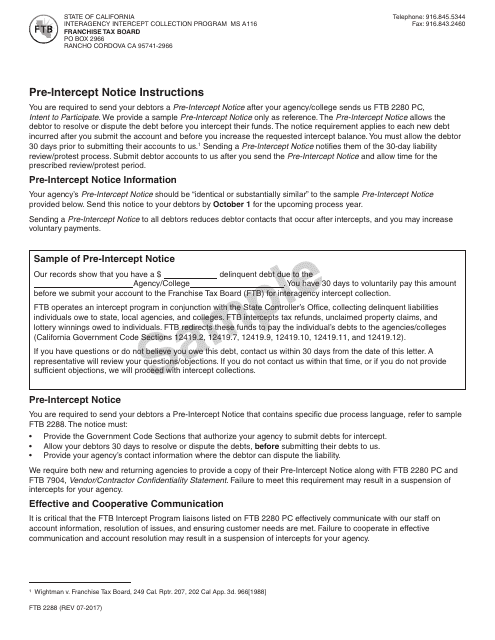

Form FTB2288 Pre-intercept Notice - Sample - California

What Is Form FTB2288?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB2288?

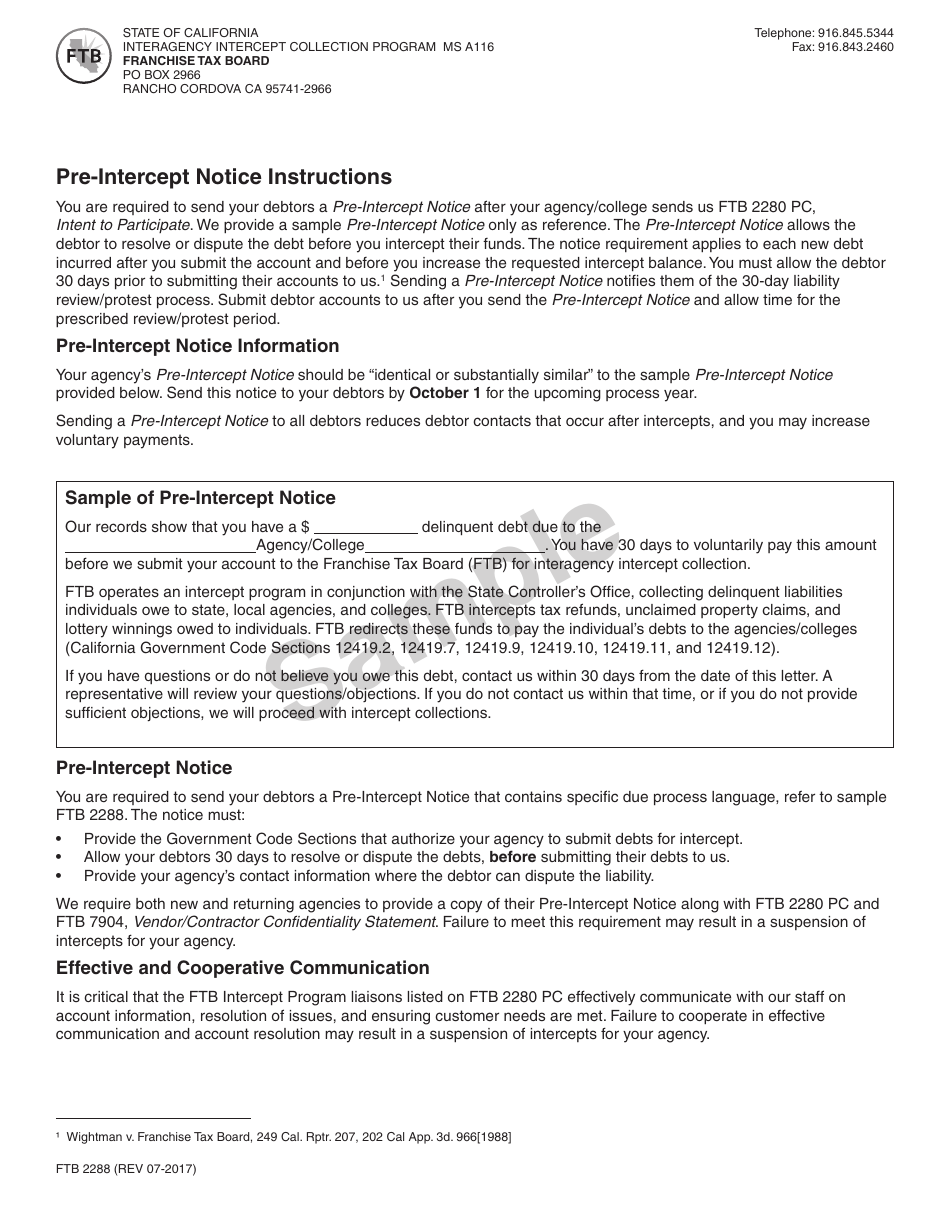

A: Form FTB2288 is a Pre-Intercept Notice that is sent by the California Franchise Tax Board (FTB) to notify individuals that their state tax refund may be intercepted to cover a debt.

Q: What is the purpose of Form FTB2288?

A: The purpose of Form FTB2288 is to inform individuals that their tax refund may be intercepted and applied towards a debt owed to a government agency or court.

Q: Who sends Form FTB2288?

A: Form FTB2288 is sent by the California Franchise Tax Board (FTB).

Q: What should I do if I receive Form FTB2288?

A: If you receive Form FTB2288, you should review the notice carefully and take any necessary action, such as contacting the FTB or the agency listed on the notice to address the debt.

Q: Can I challenge the interception of my tax refund?

A: Yes, you have the right to challenge the interception of your tax refund. You should follow the instructions provided on Form FTB2288 to dispute the debt or resolve the issue.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB2288 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.