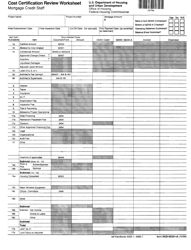

This version of the form is not currently in use and is provided for reference only. Download this version of

Form DR0112CR

for the current year.

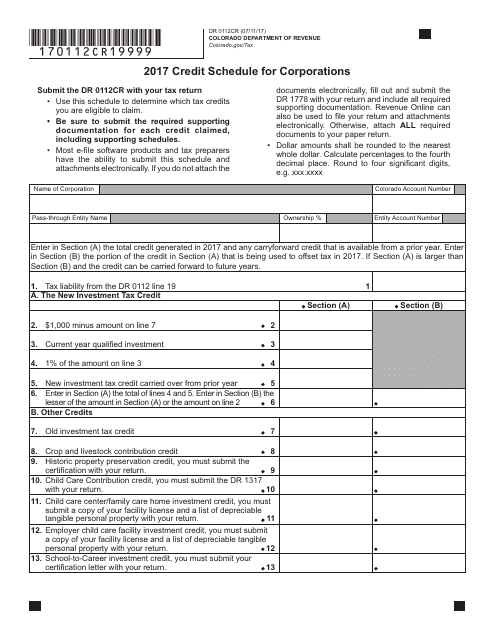

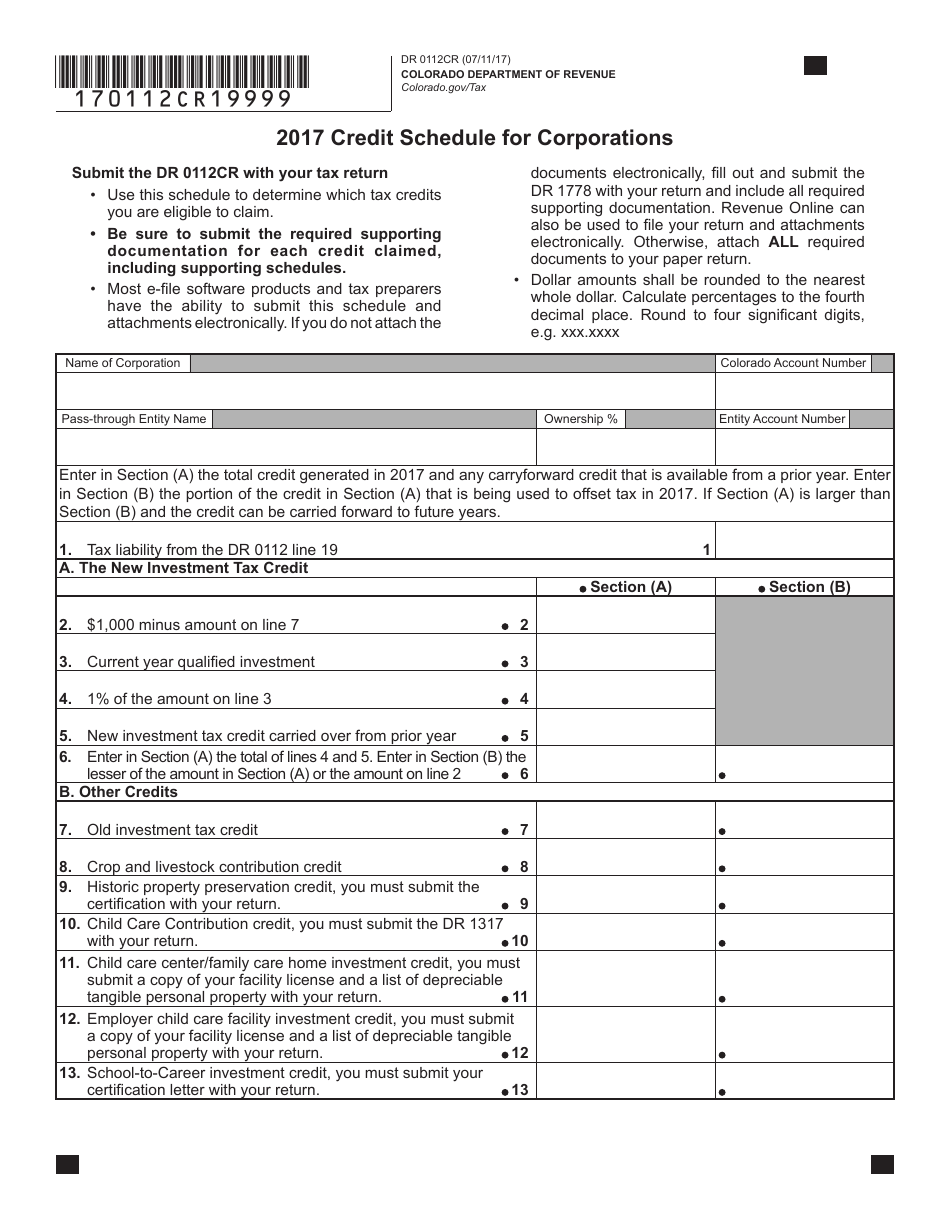

Form DR0112CR Credit Schedule for Corporations - Colorado

What Is Form DR0112CR?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0112CR?

A: Form DR0112CR is the Credit Schedule for Corporations in Colorado.

Q: Who needs to file Form DR0112CR?

