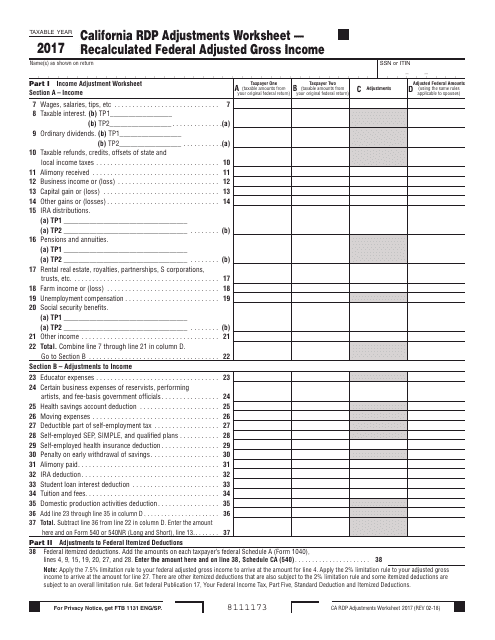

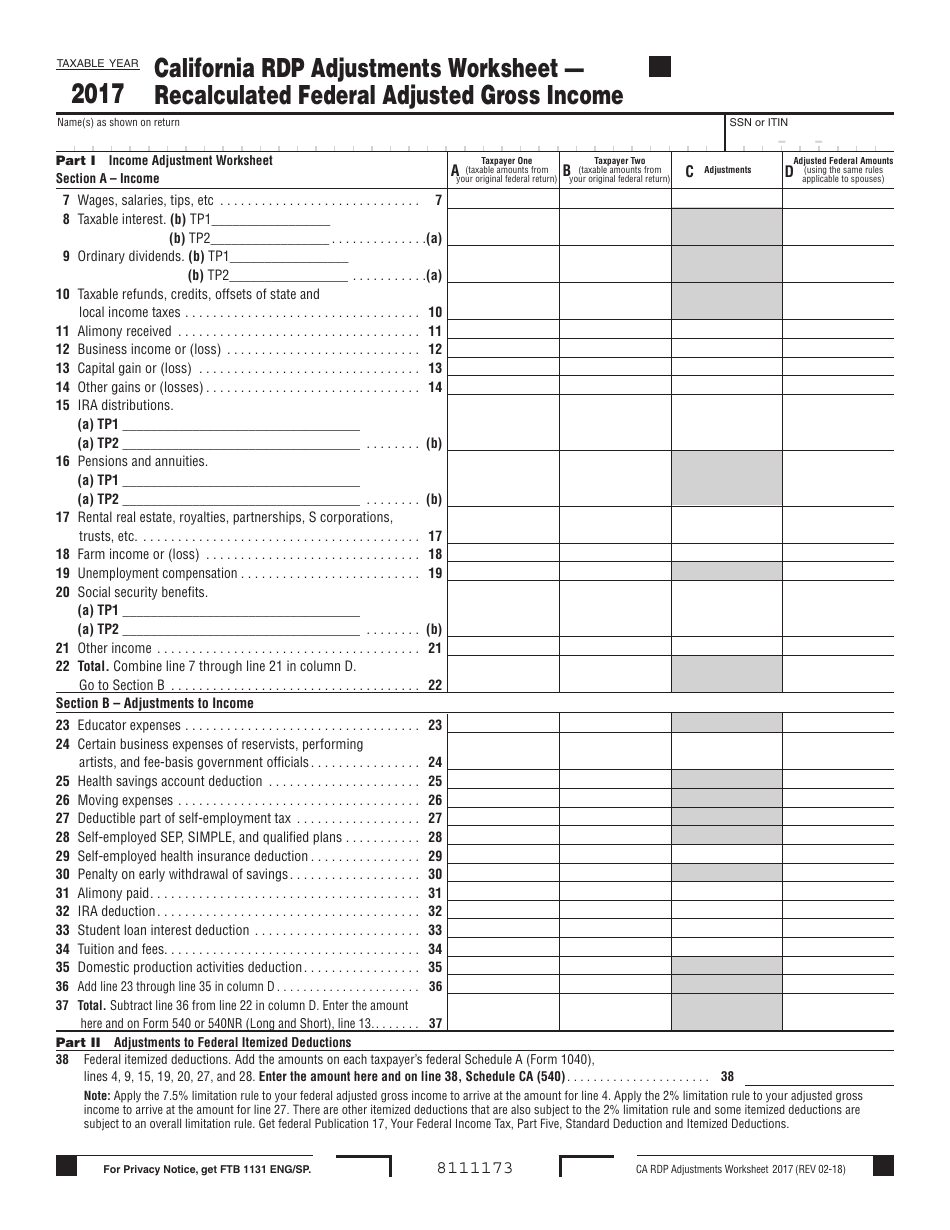

California Rdp Adjustments Worksheet " Recalculated Federal Adjusted Gross Income - California

California Rdp Adjustments Worksheet '" Recalculated Federal Adjusted Gross Income is a legal document that was released by the California Franchise Tax Board - a government authority operating within California.

FAQ

Q: What is the California Rdp Adjustments Worksheet?

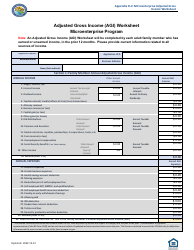

A: The California Rdp Adjustments Worksheet is a form used to calculate the Recalculated Federal Adjusted Gross Income for California tax purposes.

Q: What is Recalculated Federal Adjusted Gross Income?

A: Recalculated Federal Adjusted Gross Income is the adjusted gross income for federal tax purposes that has been adjusted to comply with California tax laws.

Q: Why is Recalculated Federal Adjusted Gross Income important for California taxes?

A: Recalculated Federal Adjusted Gross Income is important for California taxes because it affects the amount of taxable income and determines eligibility for certain tax deductions and credits.

Q: How is Recalculated Federal Adjusted Gross Income calculated?

A: Recalculated Federal Adjusted Gross Income is calculated by taking the federal adjusted gross income and making adjustments specified by California tax laws.

Q: What are some common adjustments on the California Rdp Adjustments Worksheet?

A: Some common adjustments on the California Rdp Adjustments Worksheet include adding back certain deductions that are not allowed for California purposes or subtracting out income that is exempt from California taxes.

Form Details:

- Released on February 1, 2018;

- The latest edition currently provided by the California Franchise Tax Board;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.