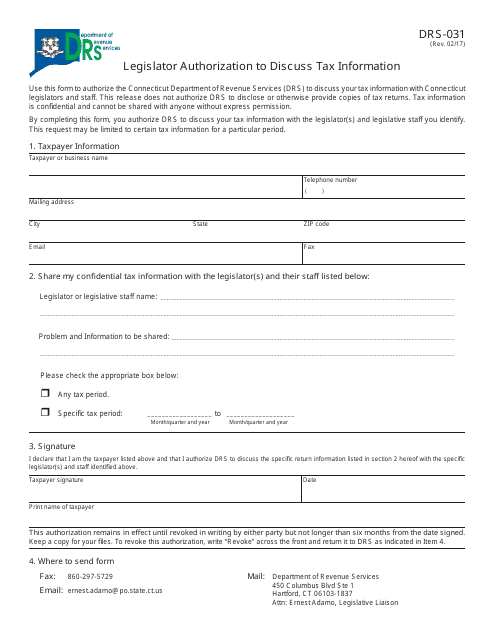

Form DRS-031 Legislator Authorization to Discuss Tax Information - Connecticut

What Is Form DRS-031?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DRS-031?

A: Form DRS-031 is the Legislator Authorization to Discuss Tax Information form used in Connecticut.

Q: Who needs to fill out Form DRS-031?

A: Connecticut legislators who need to discuss tax information on behalf of a taxpayer need to fill out Form DRS-031.

Q: What is the purpose of Form DRS-031?

A: Form DRS-031 authorizes Connecticut legislators to discuss confidential tax information with the Department of Revenue Services (DRS) on behalf of a taxpayer.

Q: Is Form DRS-031 specific to Connecticut?

A: Yes, Form DRS-031 is specific to Connecticut and is used by legislators in the state.

Q: Are there any fees associated with Form DRS-031?

A: No, there are no fees associated with Form DRS-031.

Q: Can Form DRS-031 be submitted electronically?

A: No, Form DRS-031 cannot be submitted electronically and must be submitted by mail or in person.

Q: What information is required on Form DRS-031?

A: Form DRS-031 requires the legislator's contact information, taxpayer information, and the type of tax matter they are authorized to discuss.

Q: Are there any deadlines for submitting Form DRS-031?

A: There are no specific deadlines for submitting Form DRS-031, but it should be submitted before the legislator attempts to discuss tax information with the DRS.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DRS-031 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.