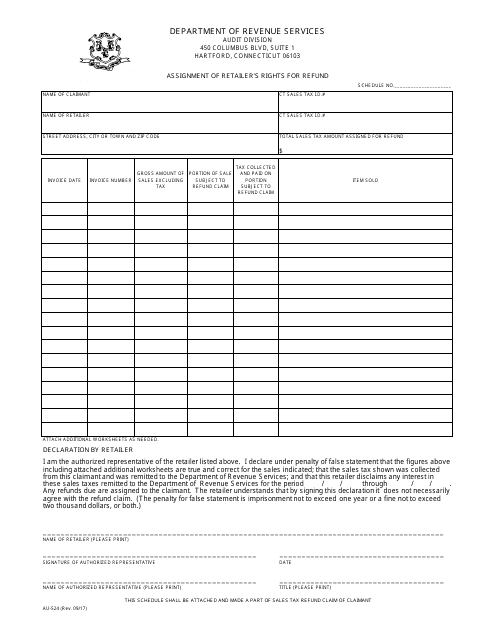

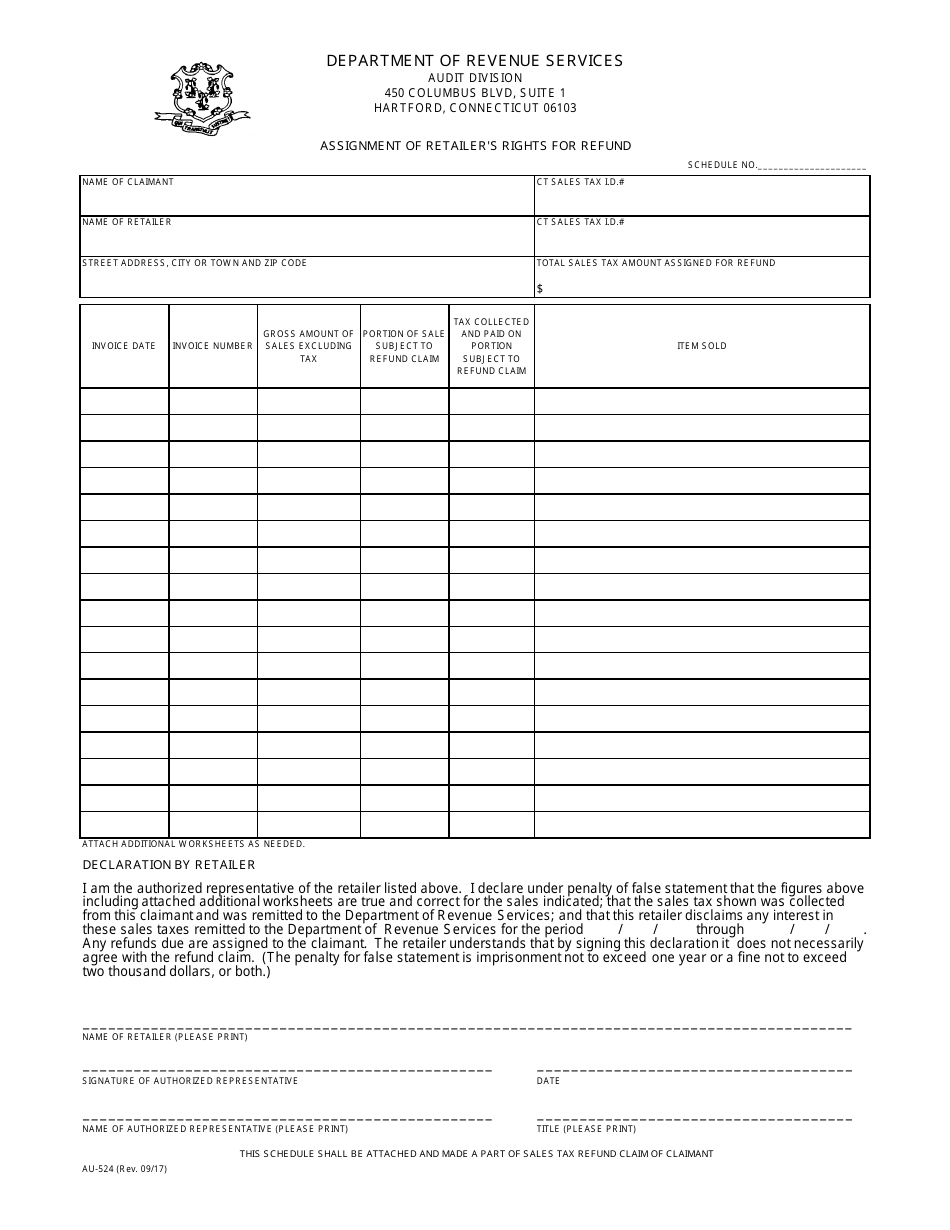

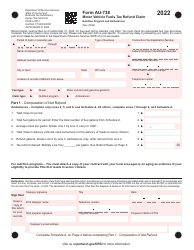

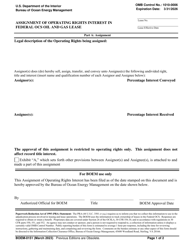

Form AU-524 Assignment of Retailer's Rights for Refund - Connecticut

What Is Form AU-524?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the AU-524 form?

A: The AU-524 form is the Assignment of Retailer's Rights for Refund form.

Q: What is the purpose of the AU-524 form?

A: The purpose of the AU-524 form is to assign a retailer's rights for refund in Connecticut.

Q: Who needs to use the AU-524 form?

A: Retailers in Connecticut who want to assign their rights for refund need to use the AU-524 form.

Q: Is there a fee for filing the AU-524 form?

A: Yes, there is a fee for filing the AU-524 form. The fee amount varies.

Q: What information is required on the AU-524 form?

A: The AU-524 form requires information such as the retailer's name, address, and Connecticut tax registration number.

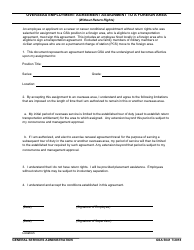

Q: Are there any specific instructions for completing the AU-524 form?

A: Yes, there are specific instructions provided with the AU-524 form that should be followed.

Q: How long does it take to process the AU-524 form?

A: The processing time for the AU-524 form can vary, but it typically takes several weeks.

Q: What should I do if I have more questions about the AU-524 form?

A: If you have more questions about the AU-524 form, you should contact the Connecticut Department of Revenue Services.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-524 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.