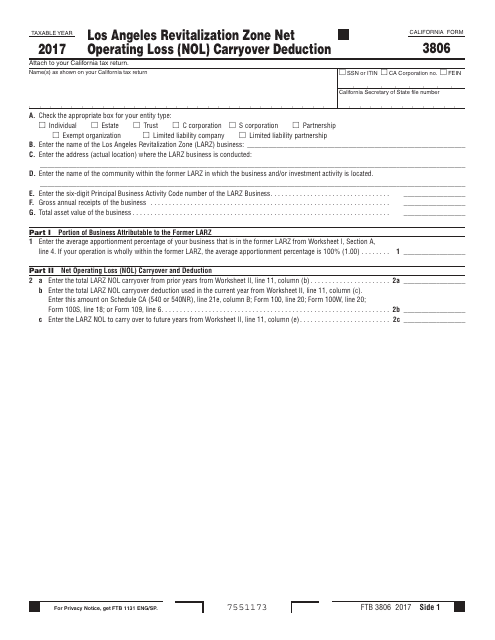

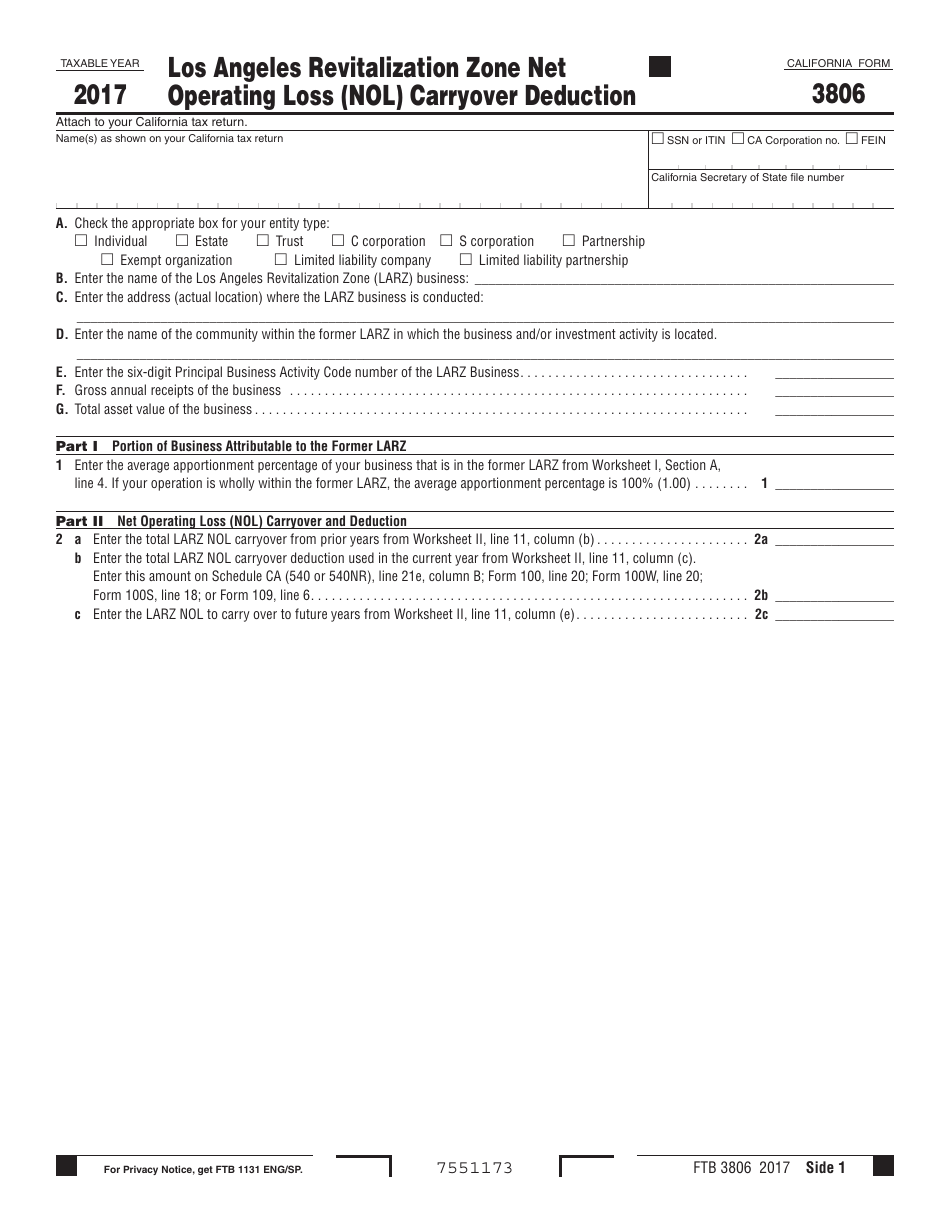

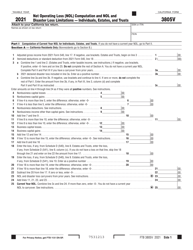

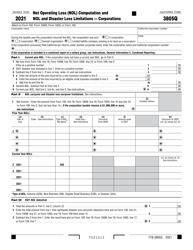

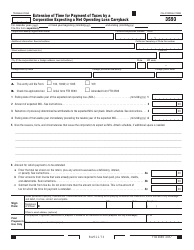

Form FTB3806 Los Angeles Revitalization Zone Net Operating Loss (Nol) Carryover Deduction - California

What Is Form FTB3806?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3806?

A: Form FTB3806 is a specific form used in California for claiming Los Angeles Revitalization Zone Net Operating Loss (NOL) Carryover Deduction.

Q: What is the purpose of Form FTB3806?

A: The purpose of Form FTB3806 is to claim a deduction for the net operating loss carryover from a Los Angeles Revitalization Zone business.

Q: What is the Los Angeles Revitalization Zone Net Operating Loss (NOL) Carryover Deduction?

A: The Los Angeles Revitalization Zone Net Operating Loss (NOL) Carryover Deduction allows businesses operating within the designated zones to carry forward and deduct any net operating losses incurred.

Q: Who can claim the Los Angeles Revitalization Zone Net Operating Loss (NOL) Carryover Deduction?

A: Businesses that operate within the designated Los Angeles Revitalization Zones can claim the Net Operating Loss (NOL) Carryover Deduction.

Q: How do I claim the Los Angeles Revitalization Zone Net Operating Loss (NOL) Carryover Deduction?

A: To claim the Los Angeles Revitalization Zone Net Operating Loss (NOL) Carryover Deduction, you need to complete and file Form FTB3806 with the California Franchise Tax Board (FTB).

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB3806 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.