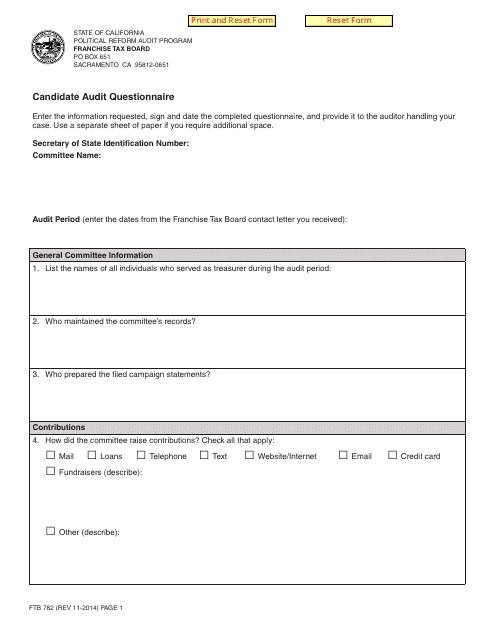

Form FTB782 Candidate Audit Questionnaire - California

What Is Form FTB782?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the FTB782 Candidate Audit Questionnaire?

A: The FTB782 Candidate Audit Questionnaire is a form used by the California Franchise Tax Board (FTB) to gather information from candidates who are running for office in California.

Q: Who is required to fill out the FTB782 Candidate Audit Questionnaire?

A: Candidates who are running for office in California and meet certain financial thresholds set by the FTB are required to fill out the FTB782 Candidate Audit Questionnaire.

