This version of the form is not currently in use and is provided for reference only. Download this version of

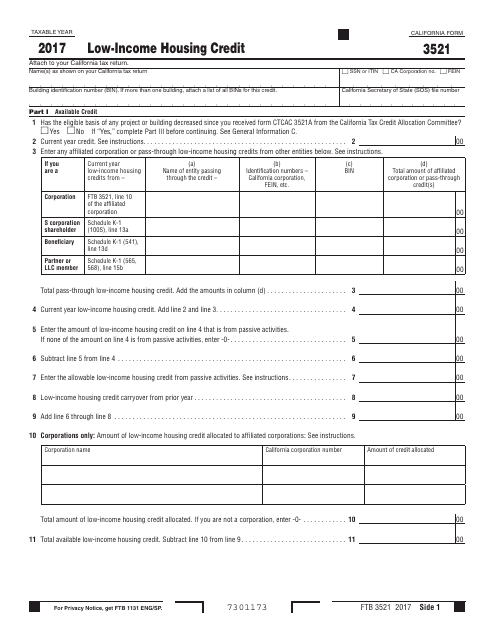

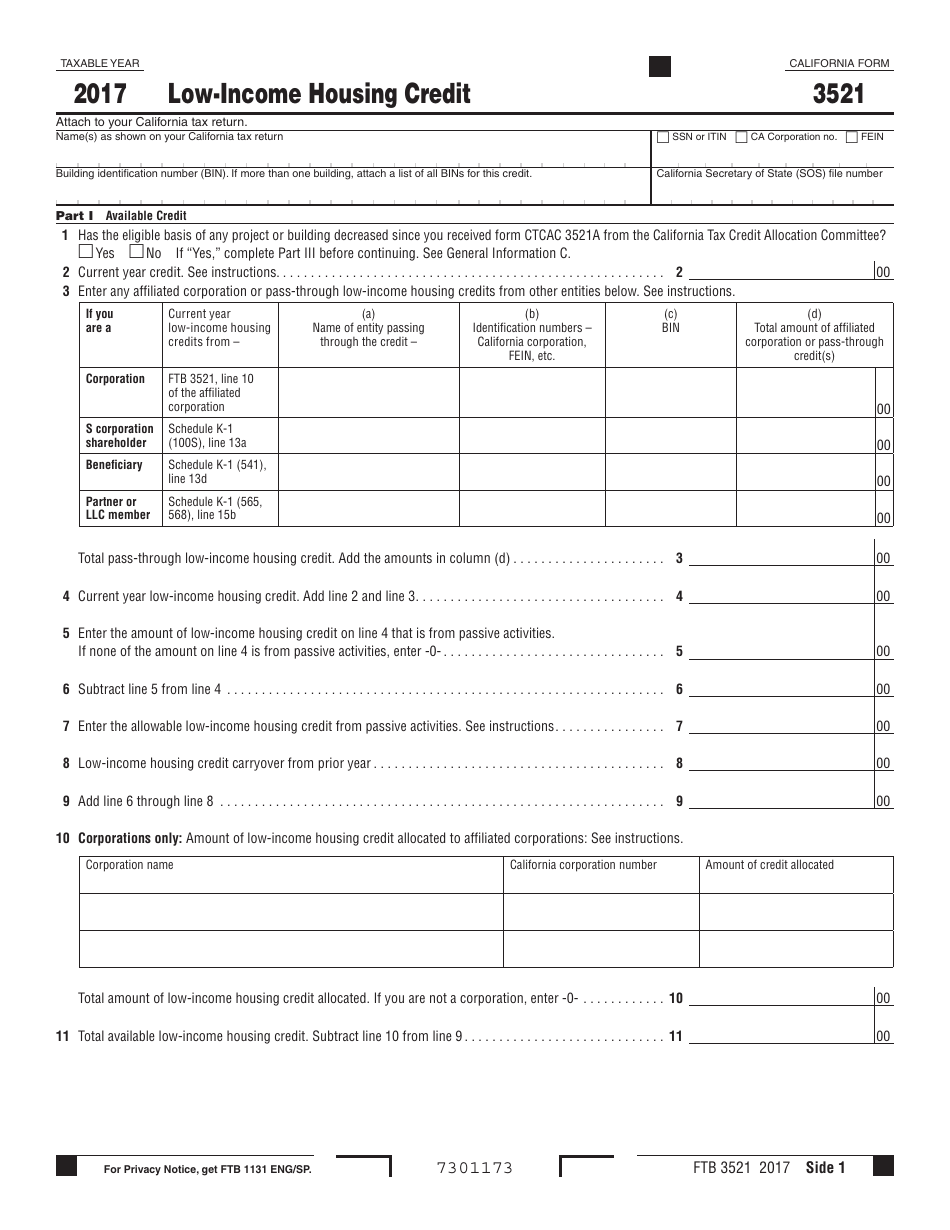

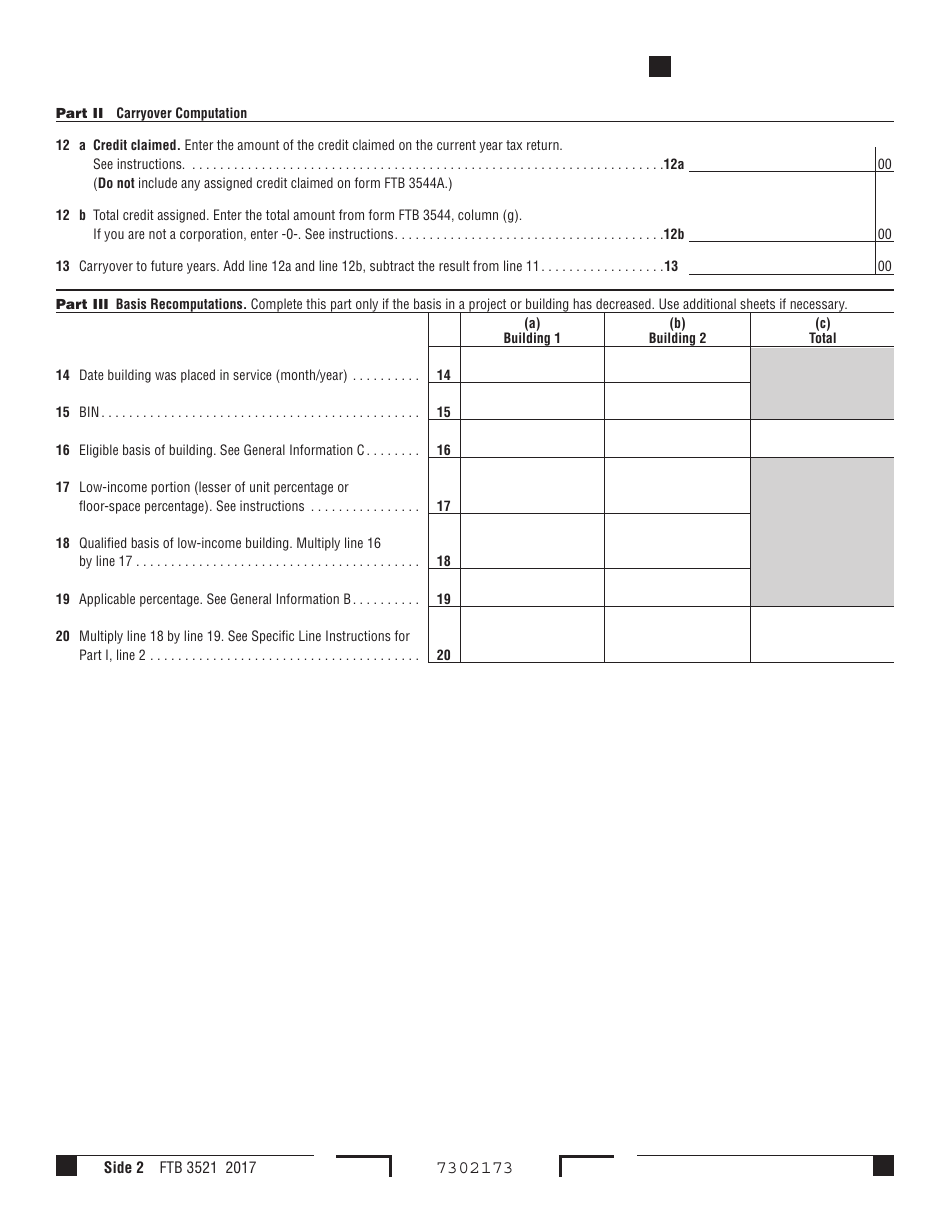

Form FTB3521

for the current year.

Form FTB3521 Low-Income Housing Credit - California

What Is Form FTB3521?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form FTB 3521?

A: Form FTB 3521 is a tax form used in California for claiming the Low-Income Housing Credit.

Q: What is the purpose of Form FTB 3521?

A: The purpose of Form FTB 3521 is to claim the Low-Income Housing Credit for eligible properties in California.

Q: Who needs to file Form FTB 3521?

A: Anyone who wants to claim the Low-Income Housing Credit in California needs to file Form FTB 3521.

Q: What is the Low-Income Housing Credit?

A: The Low-Income Housing Credit is a tax credit designed to encourage the development of affordable housing for low-income individuals and families.

Q: What information is required on Form FTB 3521?

A: Form FTB 3521 requires information about the eligible property, including the address, number of housing units, and the income limits for tenants.

Q: Are there any eligibility requirements for claiming the Low-Income Housing Credit?

A: Yes, there are specific eligibility requirements that must be met in order to claim the Low-Income Housing Credit. These requirements include having a qualified low-income building, meeting the income limits for tenants, and receiving an allocation of the credit from the California Tax Credit Allocation Committee.

Q: Is there a deadline for filing Form FTB 3521?

A: Yes, the deadline for filing Form FTB 3521 is generally the 15th day of the 4th month following the close of the taxable year.

Q: Is there a fee for filing Form FTB 3521?

A: No, there is no fee for filing Form FTB 3521.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB3521 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.