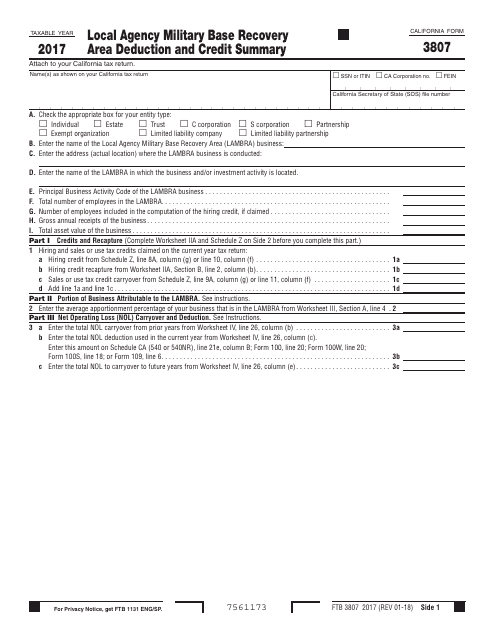

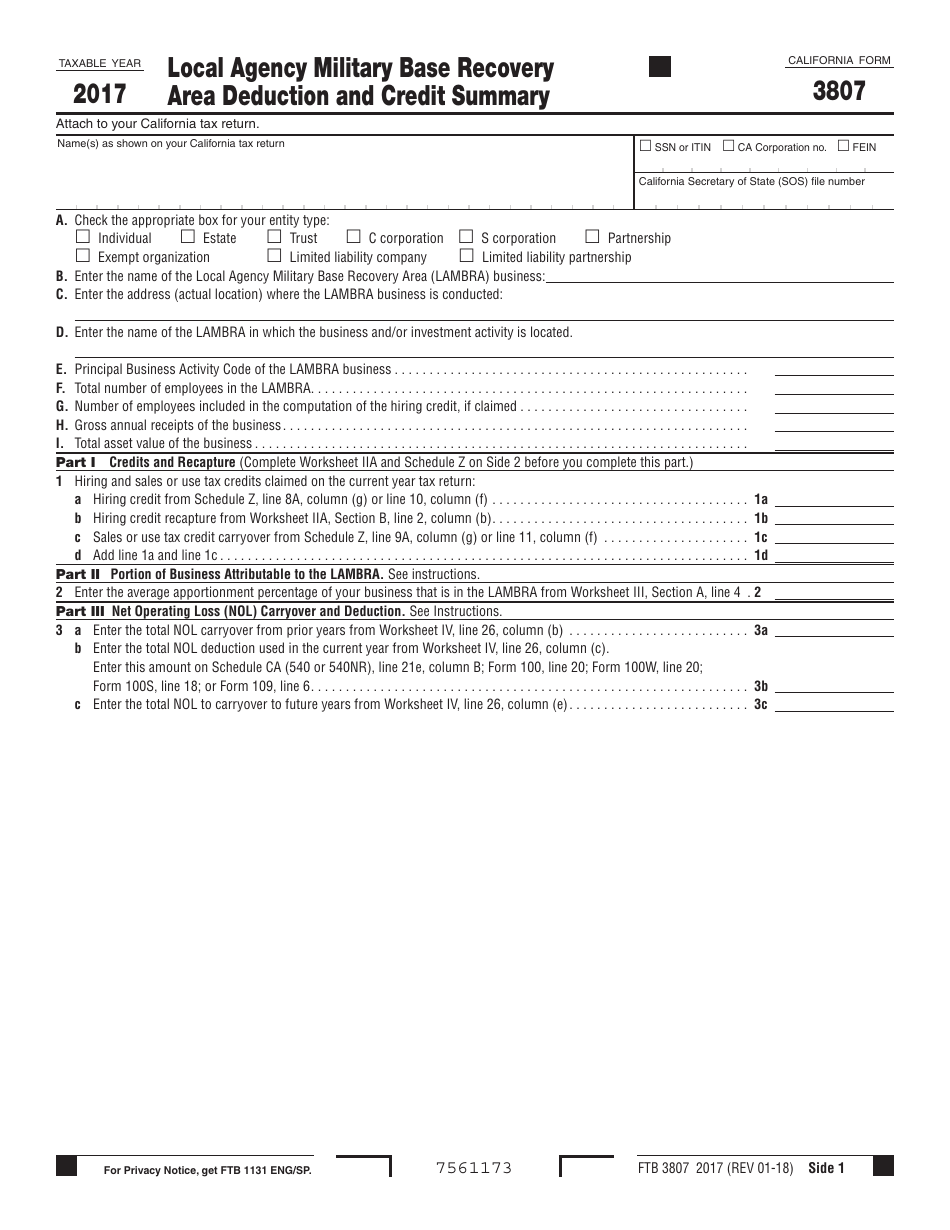

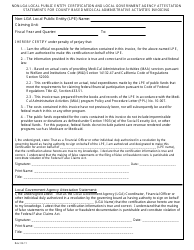

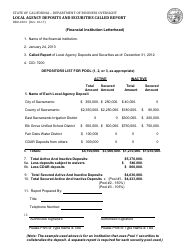

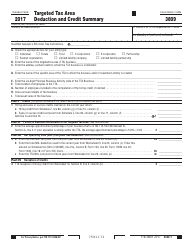

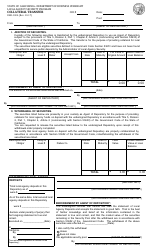

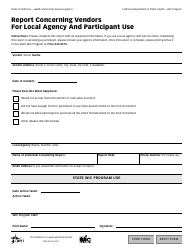

Form FTB3807 Local Agency Military Base Recovery Area Deduction and Credit Summary - California

What Is Form FTB3807?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3807?

