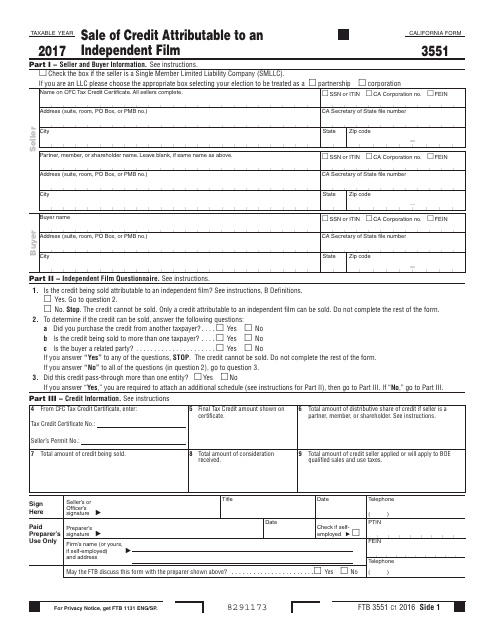

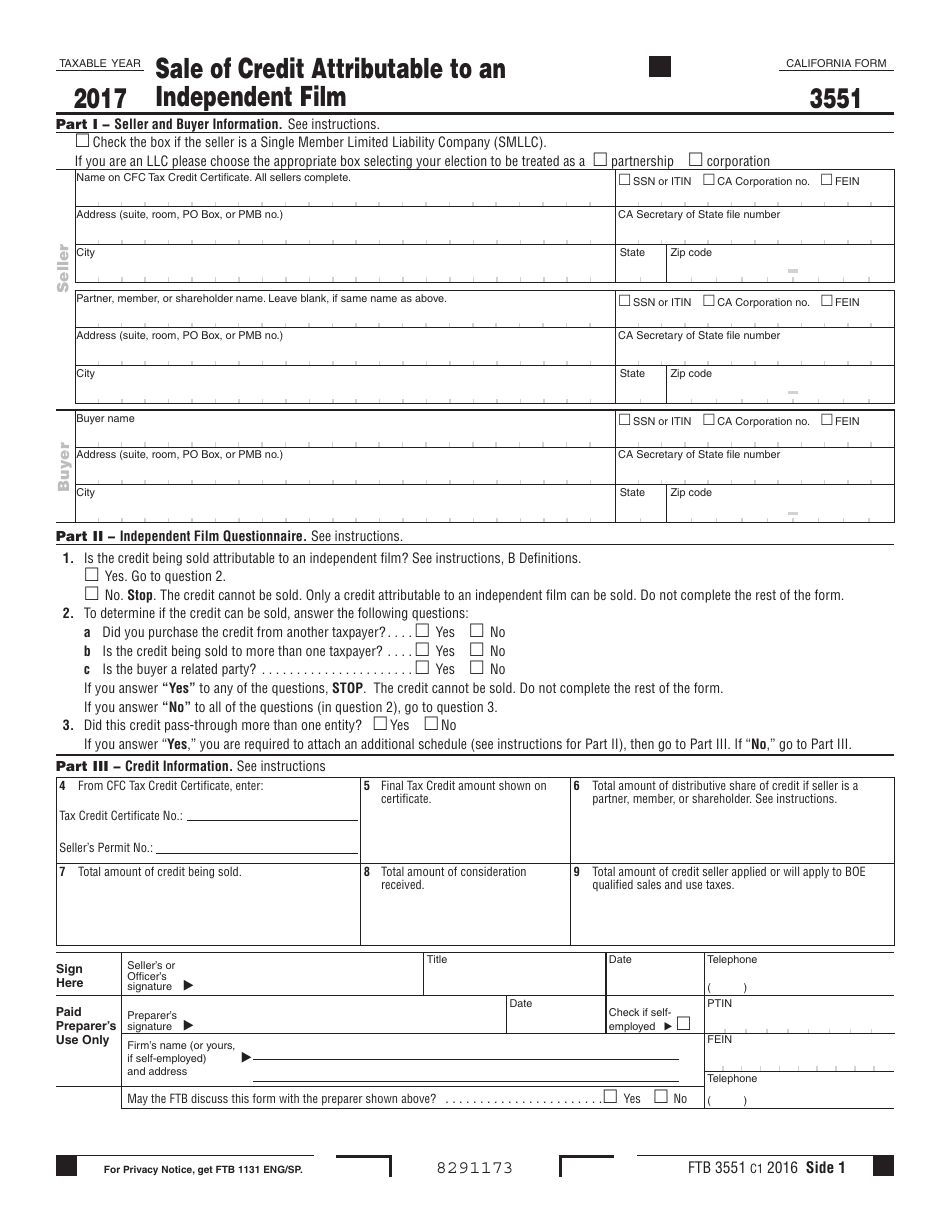

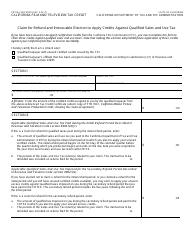

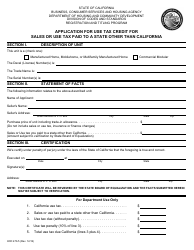

Form FTB3551 Sale of Credit Attributable to an Independent Film - California

What Is Form FTB3551?

