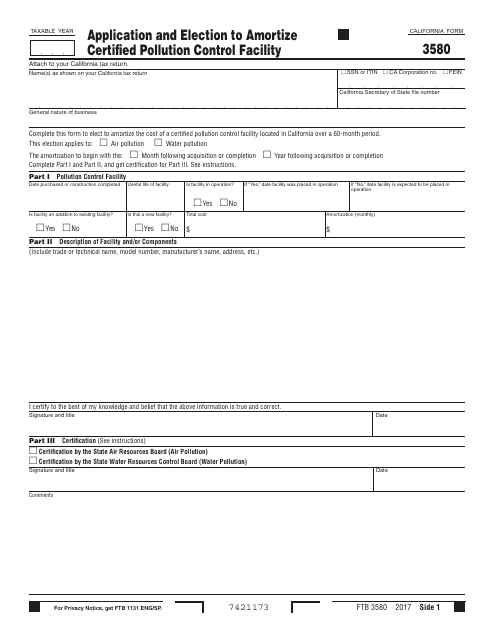

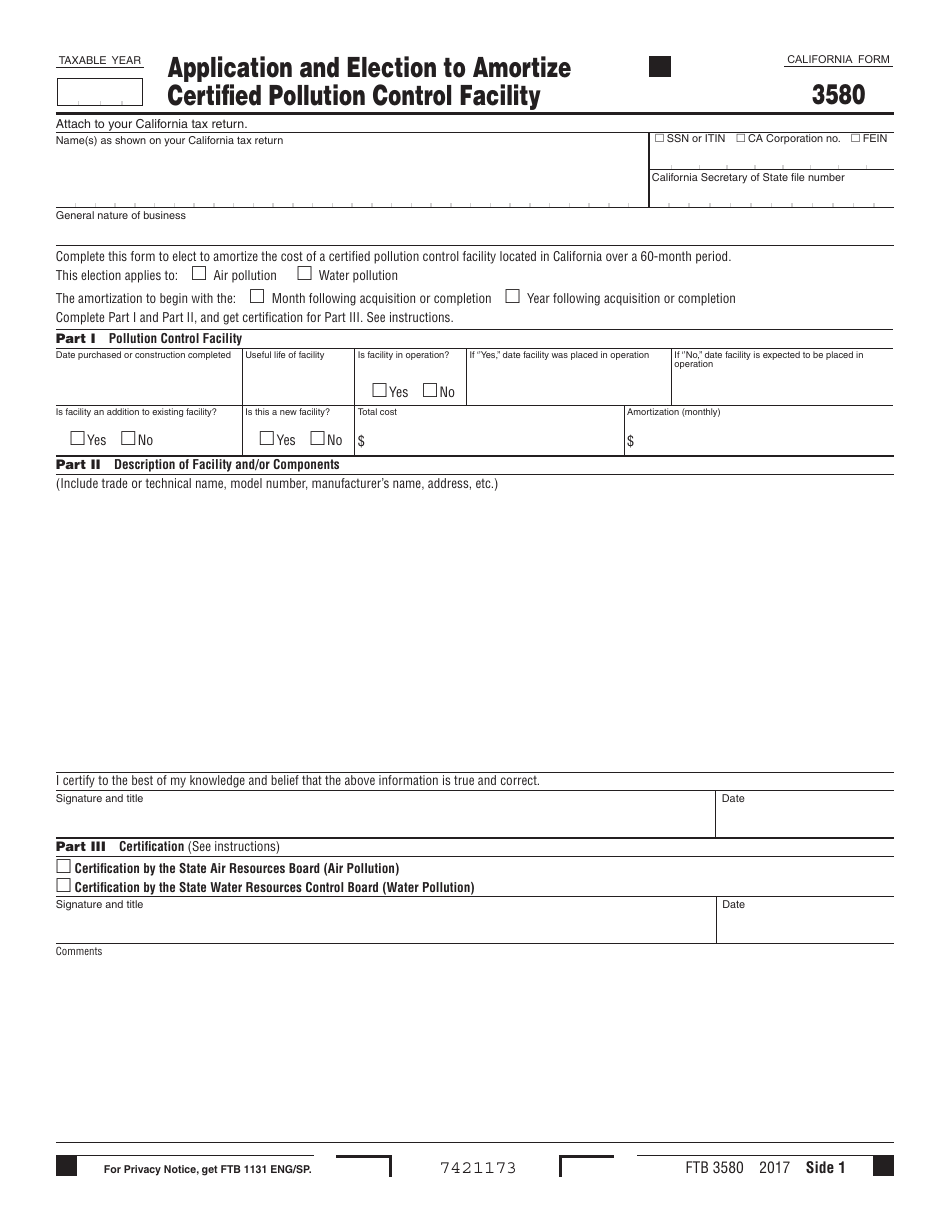

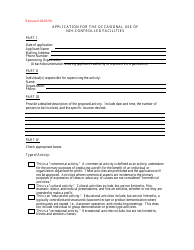

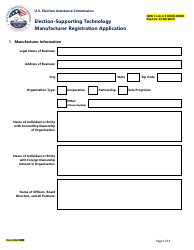

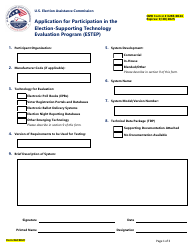

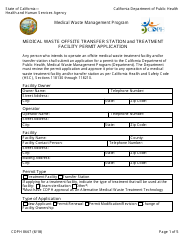

Form FTB3580 Application and Election to Amortize Certified Pollution Control Facility - California

What Is Form FTB3580?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3580?

