This version of the form is not currently in use and is provided for reference only. Download this version of

Form DR0104AD

for the current year.

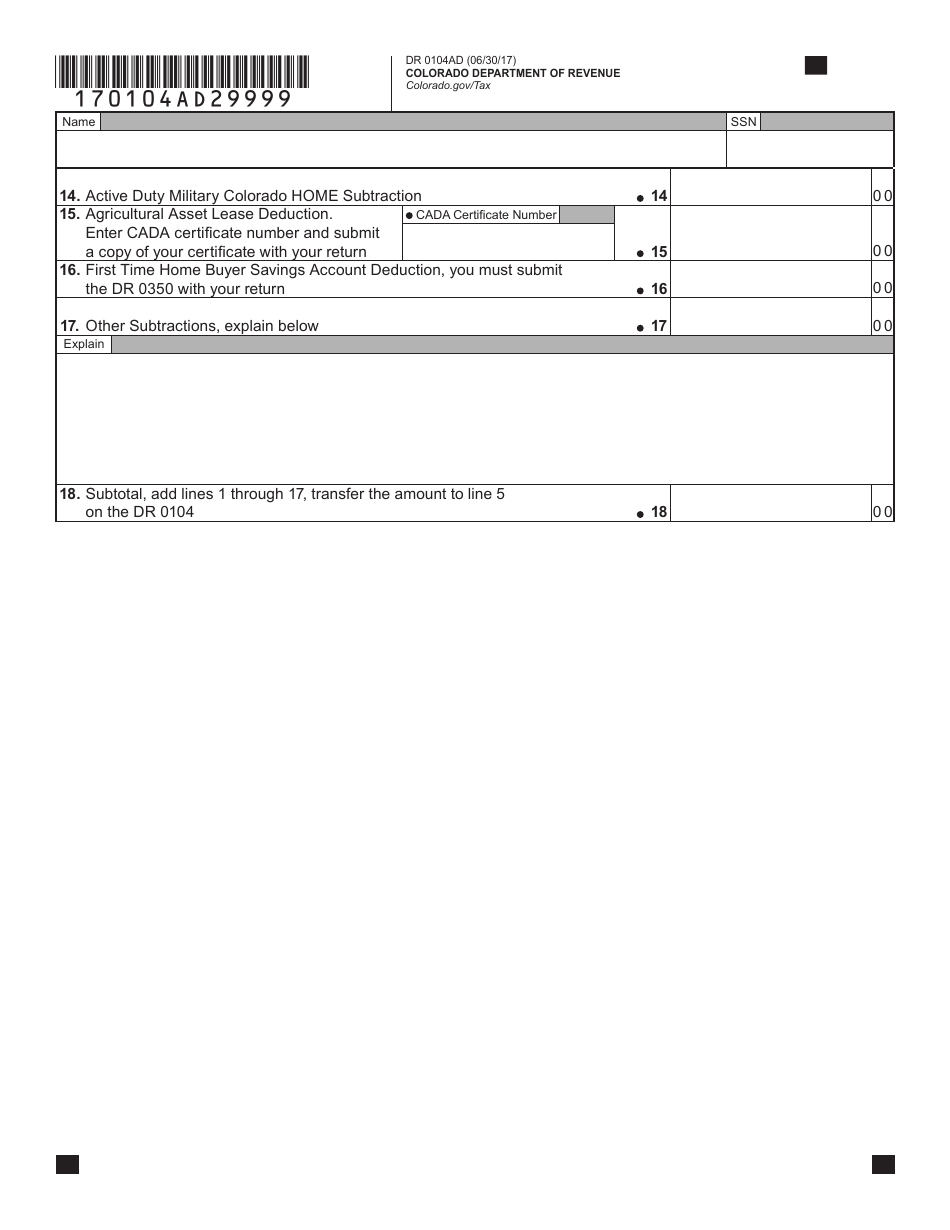

Form DR0104AD Subtractions From Income Schedule - Colorado

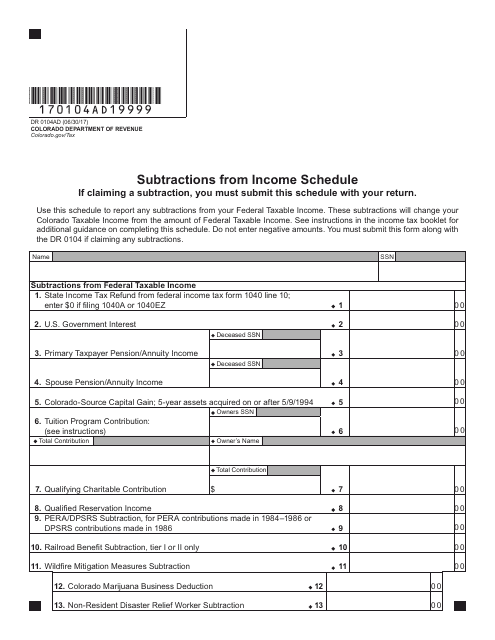

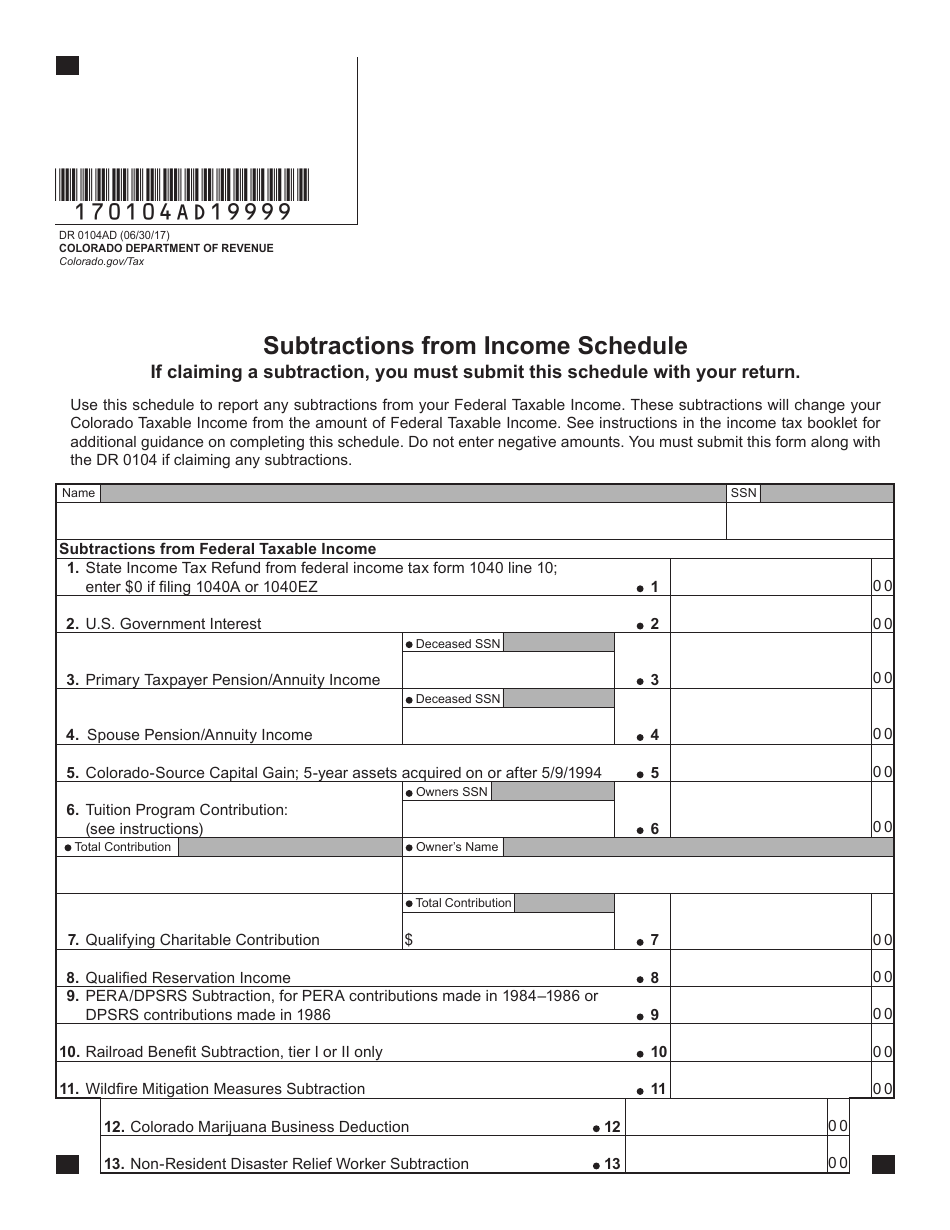

What Is Form DR 0104AD?

Form DR 0104AD, Subtractions From Income Schedule , is an application developed by the Colorado Department of Revenue . The form is to be used to report subtractions from Federal Taxable Income.

The application was last revised on June 30, 2017 . A Colorado DR 0104AD version is available for download below. The form is supposed to be submitted along with Form DR 0104, Individual Income Tax Return, if the taxpayer is claiming any subtractions on their Federal Taxable Income.

Form DR 0104AD Instructions

Colorado Tax Form DR 0104AD can be divided into two major parts:

-

Personal Information. In this part of the form, the applicant is supposed to enter their full name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). This type of information is required for identification purposes;

-

Subtractions. The biggest section of the application consists of 20 statements that are supposed to be filled out by the applicant. Here, the applicant is supposed to enter different kinds of information, such as (but not limited to):

- State Income Tax Refund from Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. To complete this line the applicant is supposed to refer to their federal income tax return;

- U.S. Government Interest. The applicant can use this line to enter the sum of all interest earned from U.S. government bonds, treasury bills and other obligations of the U.S. that were reported on their federal income tax return;

