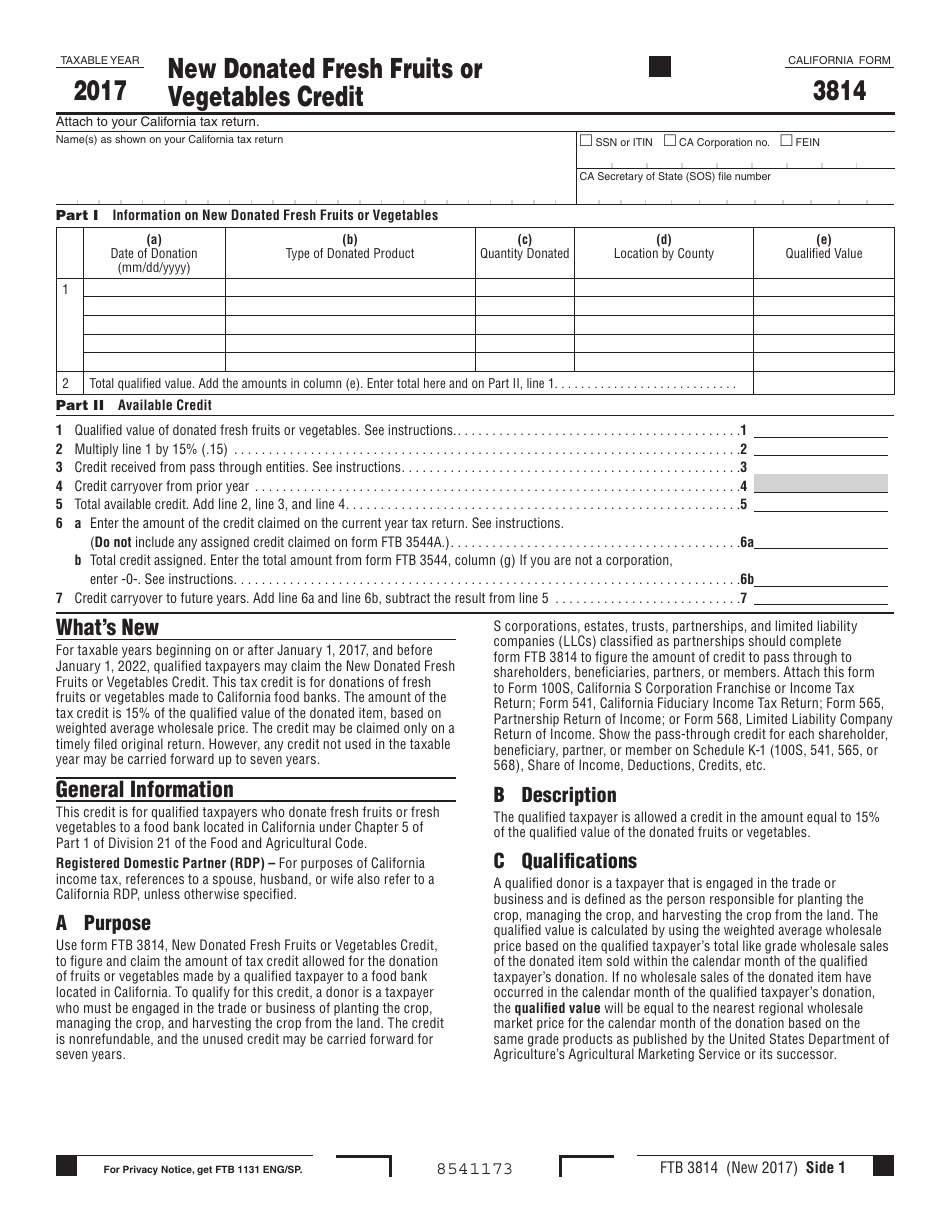

A: The New Donated Fresh Fruits or Vegetables Credit is a tax credit that allows eligible farmers or ranchers in California to claim a credit for the qualified fresh fruits or vegetables they donate to food banks or nonprofit organizations.

Q: Who is eligible to claim the credit?

A: Eligible farmers or ranchers in California who have made qualified donations of fresh fruits or vegetables to food banks or nonprofit organizations can claim the credit.

Q: What are qualified donations?

A: Qualified donations are donations of fresh fruits or vegetables that meet certain criteria specified by the California Franchise Tax Board.

Q: How much is the credit?

