This version of the form is not currently in use and is provided for reference only. Download this version of

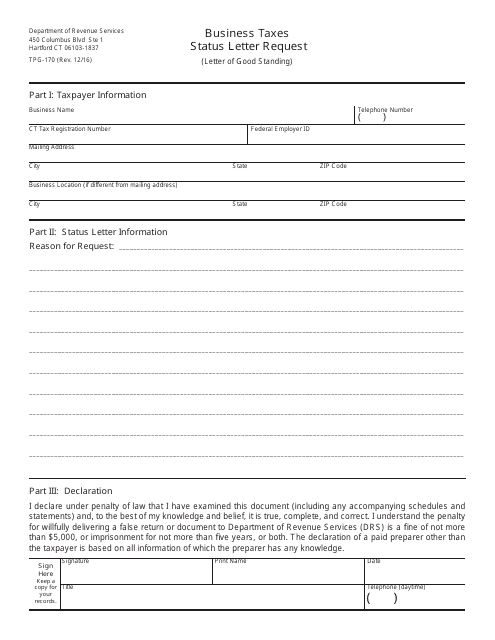

Form TPG-170

for the current year.

Form TPG-170 Business Taxes - Status Letter Request - Connecticut

What Is Form TPG-170?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TPG-170?

A: Form TPG-170 is a form used to request a status letter for business taxes in Connecticut.

Q: What is a status letter for business taxes?

A: A status letter for business taxes is a document that confirms the current tax status of a business in Connecticut.

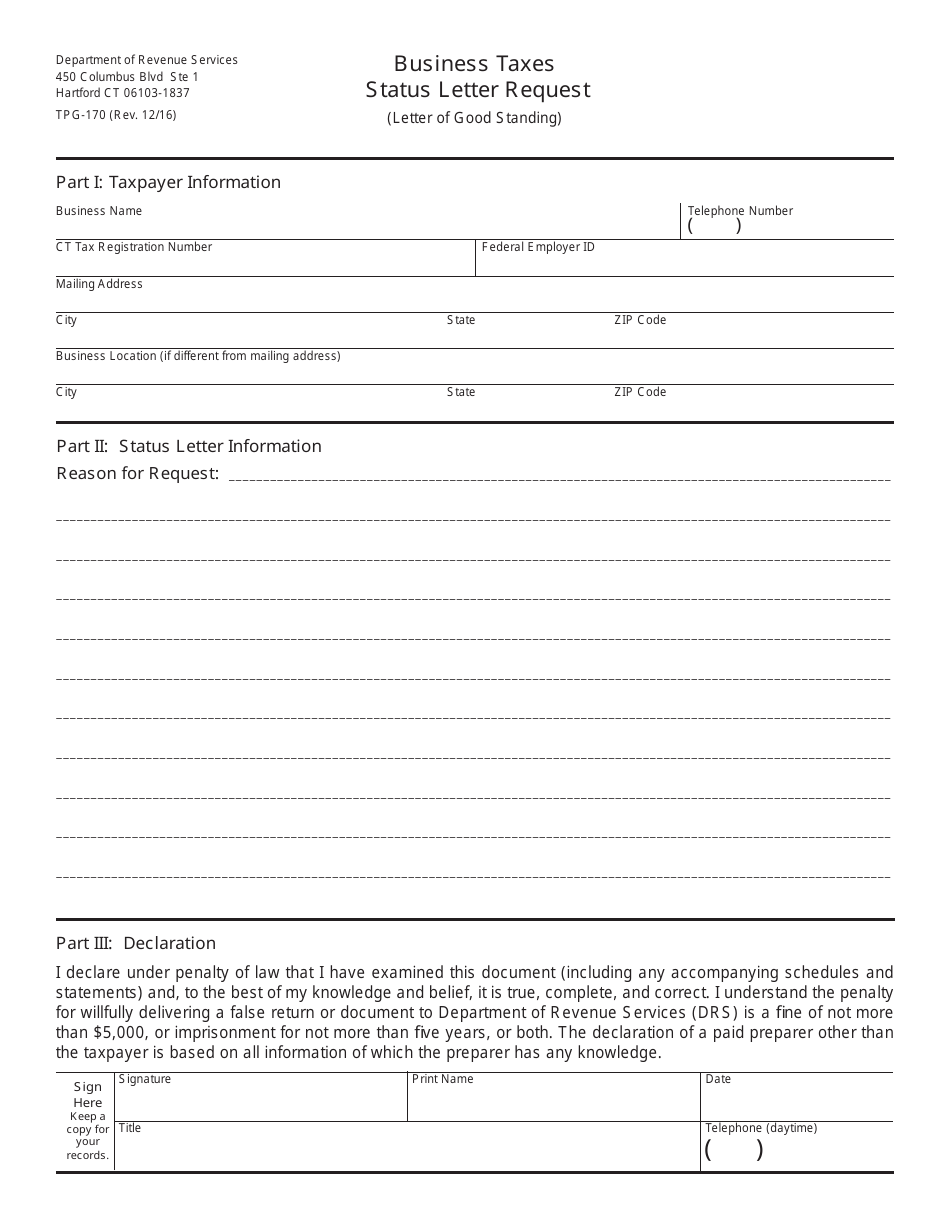

Q: How do I request a business tax status letter in Connecticut?

A: You can request a business tax status letter in Connecticut by filling out Form TPG-170 and submitting it to the appropriate tax authority.

Q: Is there a fee for requesting a business tax status letter in Connecticut?

A: Yes, there is a fee associated with the request for a business tax status letter in Connecticut. The fee amount may vary.

Q: How long does it take to receive a business tax status letter in Connecticut?

A: The processing time for a business tax status letter request in Connecticut may vary. It is best to contact the tax authority for an estimated timeline.

Q: Why would I need a business tax status letter in Connecticut?

A: A business tax status letter in Connecticut may be needed for various purposes, such as obtaining financing, demonstrating compliance with tax obligations, or responding to audit requests.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TPG-170 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.