A: Form FTB3580 is an application and election to amortize certified pollution control facility in California.

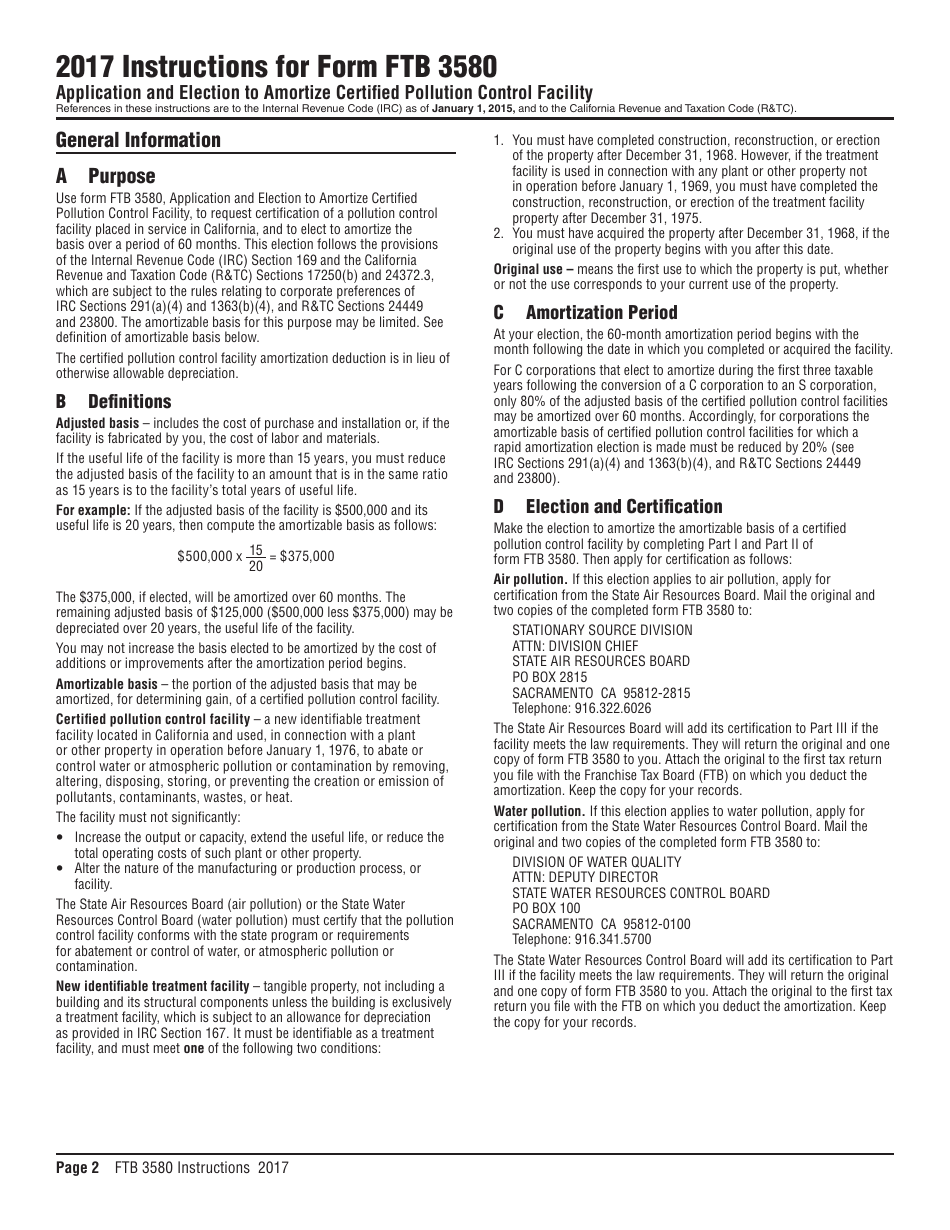

Q: What is the purpose of Form FTB3580?

A: The purpose of Form FTB3580 is to allow taxpayers to apply for and elect to amortize the costs of a certified pollution control facility.

Q: What is a certified pollution control facility?

A: A certified pollution control facility is a facility that is used primarily for the control, capture, or disposal of air or water pollution, and has been certified by the California Department of Toxic Substances Control.

Q: Who can use Form FTB3580?

A: Any taxpayer who has incurred costs for a certified pollution control facility in California can use Form FTB3580.

Q: How do I complete Form FTB3580?

A: You need to provide information about the taxpayer, the facility, and the costs incurred on Form FTB3580. Refer to the instructions provided with the form for detailed guidance.

Q: When should I file Form FTB3580?

A: Form FTB3580 should be filed within 30 days after the certification of the pollution control facility or the start of amortization, whichever is later.

Q: Are there any fees associated with filing Form FTB3580?

A: No, there are no fees associated with filing Form FTB3580.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB3580 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.