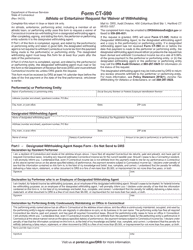

This version of the form is not currently in use and is provided for reference only. Download this version of

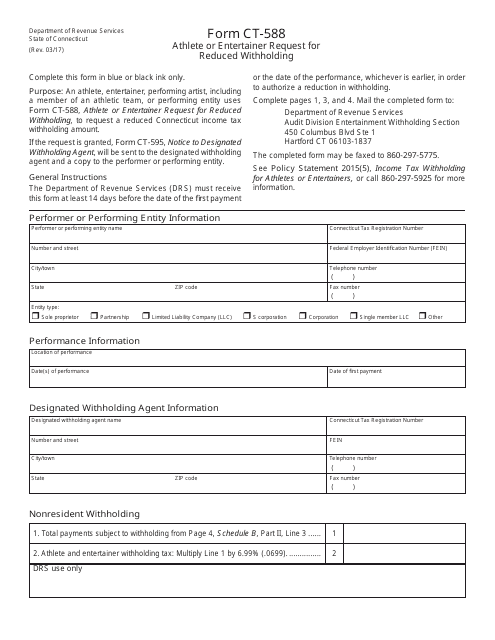

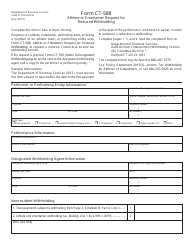

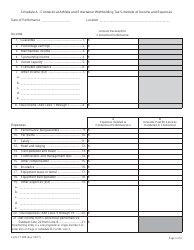

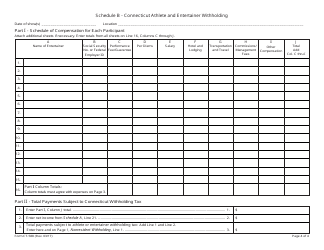

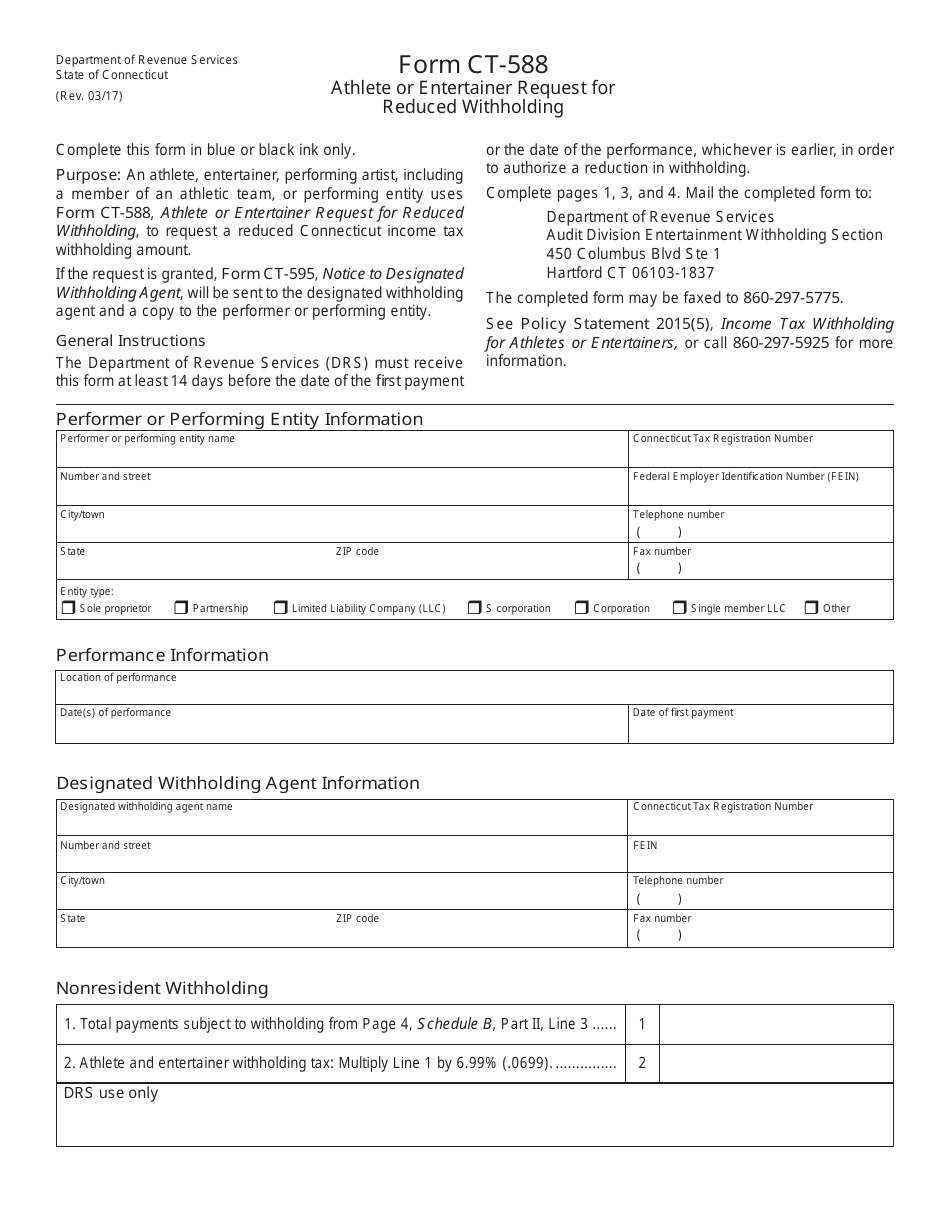

Form CT-588

for the current year.

Form CT-588 Athlete or Entertainer Request for Reduced Withholding - Connecticut

What Is Form CT-588?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-588?

A: Form CT-588 is a tax form used in Connecticut.

Q: Who needs to file Form CT-588?

A: Athletes or entertainers who perform services in Connecticut need to file Form CT-588.

Q: What is the purpose of Form CT-588?

A: The purpose of Form CT-588 is to request reduced withholding on income tax for nonresident athletes or entertainers.