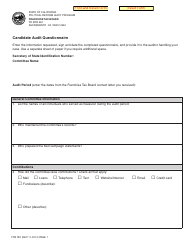

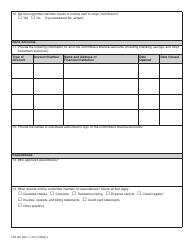

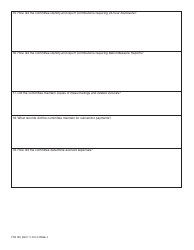

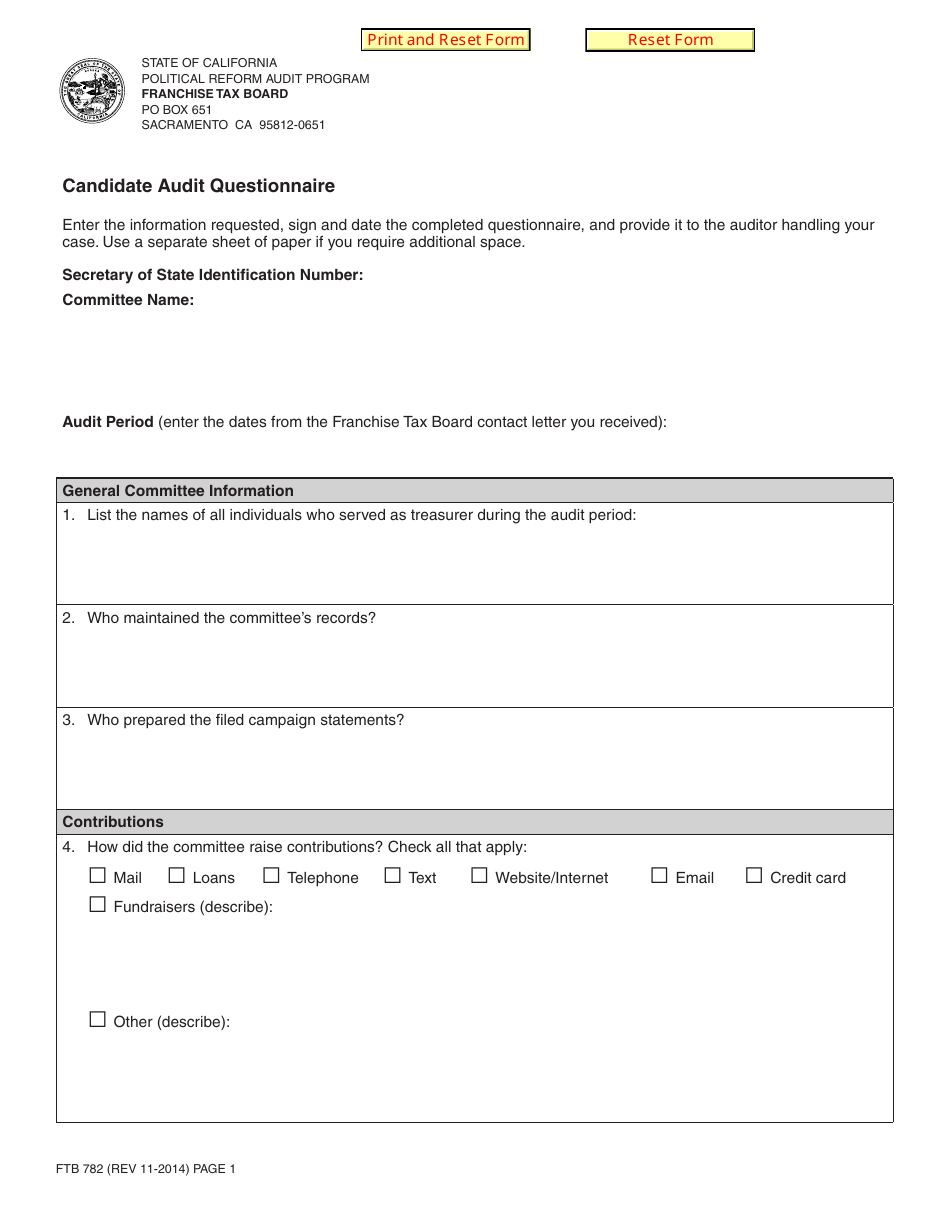

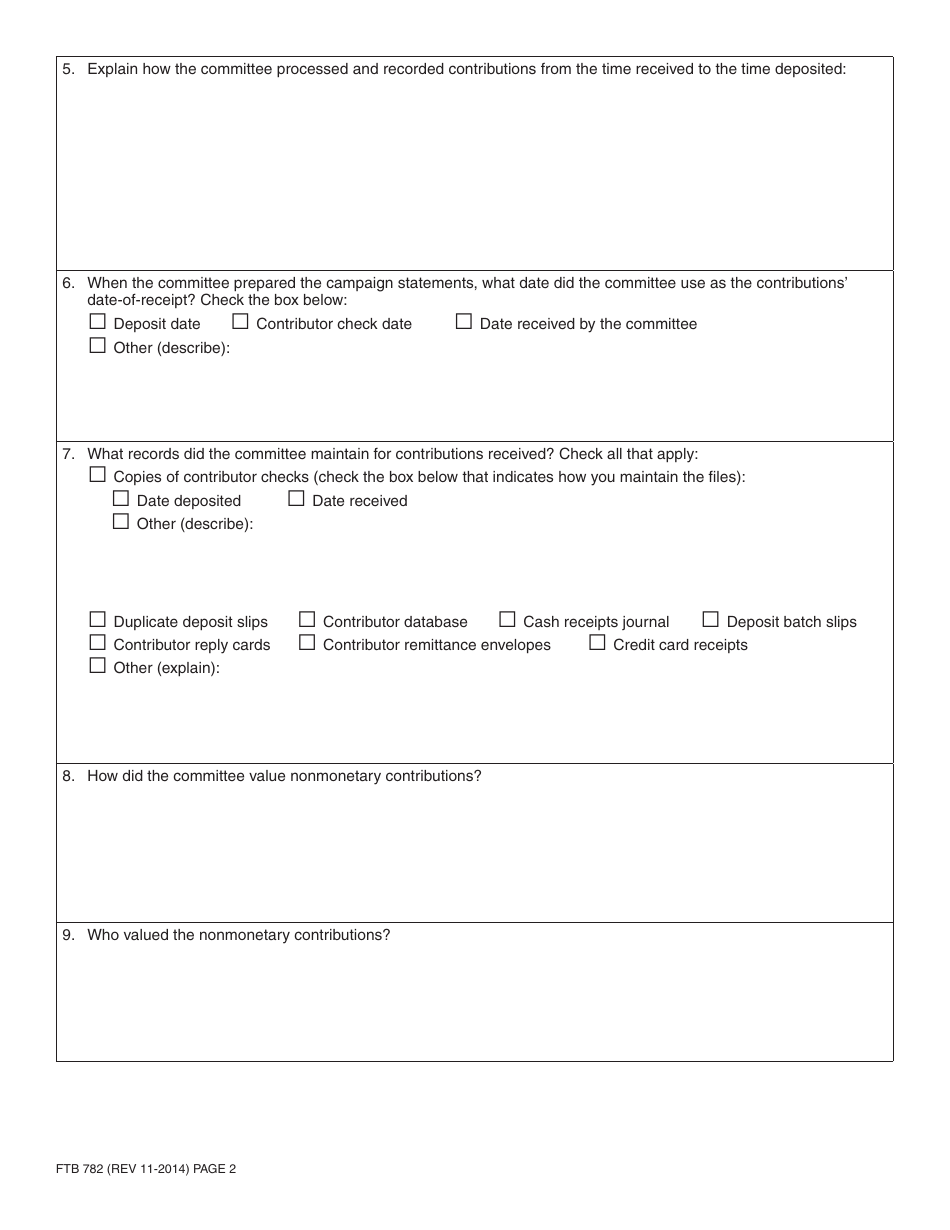

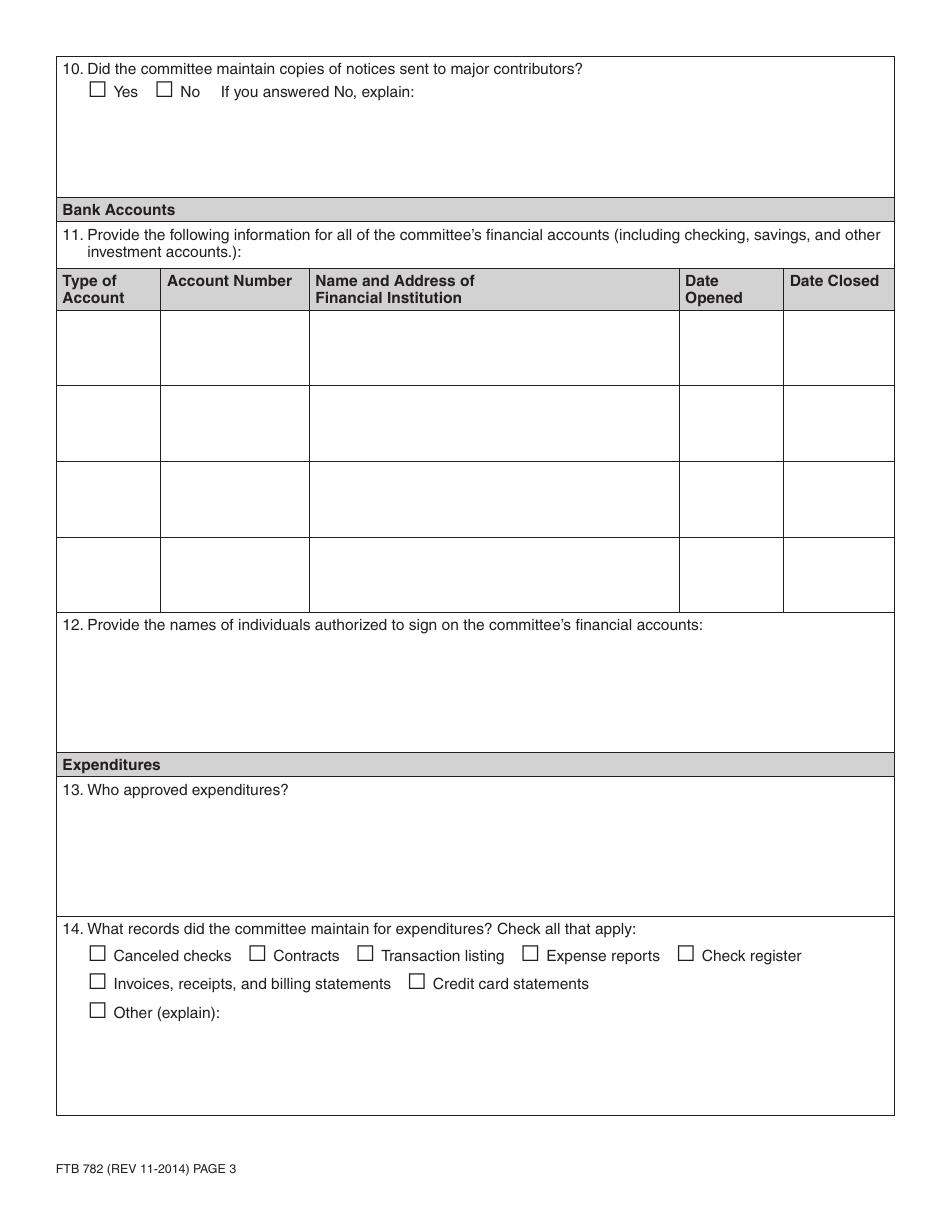

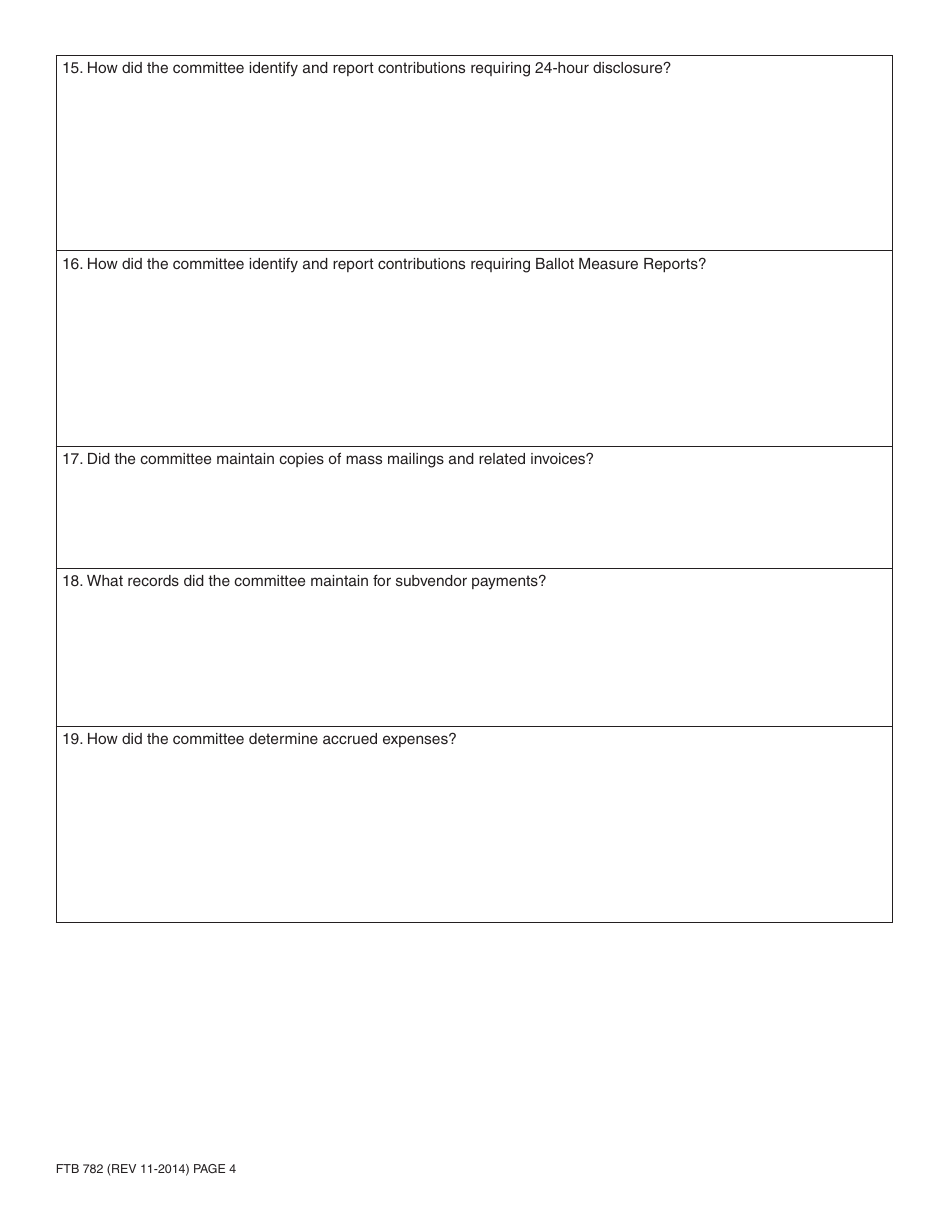

