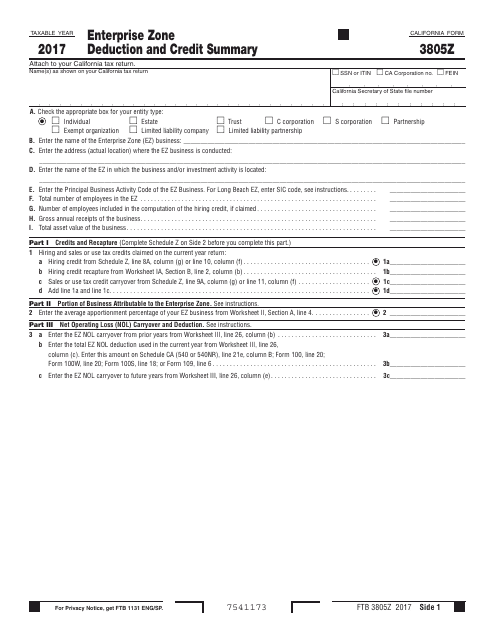

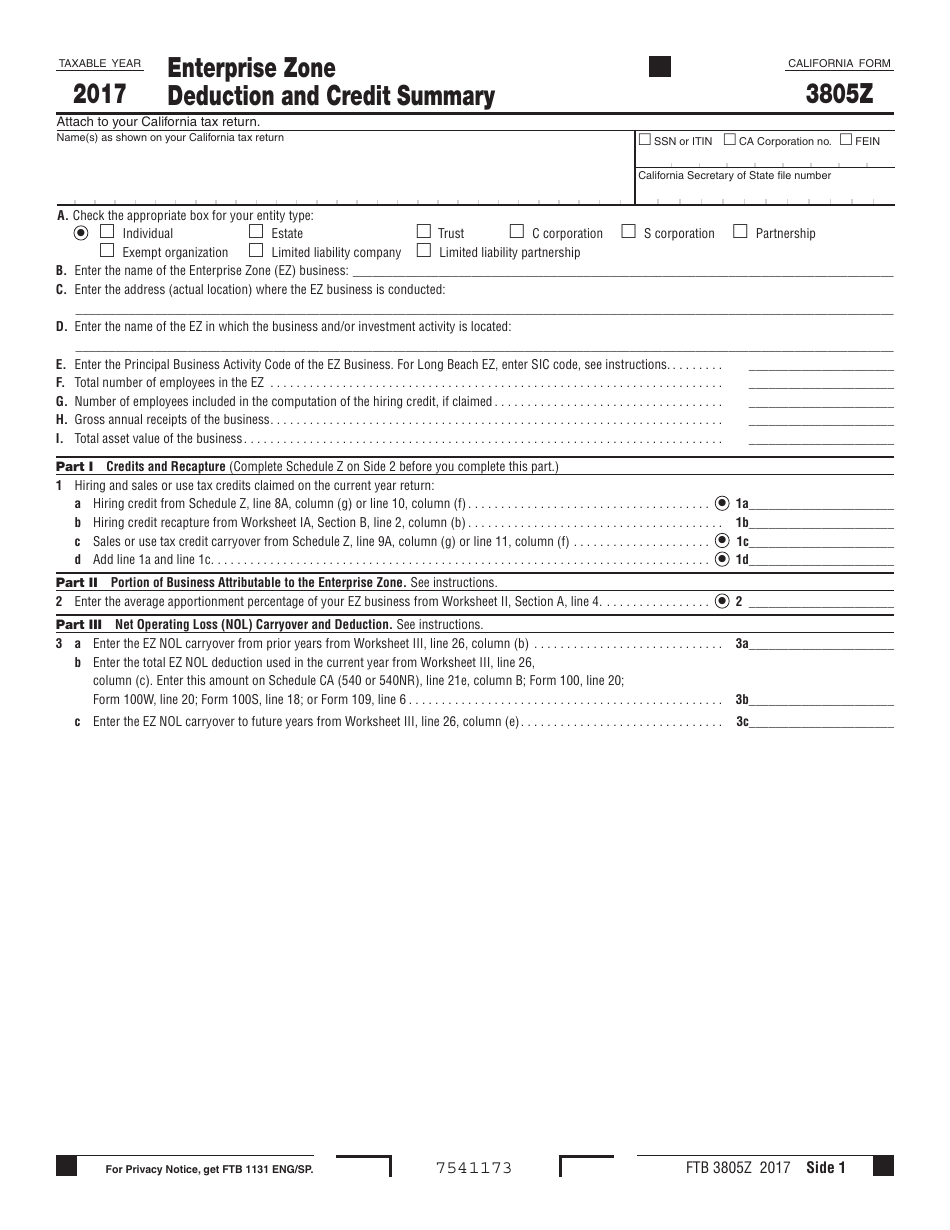

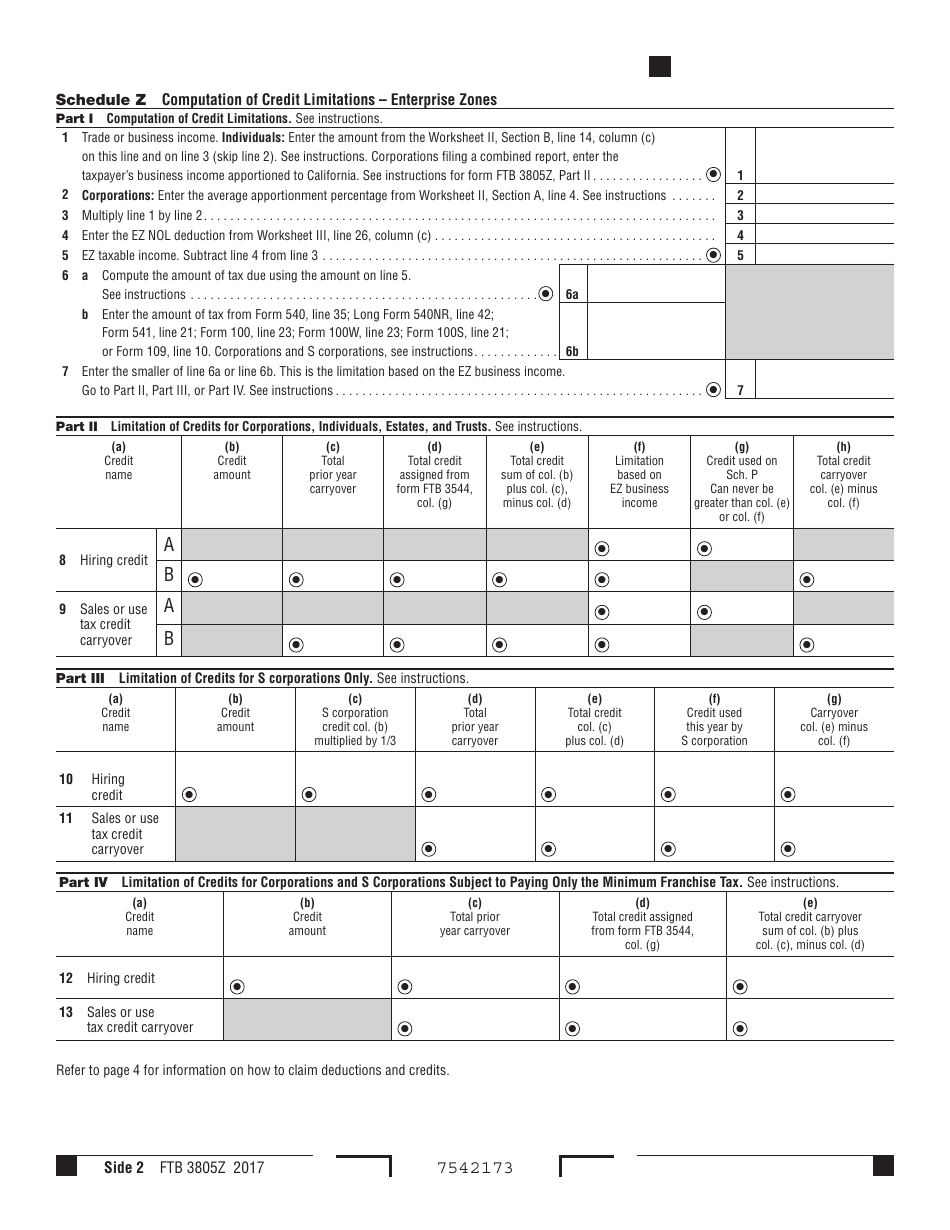

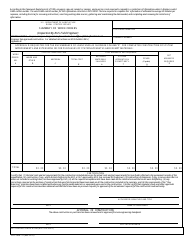

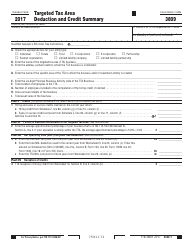

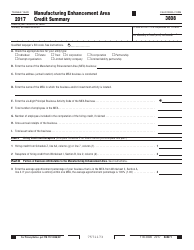

Form FTB3805Z Enterprise Zone Deduction and Credit Summary - California

What Is Form FTB3805Z?

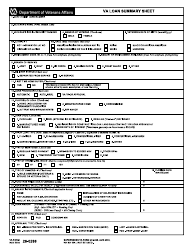

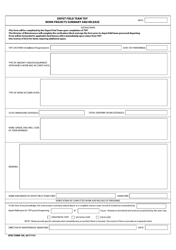

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3805Z?

A: Form FTB3805Z is a form used in California to summarize the enterprise zone deduction and credit.

Q: What is the enterprise zone deduction and credit?

A: The enterprise zone deduction and credit is a tax benefit provided to businesses located in designated enterprise zones in California.

Q: Who is eligible for the enterprise zone deduction and credit?

A: Businesses that are located in designated enterprise zones in California may be eligible for the deduction and credit.

Q: What is the purpose of Form FTB3805Z?

A: Form FTB3805Z is used to calculate and summarize the enterprise zone deduction and credit.

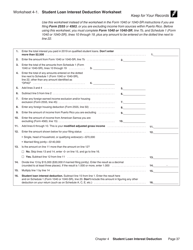

Q: How do I fill out Form FTB3805Z?

A: To fill out Form FTB3805Z, you will need to provide information about your business and its activities in the designated enterprise zone.

Q: When is Form FTB3805Z due?

A: Form FTB3805Z is typically due with the taxpayer's annual California tax return.

Q: Are there any other requirements for claiming the enterprise zone deduction and credit?

A: Yes, there are specific requirements and qualifications that businesses must meet in order to claim the enterprise zone deduction and credit. It is recommended to consult with a tax professional for guidance.

Q: What other forms may be required to claim the enterprise zone deduction and credit?

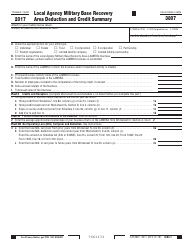

A: In addition to Form FTB3805Z, businesses may need to file other forms such as Form FTB 3807, Form FTB 3809, or Form FTB 3805P.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB3805Z by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.