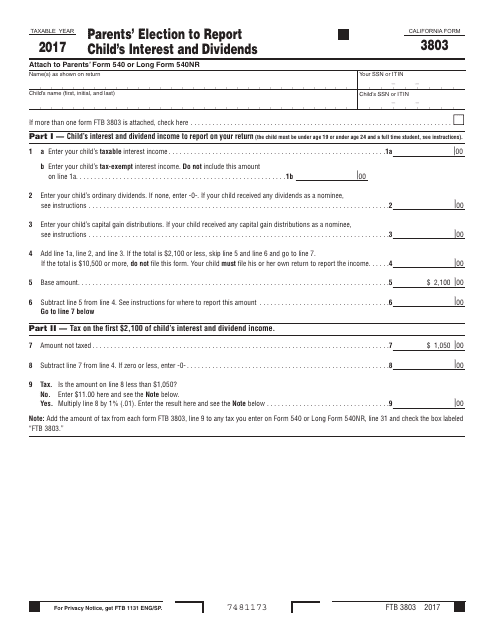

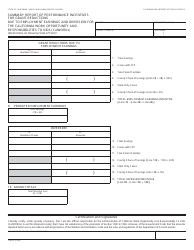

Form FTB3803 Parents' Election to Report Child's Interest and Dividends - California

What Is Form FTB3803?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form FTB3803?

A: Form FTB3803 is a form used in California to report a child's interest and dividends.

Q: Who should use form FTB3803?

A: Parents or legal guardians of a child who have unearned income in California should use form FTB3803.

Q: What is the purpose of form FTB3803?

A: The purpose of form FTB3803 is to allow parents or legal guardians to elect to report their child's unearned income on their own tax return.

Q: When should form FTB3803 be filed?

A: Form FTB3803 should be filed with the California Franchise Tax Board (FTB) when filing your annual tax return.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB3803 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.