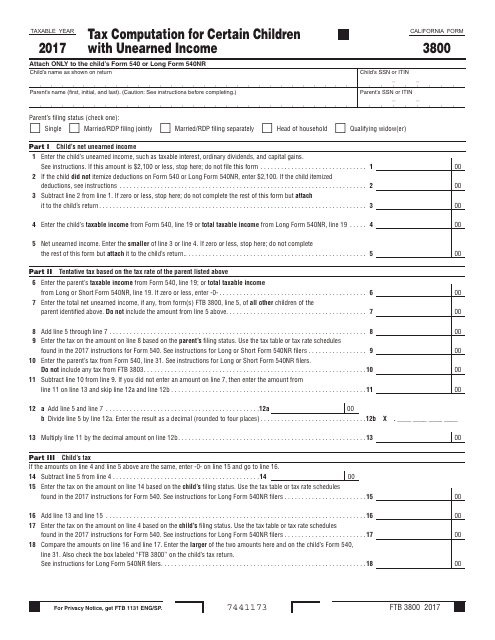

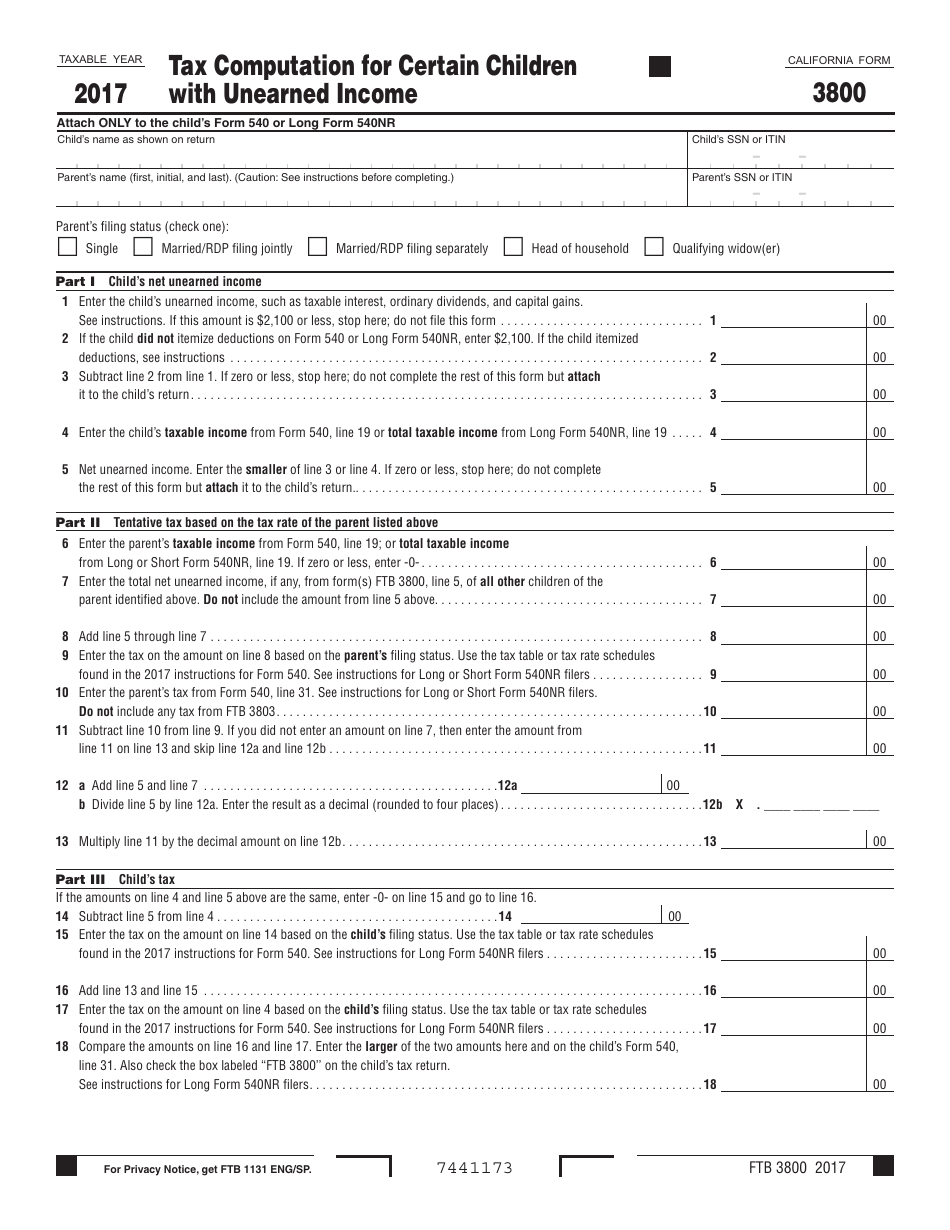

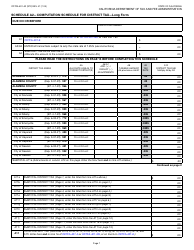

Form FTB3800 Tax Computation for Certain Children With Unearned Income - California

What Is Form FTB3800?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

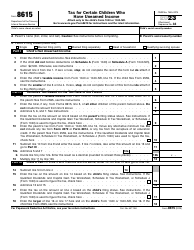

Q: What is FTB3800?

A: FTB3800 is a tax form in California used for computing tax for children with unearned income.

Q: Who is eligible to use Form FTB3800?

A: Form FTB3800 is meant for children who have unearned income and qualify for certain tax benefits.

Q: What is unearned income?

A: Unearned income refers to income derived from sources other than employment, such as interest, dividends, and capital gains.

Q: What tax benefits are available for eligible children using Form FTB3800?

A: Eligible children can claim tax benefits like the Kiddie Tax, the Additional Child Tax Credit, and the Credit for Other Dependents using Form FTB3800.

Q: How does Form FTB3800 work?

A: Form FTB3800 computes the child's tax liability based on their unearned income and applies the applicable tax benefits to determine the final tax owed.

Q: Does using Form FTB3800 affect the child's parents' tax return?

A: No, Form FTB3800 is specifically for the child's tax computation and does not impact the parents' tax return.

Q: Is Form FTB3800 only applicable in California?

A: Yes, Form FTB3800 is a California state tax form and is only applicable for individuals who are California residents.

Q: What other tax forms are commonly used in conjunction with Form FTB3800?

A: Some commonly used tax forms in conjunction with Form FTB3800 include Form 540, Form 540NR, and Form 540 2EZ, depending on the taxpayer's filing status and residency status.

Q: Is there a deadline for filing Form FTB3800?

A: Yes, the deadline for filing Form FTB3800 coincides with the regular California state tax deadline, which is usually April 15th of each year.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB3800 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.