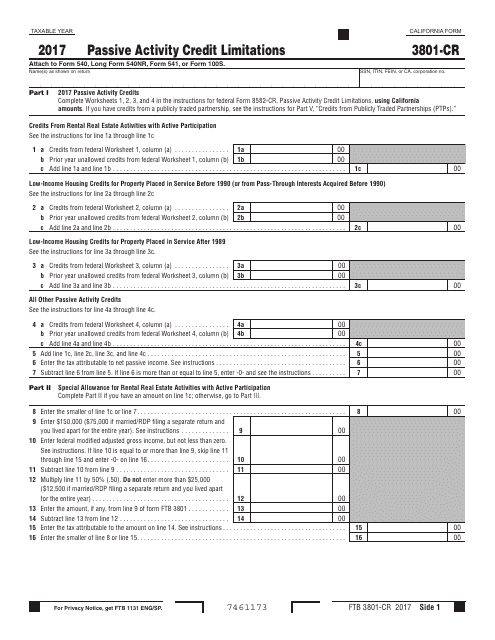

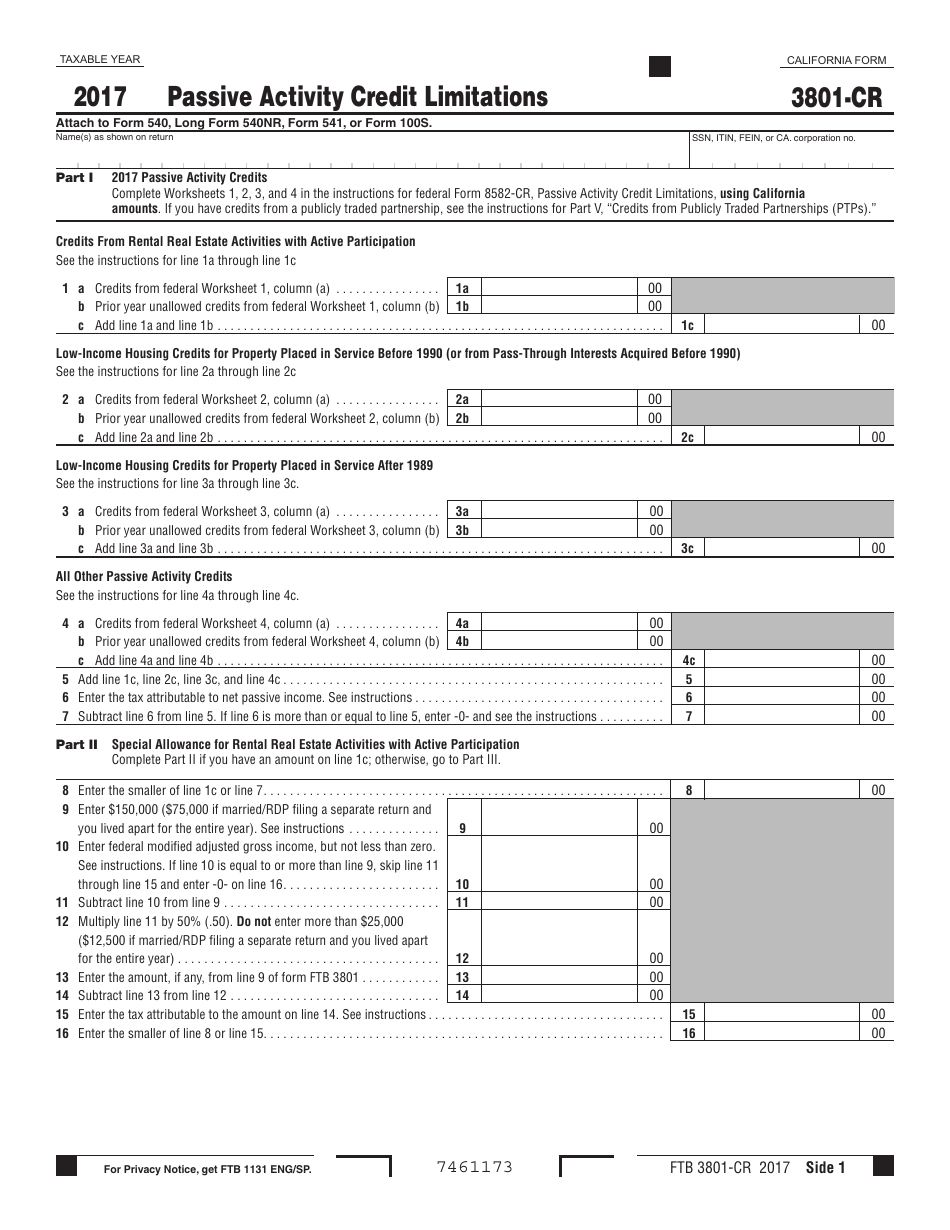

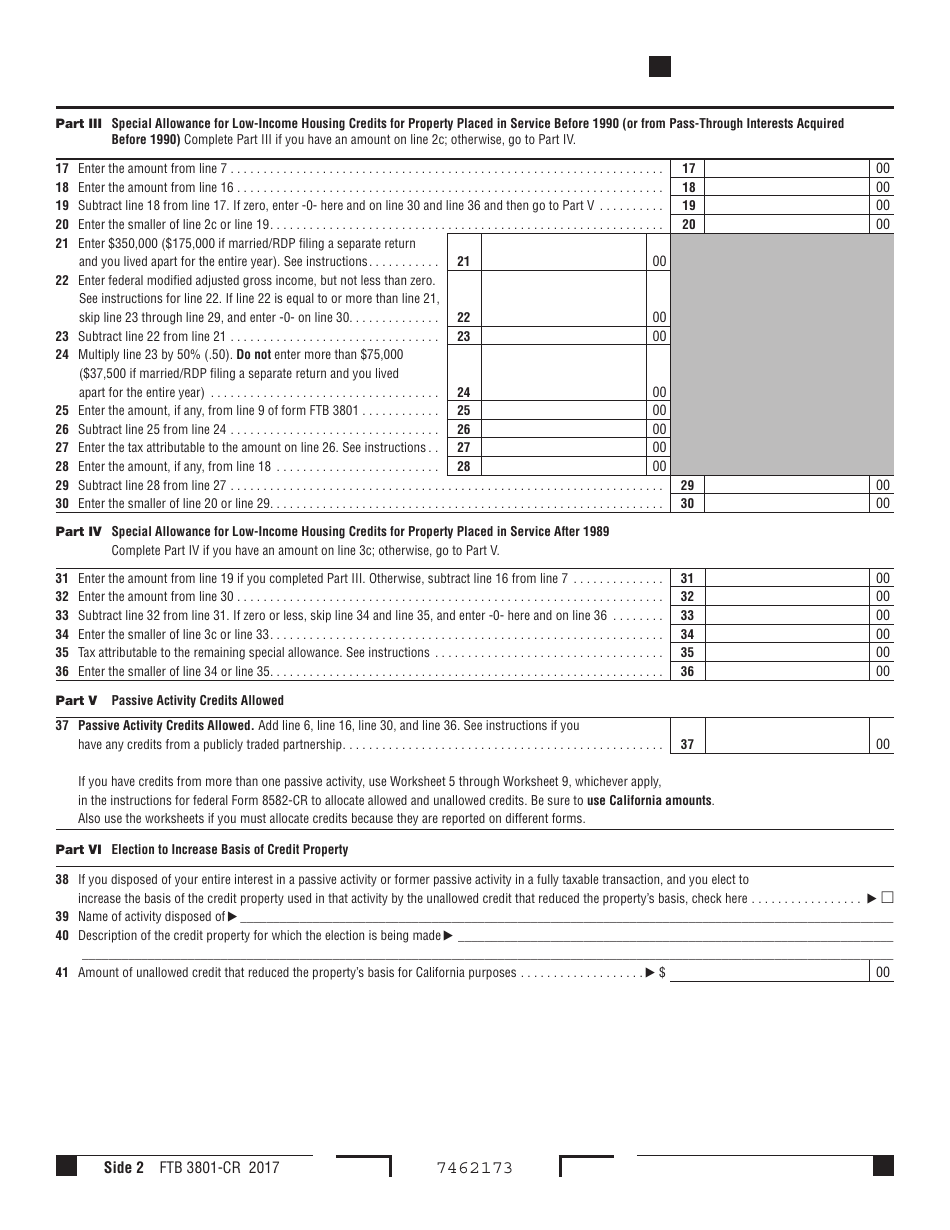

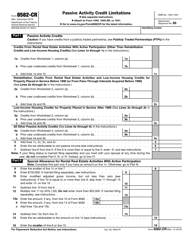

Form FTB3801-CR Passive Activity Credit Limitations - California

What Is Form FTB3801-CR?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FTB3801-CR?

A: FTB3801-CR is a form used in California to calculate the passive activity credit limitations.

Q: What are passive activity credits?

A: Passive activity credits are tax credits that are available for certain types of passive activities, such as real estate and rental activities.

Q: What is the purpose of FTB3801-CR?

A: The purpose of FTB3801-CR is to determine the amount of passive activity credits that can be claimed on your California tax return.

Q: Who needs to fill out FTB3801-CR?

A: Anyone who wants to claim passive activity credits on their California tax return needs to fill out FTB3801-CR.

Q: How do I fill out FTB3801-CR?

A: You will need to provide information about your passive activities, including income, deductions, and credits. The form will guide you through the process.

Q: Are there any limitations on the amount of passive activity credits that can be claimed?

A: Yes, there are limitations based on your income and the type of passive activity. FTB3801-CR helps you calculate these limitations.

Q: Can I carry forward unused passive activity credits?

A: Yes, if you are unable to use all of your passive activity credits in the current year, you can carry them forward to future years.

Q: When is the deadline to file FTB3801-CR?

A: FTB3801-CR is generally due at the same time as your California tax return, which is typically April 15th.

Q: Do I need to include FTB3801-CR with my federal tax return?

A: No, FTB3801-CR is specific to California taxes and should be filed separately from your federal tax return.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB3801-CR by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.