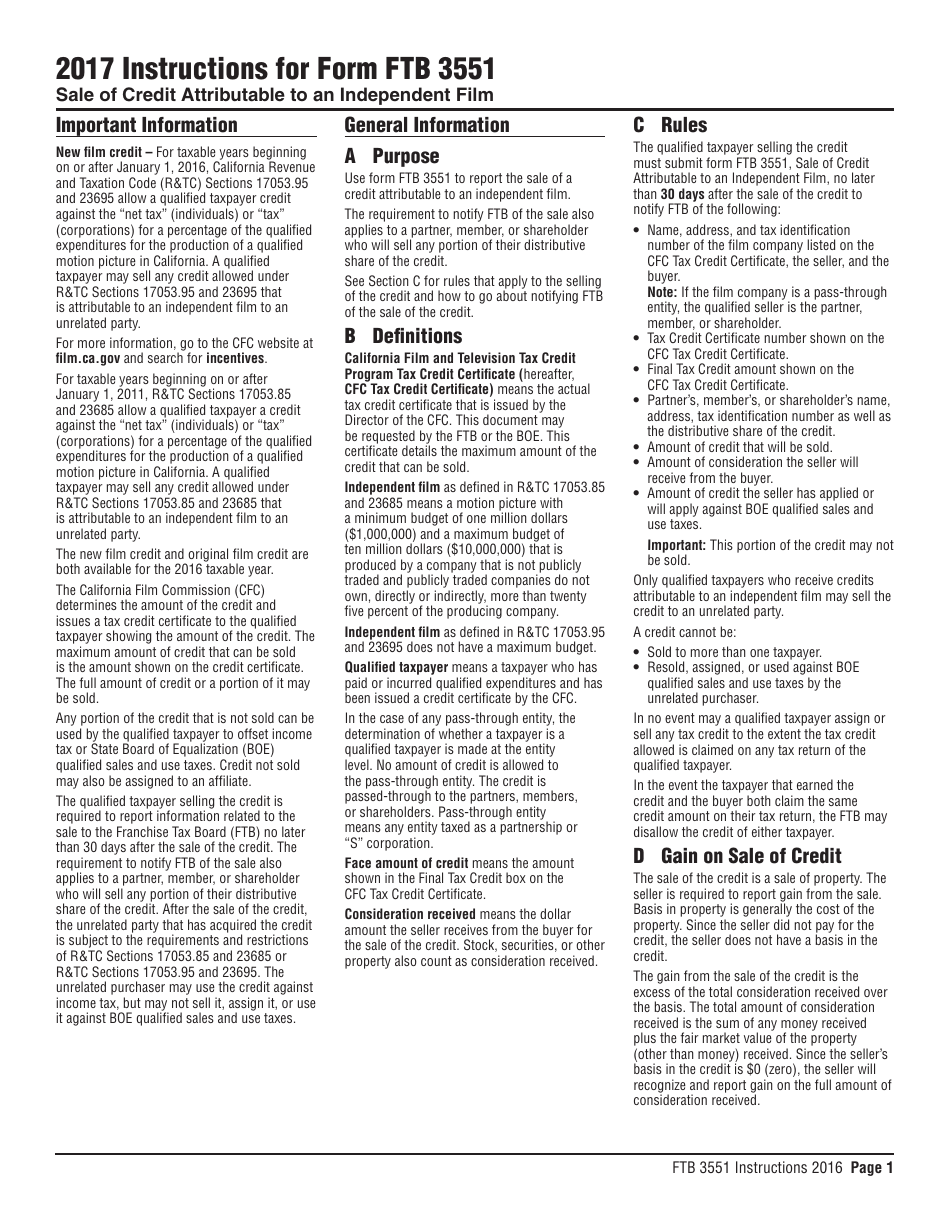

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3551?

A: Form FTB3551 is a form used in California for reporting the sale of credit attributable to an independent film.

Q: Who needs to file Form FTB3551?

A: Anyone who has sold or transferred a credit attributable to an independent film in California needs to file Form FTB3551.

Q: What is an independent film credit?

A: An independent film credit is a tax credit issued by the California Film Commission for qualifying independent films.

Q: What information is needed to complete Form FTB3551?

A: To complete Form FTB3551, you will need to provide details about the buyer or transferee, the amount of credit sold or transferred, and other relevant information.

Q: Is there a deadline for filing Form FTB3551?

A: Yes, Form FTB3551 must be filed within 30 days of the sale or transfer of the credit.

Q: Are there any penalties for late filing of Form FTB3551?

A: Yes, there are penalties for late filing of Form FTB3551. It is important to meet the deadline to avoid penalties.

Q: Can I e-file Form FTB3551?

A: No, Form FTB3551 cannot be e-filed. It must be filed by mail.

Q: What should I do if I have questions about completing Form FTB3551?

A: If you have questions about completing Form FTB3551, you can contact the California Franchise Tax Board for assistance.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3551 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.