A: Form FTB3807 is the Local Agency Military Base Recovery Area Deduction and Credit Summary form in California.

Q: What is the purpose of Form FTB3807?

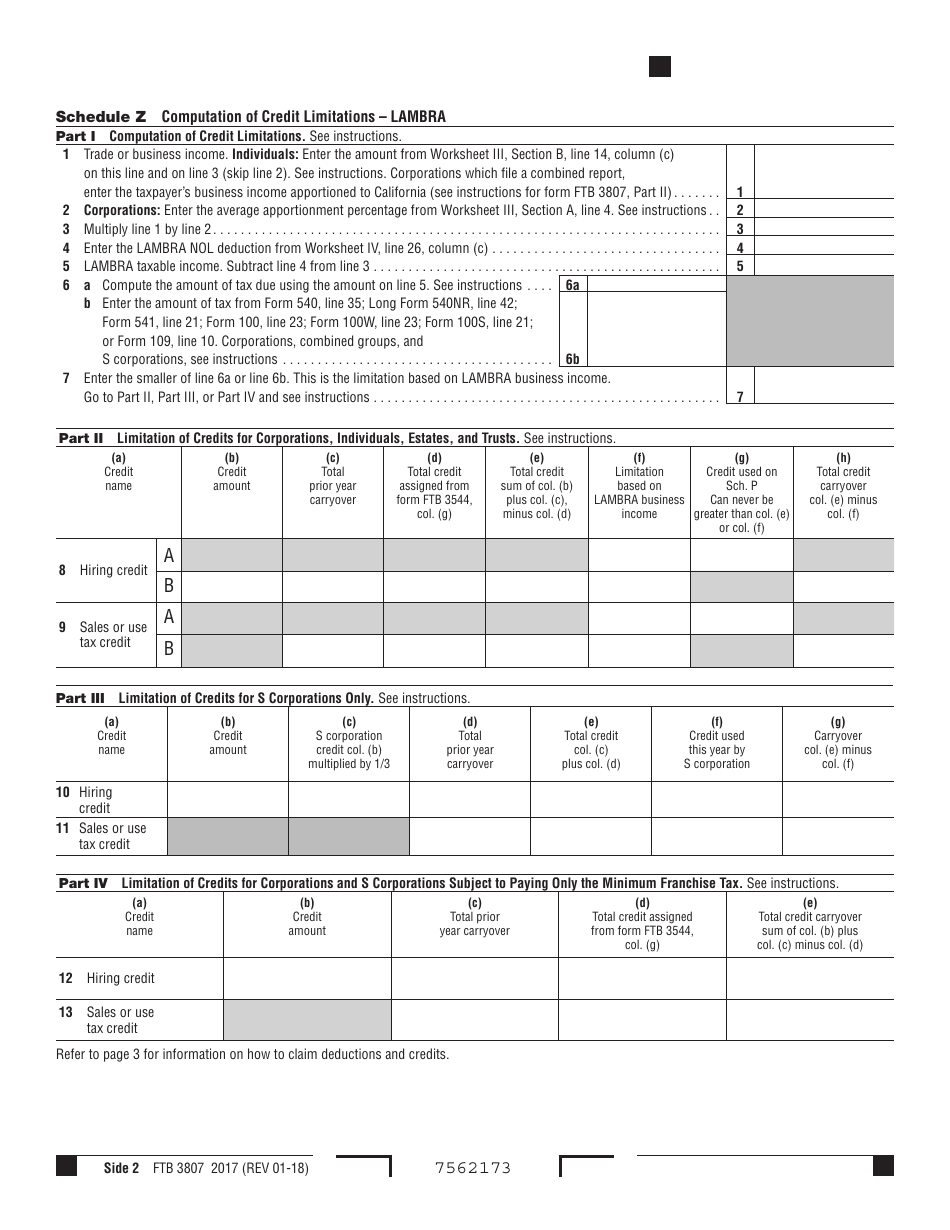

A: The purpose of Form FTB3807 is to calculate the deduction and credit available to taxpayers who invest in Local Agency Military Base Recovery Areas (LAMBRA) in California.

Q: Who is eligible to use Form FTB3807?

A: Taxpayers who have made qualified investments in LAMBRA in California are eligible to use Form FTB3807.

Q: How do I calculate the deduction and credit using Form FTB3807?

A: The deduction and credit are calculated based on the qualified investments made in LAMBRA. You need to follow the instructions provided with the form.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB3807 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.