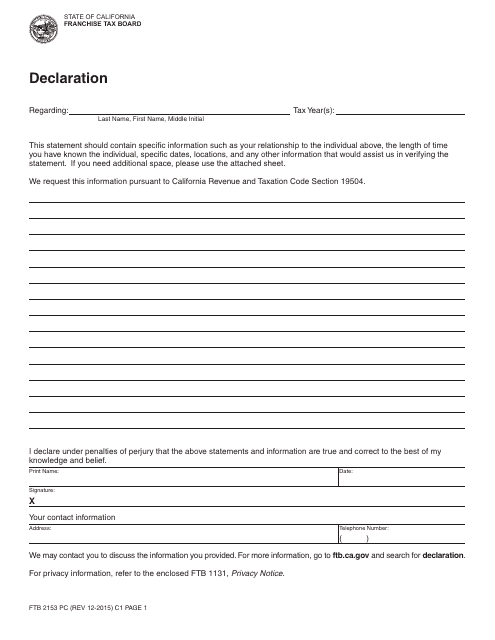

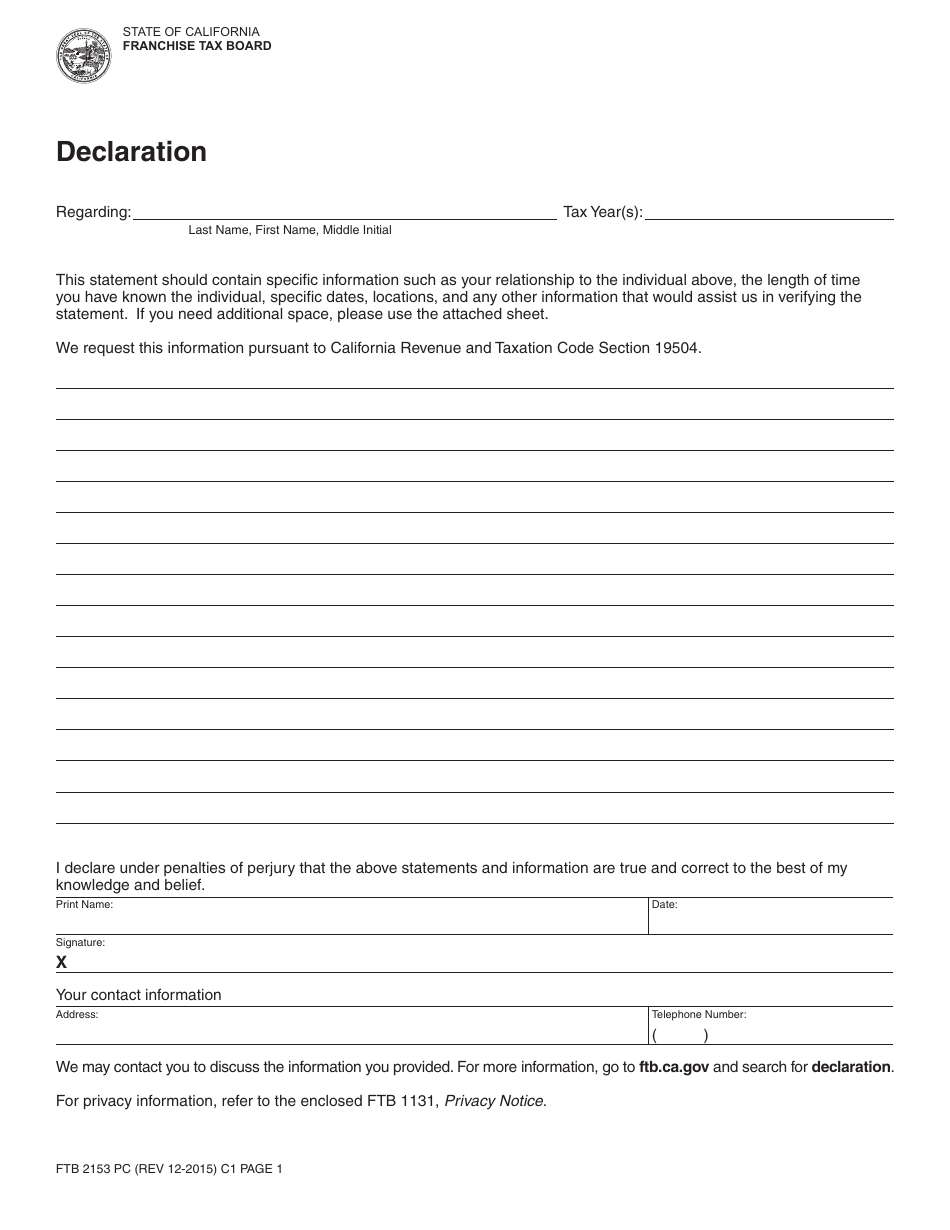

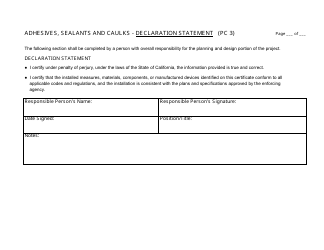

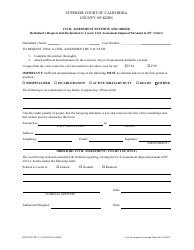

Form FTB2153 PC Declaration - California

What Is Form FTB2153 PC?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB2153 PC Declaration?

A: Form FTB2153 PC Declaration is a form used by taxpayers in California to declare estimated tax payments for a taxable year.

Q: Who needs to file Form FTB2153 PC Declaration?

A: Taxpayers in California who anticipate owing more than $500 in tax for a taxable year are required to file Form FTB2153 PC Declaration.

Q: When should Form FTB2153 PC Declaration be filed?

A: Form FTB2153 PC Declaration should be filed on or before the 15th day of the fourth month following the close of the taxable year.

Q: What information is required on Form FTB2153 PC Declaration?

A: Form FTB2153 PC Declaration requires taxpayers to provide their personal identifying information, estimate their total tax liability for the taxable year, and calculate their estimated tax payments.

Q: Can Form FTB2153 PC Declaration be filed electronically?

A: Yes, taxpayers have the option to file Form FTB2153 PC Declaration electronically.

Q: What happens if a taxpayer fails to file Form FTB2153 PC Declaration?

A: If a taxpayer fails to file Form FTB2153 PC Declaration when required, they may be subject to penalties and interest on the underpayment of estimated taxes.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB2153 PC by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.