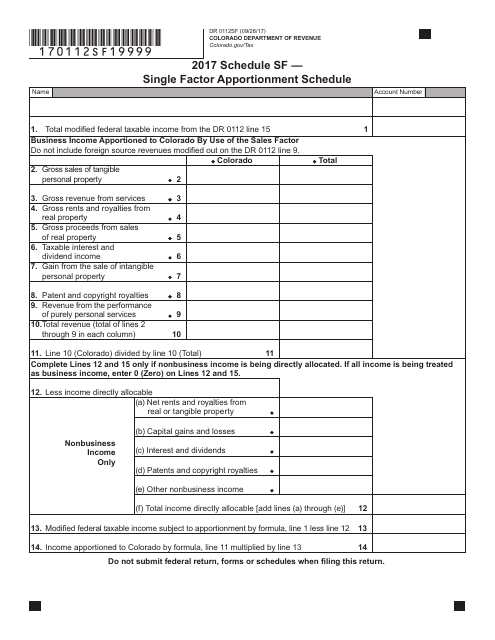

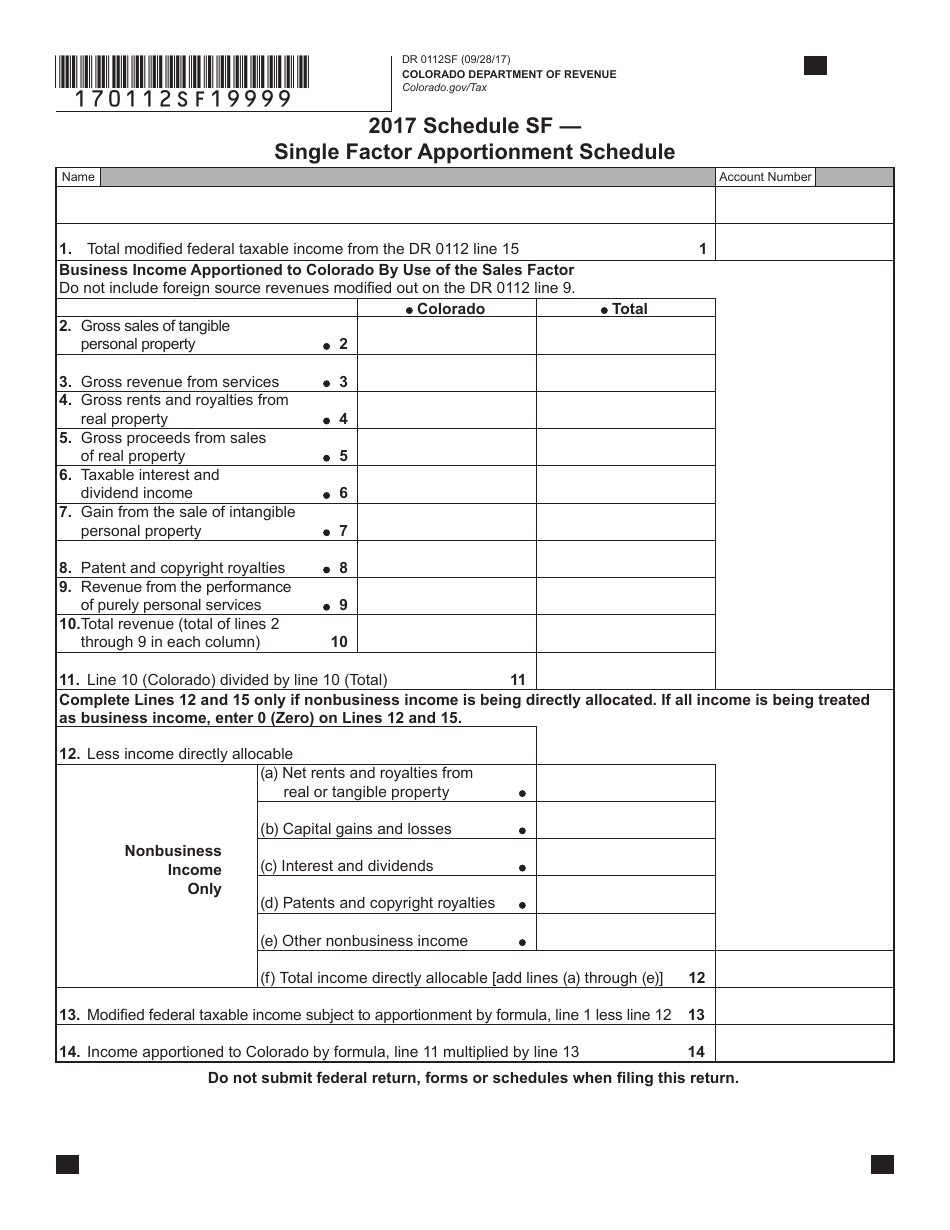

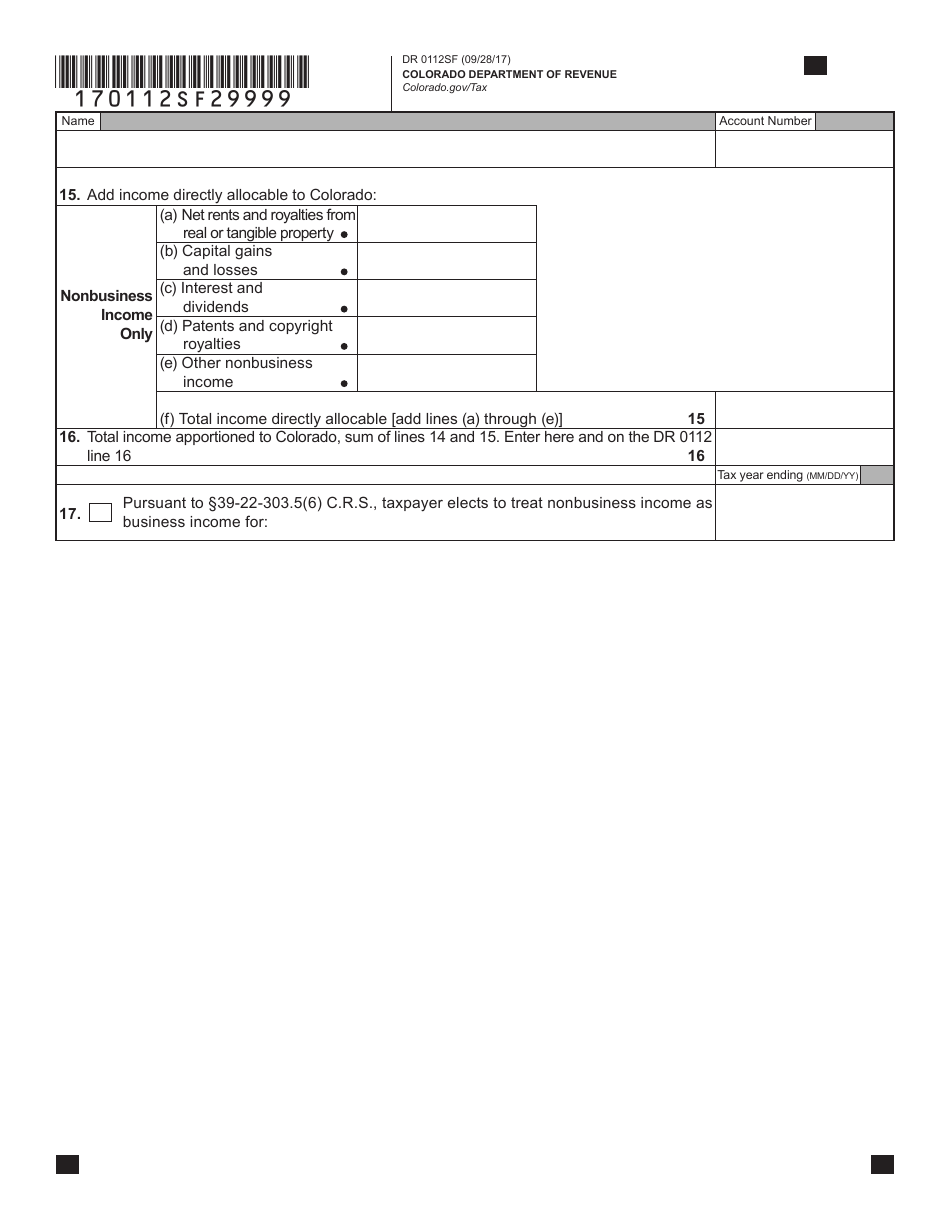

Form DR0112SF Schedule SF Single Factor Apportionment Schedule - Colorado

What Is Form DR0112SF Schedule SF?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the DR0112SF Schedule SF Single Factor Apportionment Schedule?

A: The DR0112SF Schedule SF is a form used in Colorado to determine the taxable income of a business based on its sales within and outside of the state.

Q: When is the DR0112SF Schedule SF required to be filed?

A: The DR0112SF Schedule SF is required to be filed by businesses that have income from both within and outside of Colorado and need to apportion their taxable income accordingly.

Q: How does the DR0112SF Schedule SF work?

A: The DR0112SF Schedule SF uses the single factor apportionment method to determine the portion of a business's income that is subject to Colorado taxes. This is based on the ratio of the business's sales within the state compared to its total sales.

Q: Are there any specific requirements or instructions for filling out the DR0112SF Schedule SF?

A: Yes, there are specific instructions provided on the form itself as well as in the corresponding instructions booklet. It is important to carefully follow these instructions to accurately complete the form.

Q: Do I need to file the DR0112SF Schedule SF if my business only operates within Colorado?

A: No, if your business only operates within Colorado and does not have any income from outside the state, you would not need to file the DR0112SF Schedule SF.

Form Details:

- Released on September 28, 2017;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0112SF Schedule SF by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.