A: Corporations in Colorado who want to claim certain tax credits need to file Form DR0112CR.

Q: What is the purpose of Form DR0112CR?

A: The purpose of Form DR0112CR is to report and calculate various tax credits available to corporations in Colorado.

Q: Is Form DR0112CR to be filed separately or with another form?

A: Form DR0112CR should be filed separately from the Colorado tax return. It is an additional schedule for reporting tax credits.

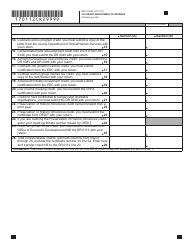

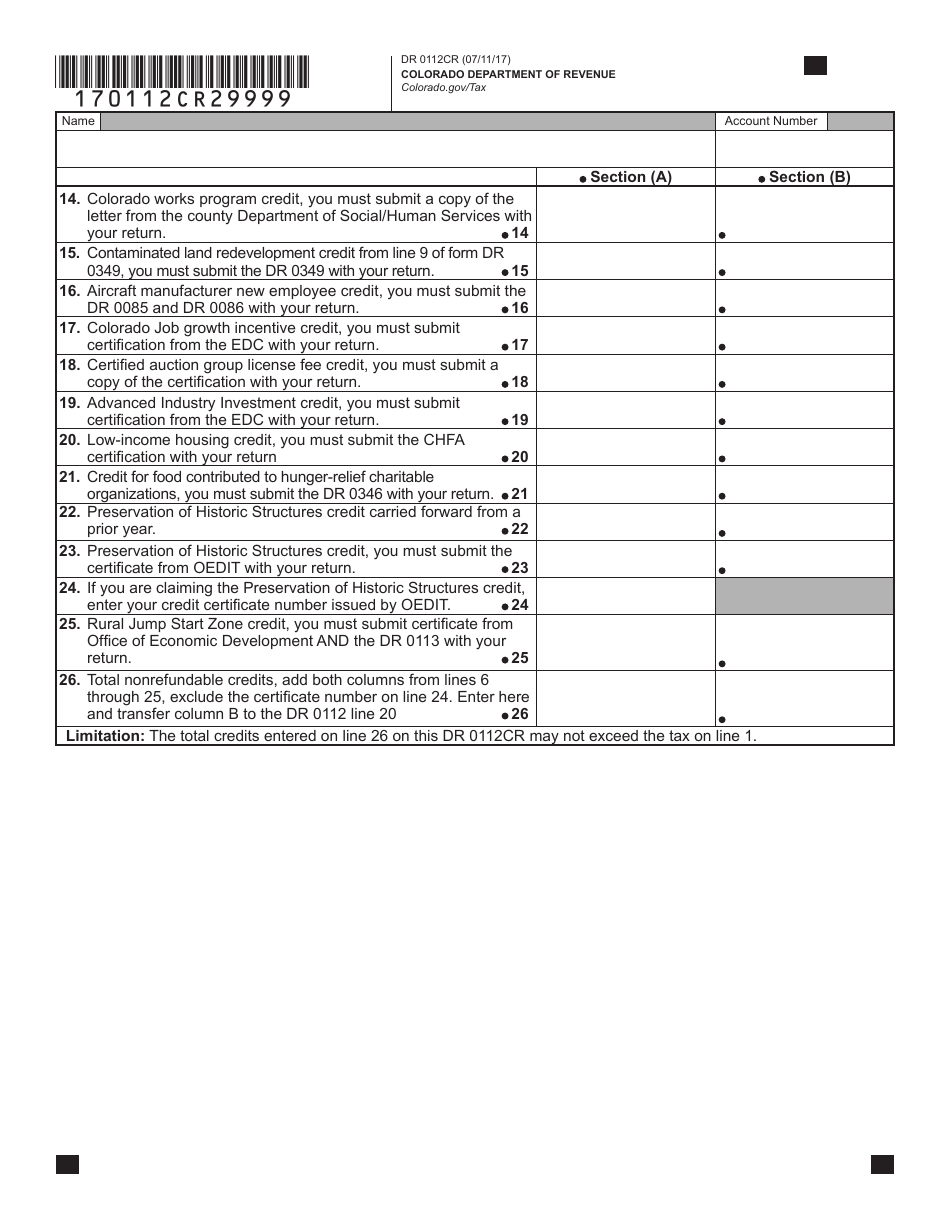

Q: What are some of the tax credits that can be claimed on Form DR0112CR?

A: Some of the tax credits that can be claimed on Form DR0112CR include the Job Growth Incentive Tax Credit, the Enterprise Zone Credit, and the Research and Development Credit.

Q: Is there a deadline for filing Form DR0112CR?

A: Yes, the deadline for filing Form DR0112CR is the same as the deadline for filing the Colorado tax return, which is typically April 15th or the 15th day of the 4th month following the close of the tax year.

Q: What happens if Form DR0112CR is filed late or not filed at all?

A: If Form DR0112CR is filed late or not filed at all, the taxpayer may lose out on the opportunity to claim certain tax credits.

Q: Can I file Form DR0112CR electronically?

A: Yes, the Colorado Department of Revenue allows for electronic filing of Form DR0112CR.

Q: Can I amend Form DR0112CR if I made a mistake?

A: Yes, if you made a mistake on Form DR0112CR, you can file an amended version of the form to correct the error.

Form Details:

- Released on July 11, 2017;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0112CR by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.