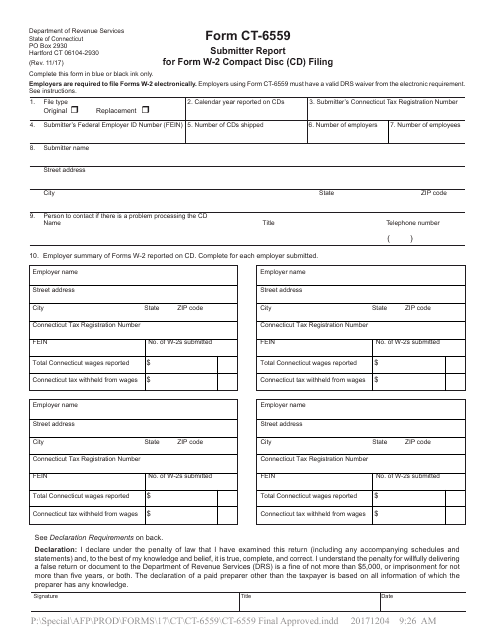

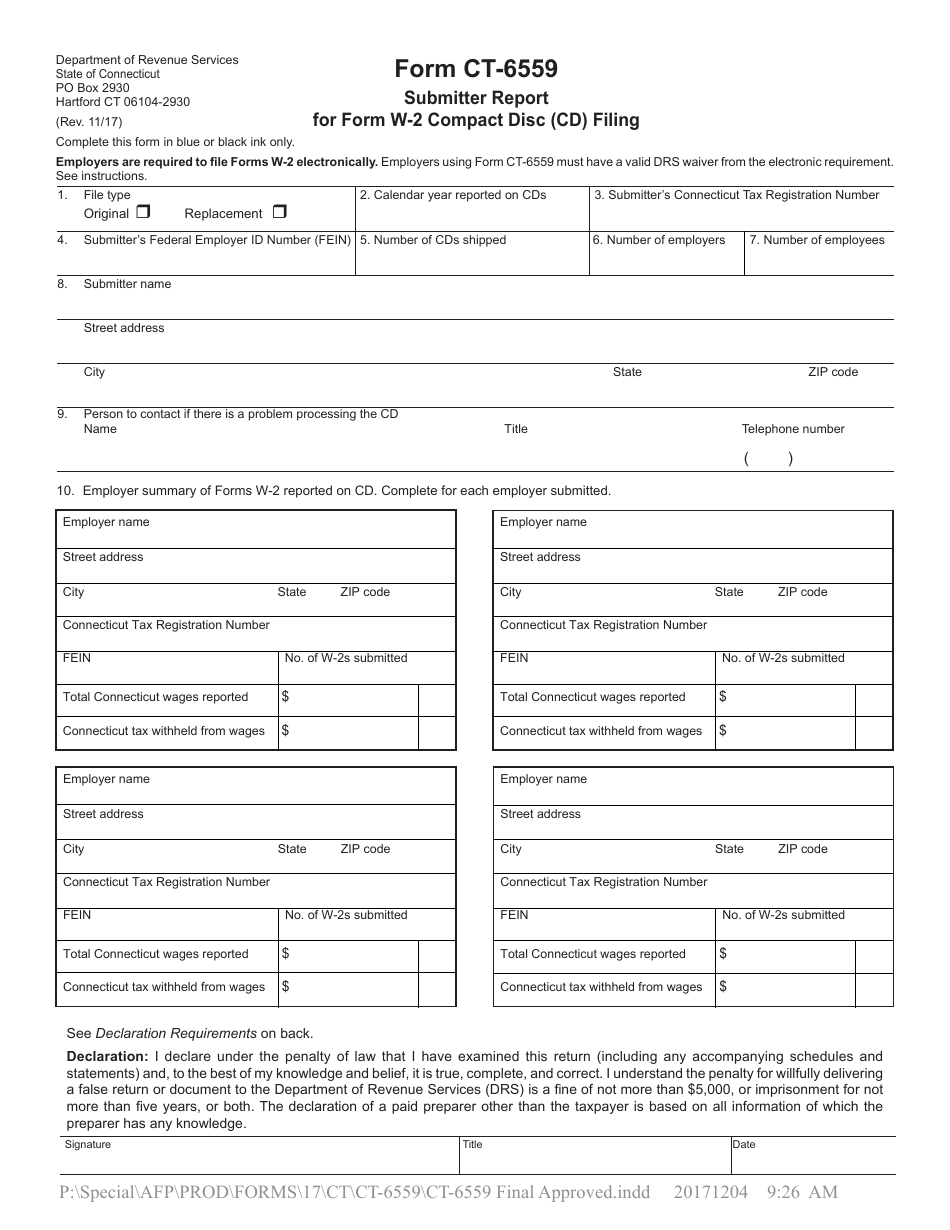

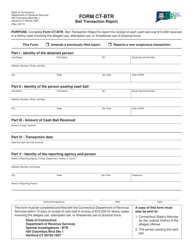

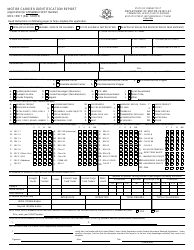

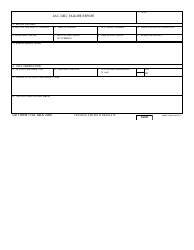

Form CT-6559 Submitter Report for Form W-2 Compact Disc (Cd) Filing - Connecticut

What Is Form CT-6559?