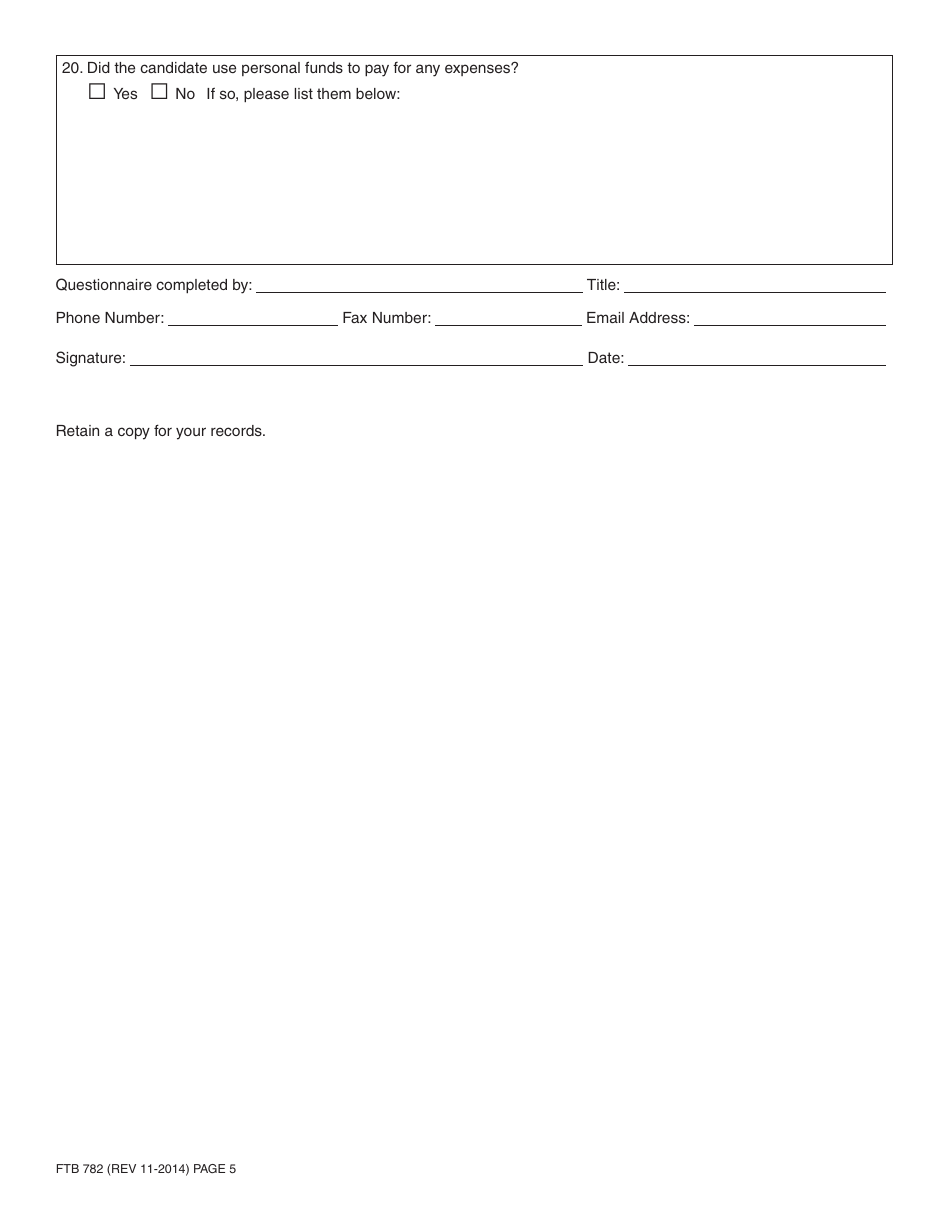

Q: What information is requested in the FTB782 Candidate Audit Questionnaire?

A: The FTB782 Candidate Audit Questionnaire requests information about the candidate's income, expenses, assets, liabilities, and certain other financial transactions.

Q: Why is the FTB782 Candidate Audit Questionnaire used?

A: The FTB782 Candidate Audit Questionnaire is used to ensure compliance with California tax laws and to detect any potential tax evasion or fraud by candidates running for office.

Q: What happens if a candidate does not fill out the FTB782 Candidate Audit Questionnaire?

A: If a candidate who is required to fill out the FTB782 Candidate Audit Questionnaire fails to do so, they may face penalties or sanctions from the FTB.

Form Details:

- Released on November 1, 2014;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB782 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.