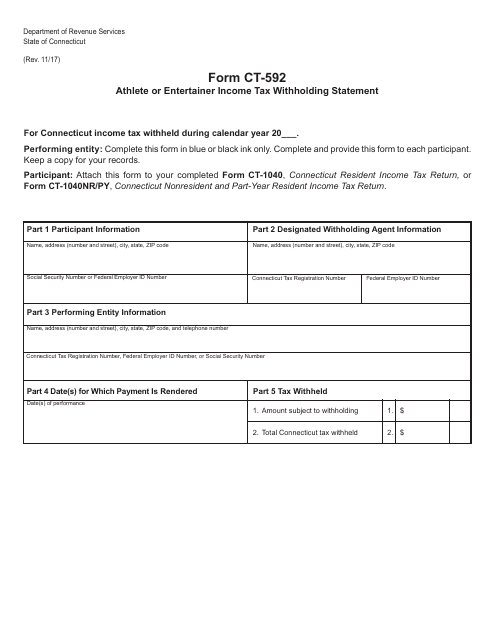

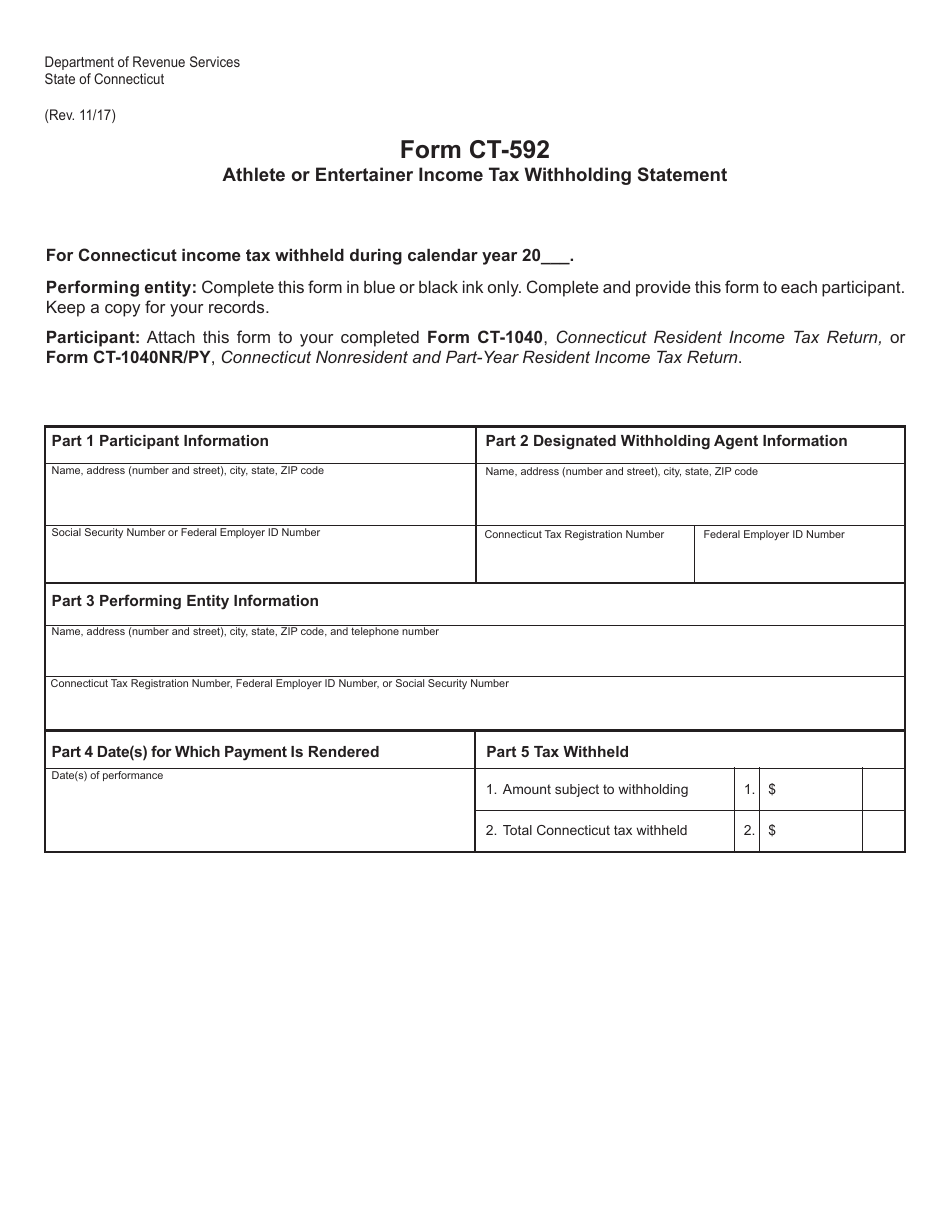

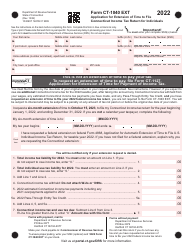

Form CT-592 Athlete or Entertainer Income Tax Withholding Statement - Connecticut

What Is Form CT-592?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-592?

A: Form CT-592 is the Athlete or Entertainer Income Tax Withholding Statement specific to Connecticut.

Q: Who needs to file Form CT-592?

A: Athletes or entertainers who earned income in Connecticut and had tax withheld from their earnings need to file Form CT-592.

Q: What information is required on Form CT-592?

A: Form CT-592 requires the individual's personal information, details of the income earned in Connecticut, and the amount of tax withheld.

Q: When is Form CT-592 due?

A: Form CT-592 is due on or before the 15th day of the month following the end of the tax quarter in which the income was earned.

Q: Can Form CT-592 be filed electronically?

A: Yes, Form CT-592 can be filed electronically through the Connecticut Taxpayer Service Center.

Q: Are there any penalties for not filing Form CT-592?

A: Yes, failure to timely file Form CT-592 or failure to withhold the required amount of tax may result in penalties and interest.

Q: Is Form CT-592 specific to athletes and entertainers?

A: Yes, Form CT-592 is specifically designed for athletes and entertainers who had income taxed withheld in Connecticut.

Q: Do athletes and entertainers need to file Form CT-592 for income earned in other states?

A: No, Form CT-592 is specific to income earned in Connecticut. Athletes and entertainers should consult the respective states' tax departments for filing requirements in other states.

Q: Can athletes and entertainers use Form CT-592 to claim refunds?

A: No, Form CT-592 is for reporting income and tax withholding purposes only. Athletes and entertainers need to file a Connecticut income tax return to claim any refund they are entitled to.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-592 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.