- Qualifying Charitable Contribution . Applicants who make charitable contributions that would be eligible for a federal income tax deduction might be eligible to deduct a portion of their contribution;

- Qualified Reservation Income. In this line, the applicant should indicate any amount of income that was received from reservation sources by an enrolled tribal member who lives on the reservation, which was included as taxable income;

- Railroad Benefit. This line is a place for the applicant to list any railroad retirement benefits that they reported on your federal income tax return. It is supposed to be calculated as part of your federal taxable income;

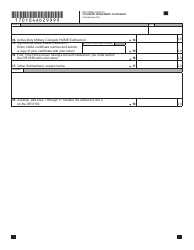

- Colorado Capital Gain Subtraction. A filer might be eligible to subtract some or all of the capital gain included in their federal taxable income if the gain is derived from the sale of tangible personal property or from the sale of real property located in Colorado;

- CollegeInvest Contribution. Contributions to CollegeInvest can be deducted from the applicant's tax return. The contribution must have been included on their federal income tax return and calculated as part of their federal taxable income;

- Colorado Marijuana Business Deduction. Marijuana businesses with a license issued in Colorado can use this line to list any expenses that are eligible to be claimed as a federal income tax deduction but is disallowed by the Internal Revenue Code (because marijuana is a controlled substance under federal law);

- First Time Home Buyer Interest Deduction. If the applicant is claiming this kind of a deduction, they must complete Form DR 0350, First-time Home Buyer Savings Account Interest Deduction, and submit it with their return;

- Subtotal. In the last line, the applicant is supposed to enter the sum of lines one through 19.