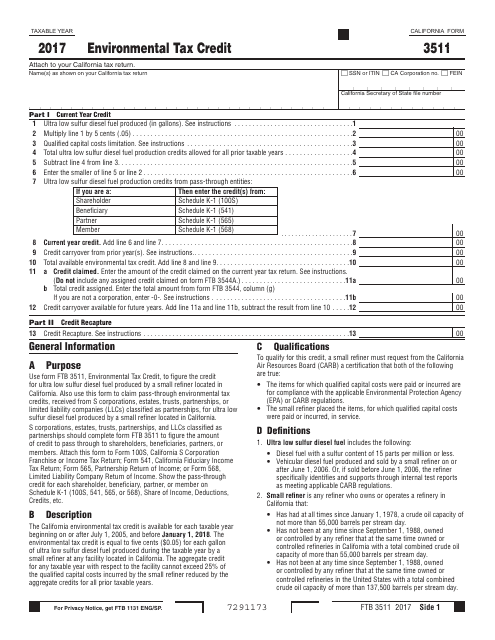

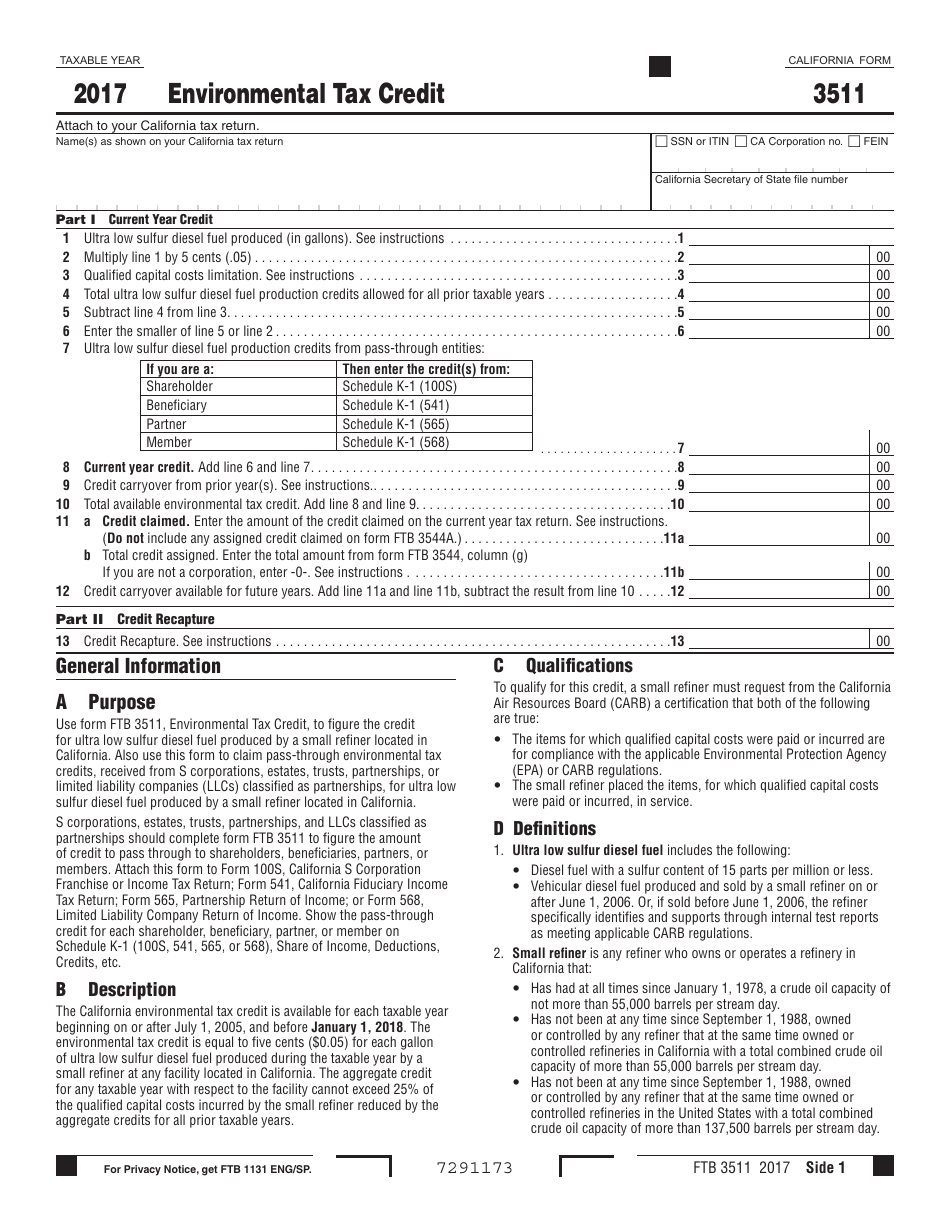

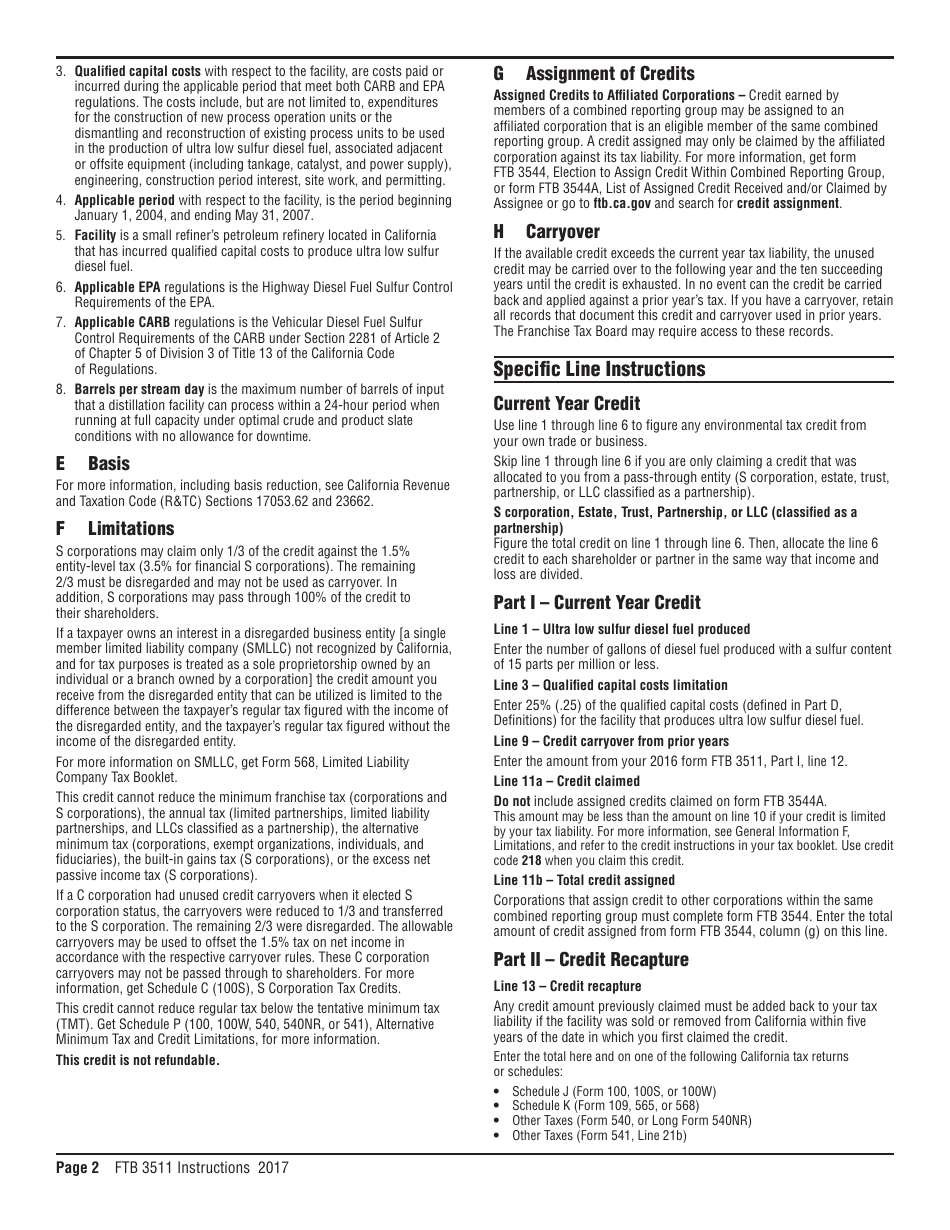

Form FTB3511 Environmental Tax Credit - California

What Is Form FTB3511?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3511?

A: Form FTB3511 is the Environmental Tax Credit form for the state of California.

Q: What is the purpose of Form FTB3511?

A: The purpose of Form FTB3511 is to claim the Environmental Tax Credit in California.

Q: Who is eligible to use Form FTB3511?

A: Taxpayers in California who qualify for the Environmental Tax Credit are eligible to use Form FTB3511.

Q: What is the Environmental Tax Credit?

A: The Environmental Tax Credit is a tax credit offered by the state of California for activities that promote environmental enhancement, conservation, or preservation.

Q: What activities qualify for the Environmental Tax Credit?

A: Activities such as energy conservation, pollution control, and preservation of endangered species may qualify for the Environmental Tax Credit.

Q: Is there a deadline for filing Form FTB3511?

A: Yes, Form FTB3511 must be filed within four years from the original due date of the tax return to which the credit relates.

Q: Are there any supporting documents required for Form FTB3511?

A: Yes, you may need to provide documentation to support your eligibility for the Environmental Tax Credit. Consult the instructions provided with the form for more information.

Q: Can I claim the Environmental Tax Credit if I don't owe any taxes?

A: No, you must have a tax liability in order to claim the Environmental Tax Credit.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB3511 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.