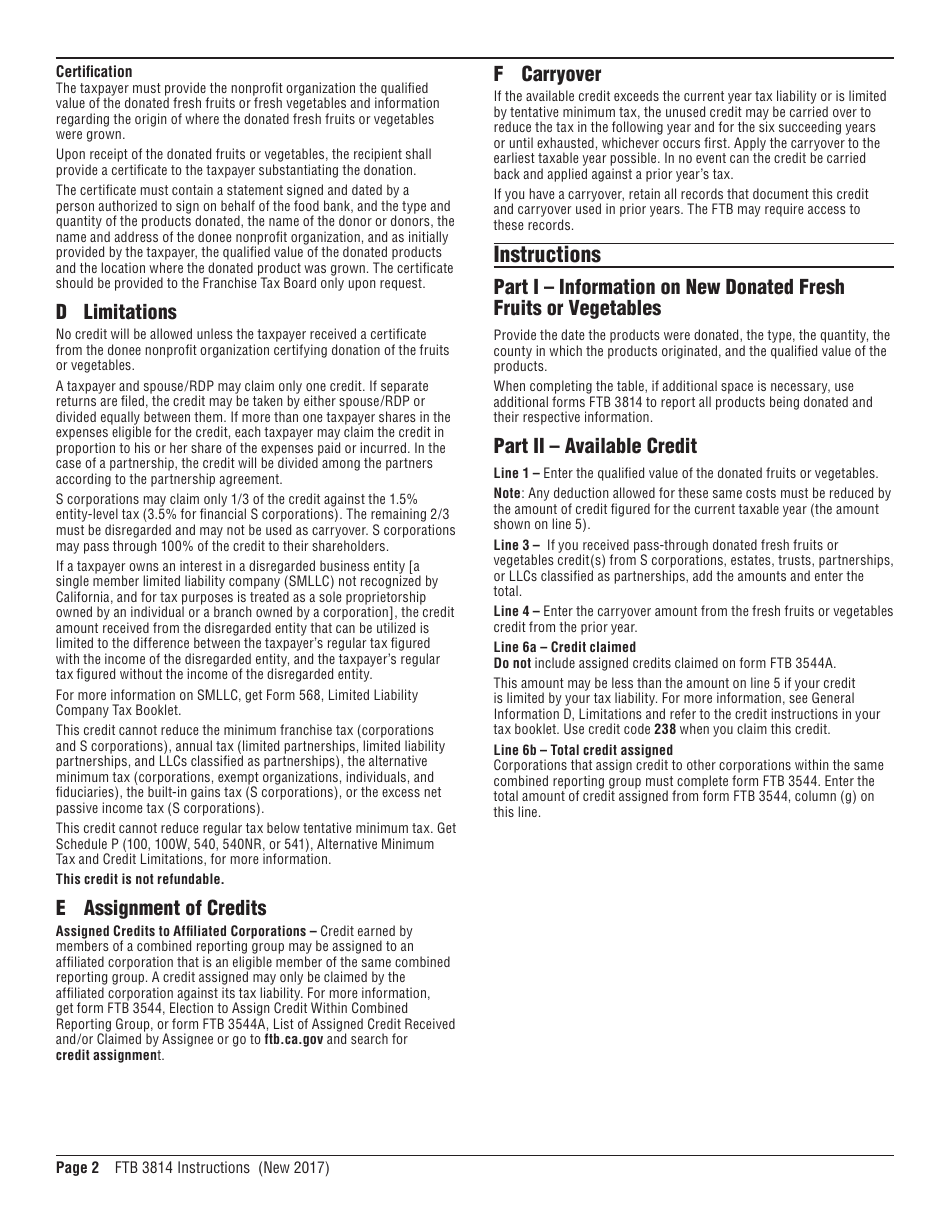

A: The credit amount is 15% of the fair market value of the qualified donations. However, the total credit claimed by each taxpayer cannot exceed $5,000 per taxable year.

Q: Is there a deadline for filing Form FTB3814?

A: Yes, Form FTB3814 must be filed with the California Franchise Tax Board by the due date of the taxpayer's income tax return for the taxable year in which the donation was made.

Q: Are there any other requirements or documentation needed to claim the credit?

A: Yes, in addition to Form FTB3814, taxpayers must also submit supporting documentation such as receipts or records of the qualified donations.

Q: Can the credit be carried forward or back?

A: No, the New Donated Fresh Fruits or Vegetables Credit cannot be carried forward or back. It can only be claimed in the taxable year in which the qualified donations were made.

Q: Is the credit refundable?

A: No, the credit is nonrefundable, which means that it can only be used to offset the taxpayer's California income tax liability. Any excess credit cannot be refunded.

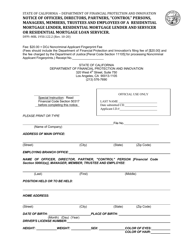

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB3814 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.