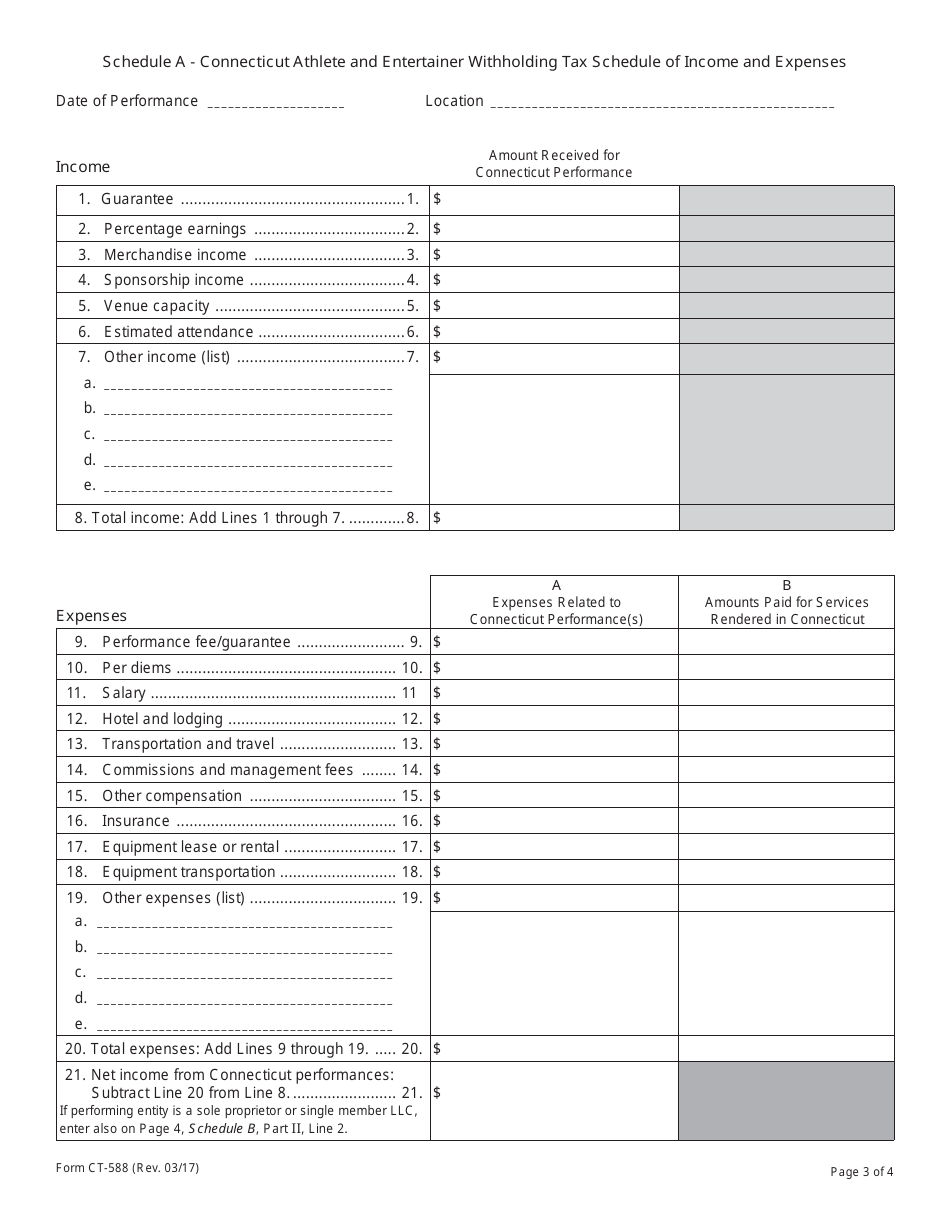

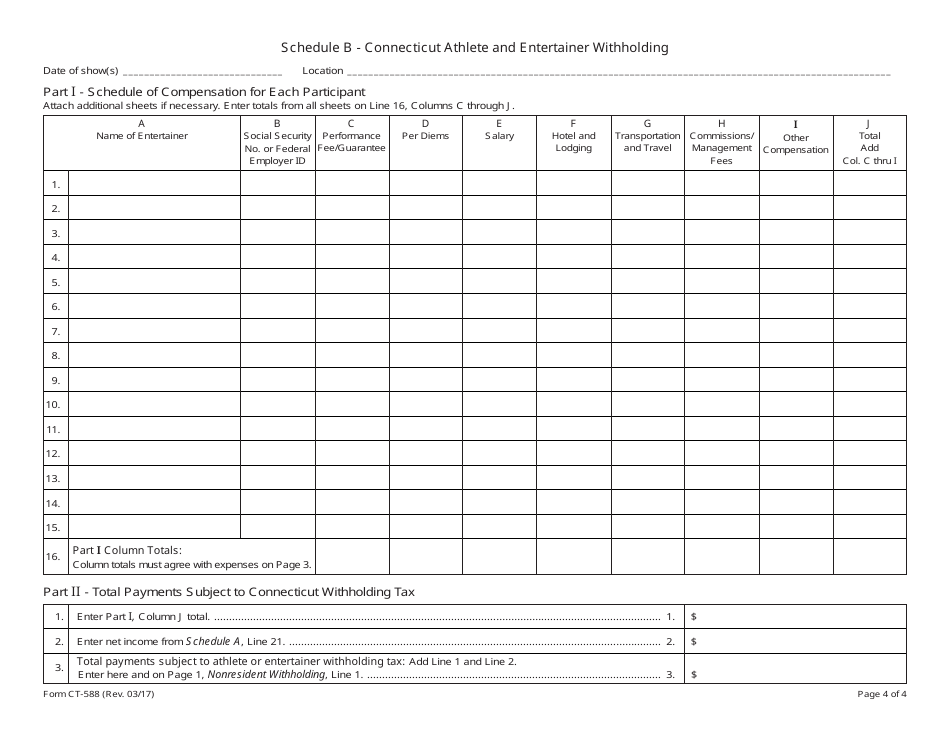

Q: What information do I need to provide on Form CT-588?

A: You will need to provide your personal information, details of your performances in Connecticut, and the amount of reduced withholding you are requesting.

Q: When should I file Form CT-588?

A: You should file Form CT-588 at least 15 days before your first performance in Connecticut.

Q: Are there any exceptions to filing Form CT-588?

A: Yes, if you are already exempt from Connecticut income tax or if your income from Connecticut sources does not exceed $1,000, you do not need to file Form CT-588.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-588 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.