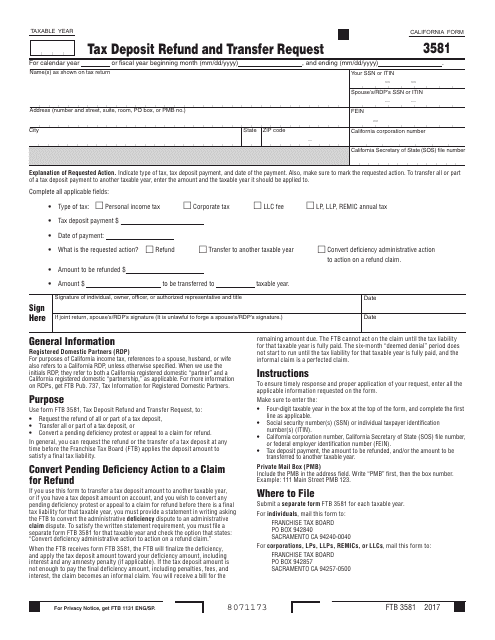

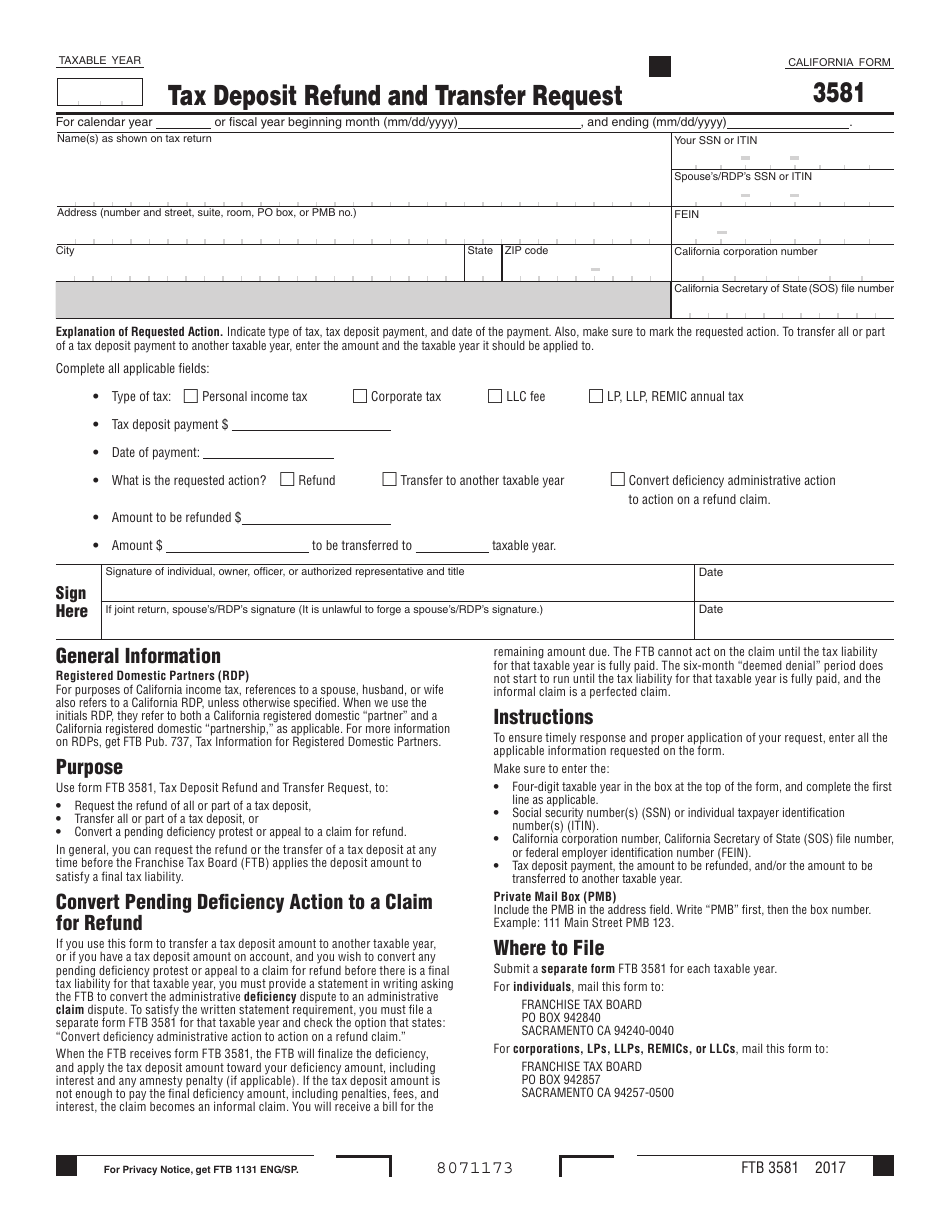

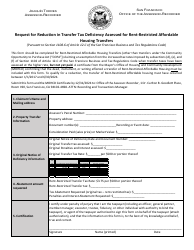

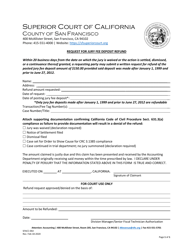

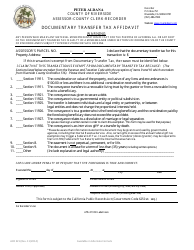

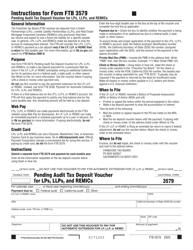

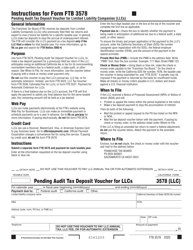

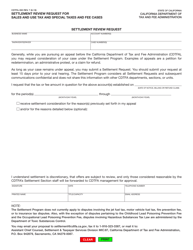

Form FTB3581 Tax Deposit Refund and Transfer Request - California

What Is Form FTB3581?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB 3581?

A: Form FTB 3581 is the Tax Deposit Refund and Transfer Request form for California.

Q: Who needs to file Form FTB 3581?

A: Taxpayers who have made a tax deposit and wish to request a refund or transfer of the deposit must file Form FTB 3581.

Q: What is the purpose of Form FTB 3581?

A: The purpose of Form FTB 3581 is to request a refund or transfer of a tax deposit made with the California Franchise Tax Board.

Q: What information is required on Form FTB 3581?

A: Form FTB 3581 requires information such as your name, address, Social Security number or business entity number, and details about the tax deposit you are requesting a refund or transfer for.

Q: When should I file Form FTB 3581?

A: You should file Form FTB 3581 as soon as possible after making the tax deposit and determining that a refund or transfer is necessary.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3581 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.