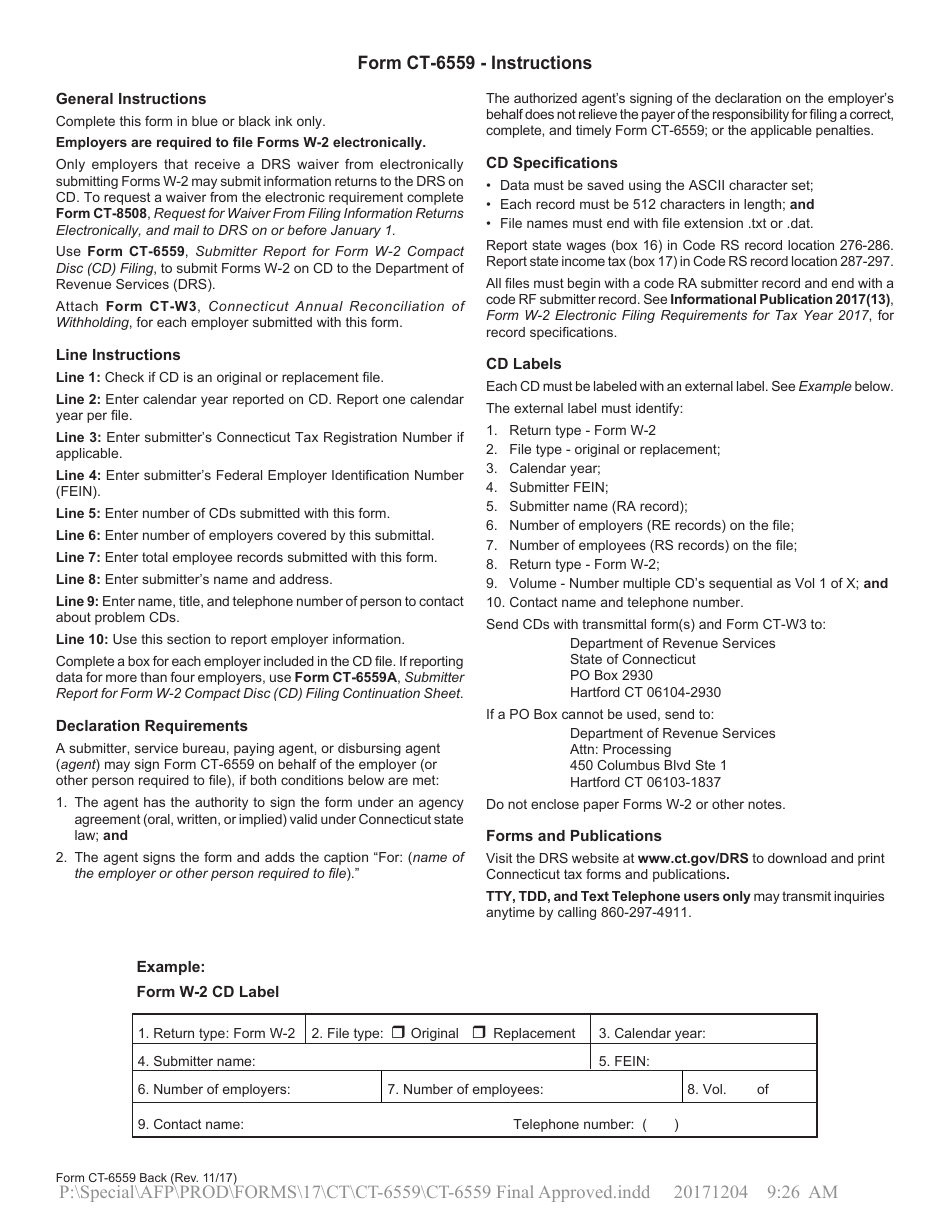

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-6559?

A: Form CT-6559 is the Submitter Report for Form W-2 Compact Disc (CD) Filing in Connecticut.

Q: What is the purpose of Form CT-6559?

A: The purpose of Form CT-6559 is to report wage and tax information to the State of Connecticut.

Q: Who needs to file Form CT-6559?

A: Employers who are filing Form W-2 information on a compact disc (CD) in Connecticut need to file Form CT-6559.

Q: What is the deadline for filing Form CT-6559?

A: Form CT-6559 must be filed annually by January 31st.

Q: What information is required on Form CT-6559?

A: Form CT-6559 requires you to provide employer information, employee wage and tax information, and details about the compact disc (CD) filing.

Q: Are there any penalties for not filing Form CT-6559?

A: Yes, there may be penalties for not filing Form CT-6559 or for filing it late. It is important to file the form by the due date to avoid any penalties.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-6559 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.